When dealing with Medicare Supplement insurance, one of the essential things you’ll come across is the payer ID. If you’re searching for details about the Ace Medicare Supplement Payer ID, you’ve come to the right place! In this article, we’ll break down what a payer ID is, why it’s important, and how to avoid some common (and humorous) pitfalls along the way.

What is a Payer ID?

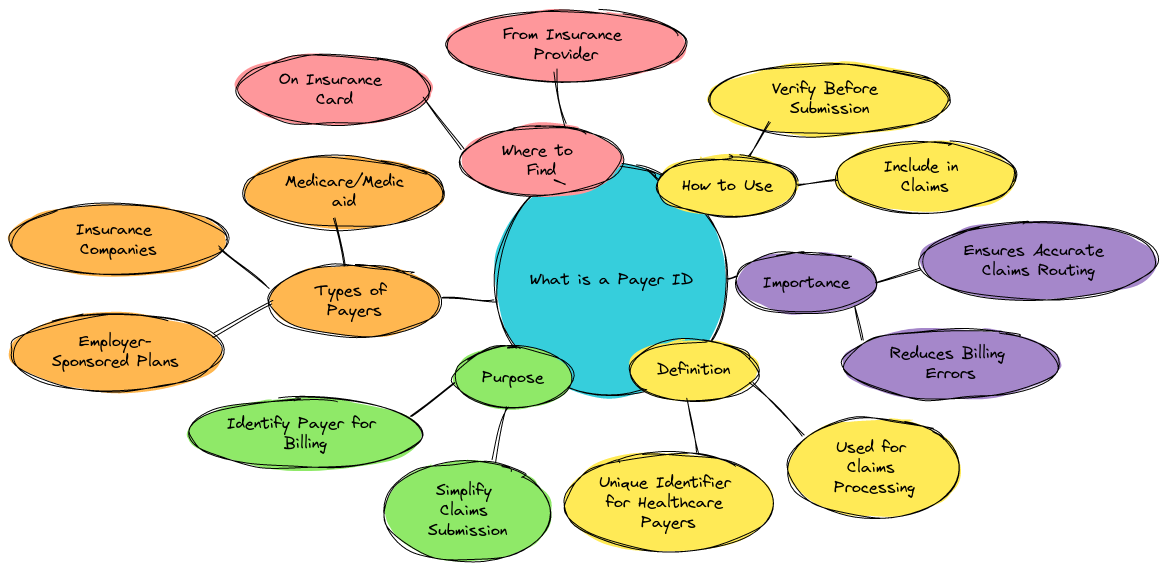

A payer ID is a unique identifier used by Medicare Supplement insurance companies to process claims. When your healthcare provider sends a claim to Ace Medicare (or any other insurance provider), they use this number to ensure it gets to the right place.

Why is the Ace Medicare Supplement Payer ID Important?

Imagine this: You go to your doctor for a routine check-up. They send the bill to Ace Medicare Supplement for payment, but wait — they forget the payer ID! Without it, your claim is like a letter without an address — lost in the insurance ether. To avoid delays, make sure your provider uses the correct payer ID. Trust me no one wants to chase after unpaid claims.

“The payer ID is like the key to unlocking the doors of quick payment. Without it you’re likely to face more delays than a bad airport layover”, says Henry Beltran, owner of Medicare Advisors Insurance Group LLC. He jokes, “I’ve seen more paperwork lost than socks in the dryer.”

Where to Find the Ace Medicare Supplement Payer ID?

You can usually find the Ace Medicare Supplement payer ID on your insurance card or through your provider’s billing department. If you can’t find it or your provider is as lost as you are a quick call to Ace Medicare Supplement’s customer service should clear things up.

- Check your insurance card

- Ask your healthcare provider

- Contact Ace Medicare Supplement customer service

If you’re feeling like a detective on the case of the missing payer ID don’t worry! This number is easier to find than your car keys on a Monday morning.

How to Use the Payer ID for Claims?

When your doctor’s office submits a claim to Ace Medicare Supplement, they must include the correct payer ID. It’s their job to ensure everything gets processed correctly but it’s not a bad idea to double-check. After all, no one wants to be left hanging with an unpaid bill.

Common Mistakes Providers Make with Payer IDs

Even the best healthcare offices can make mistakes. Here are some common goofs that you’ll want to avoid:

- Using the wrong payer ID: This is like sending a love letter to the wrong address—awkward and unproductive.

- Forgetting to include it: Without the payer ID, your claim might be stuck in limbo like a movie without an ending.

- Entering the number incorrectly: We’re all human, right? But typing in the wrong digits can make things much more complicated.

Henry Beltran, in his own humorous style, notes, “Look, these offices are busy, and errors happen. Just make sure they’ve got the right payer ID. Otherwise, it’s like trying to order pizza from a sushi restaurant. You won’t get what you’re looking for!”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Potential Drawbacks of Ace Medicare Supplement (But with a Smile)

Now let’s get to the juicy stuff — some drawbacks of Ace Medicare Supplement. Every car has its dings and scratches so it’s only fair to highlight them with a sense of humor.

1. Claims Processing Times

Sometimes the claims take longer than you’d like. It’s like waiting for your luggage at baggage claim—eventually, it’ll show up but man can it be slow. While Ace Medicare Supplement generally processes claims on time there have been some reports of delays.

- Tip: Stay patient. But don’t be afraid to follow up if your claim seems to be stuck in the insurance Bermuda Triangle.

2. Customer Service Hold Times

We’ve all been there—stuck on hold listening to the same classical tune over and over. Ace Medicare Supplement’s customer service is helpful when you can get through but some customers report long wait times.

- Tip: Call during non-peak hours. Or put it on speaker and enjoy a cup of coffee while you wait!

3. Coverage Confusion

Insurance terms can sometimes sound like they’re in a foreign language. With Ace Medicare Supplement make sure you fully understand what’s covered and what’s not. Otherwise, you might end up with unexpected out-of-pocket expenses—and no one likes a surprise bill.

- Tip: Read your policy. Then read it again. And if you’re still confused, don’t hesitate to call them and clarify.

4. Doctor Networks

While Ace Medicare Supplement works with a wide range of providers, there’s always a chance that your favorite doctor or specialist might not be in-network.

- Tip: Before getting too attached to a new healthcare provider check if they accept Ace Medicare Supplement. Breaking up with your doctor over insurance issues is never fun.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Conclusion: Don’t Let Payer ID Confusion Get You Down

At the end of the day, using the correct Ace Medicare Supplement Payer ID ensures your claims get processed efficiently. It’s one of those small but crucial details that can make a big difference in your Medicare experience.

And remember, “The only thing worse than not knowing your payer ID is trying to fix a claim without it”, as Henry Beltran always says.

So next time you visit your healthcare provider be the hero and make sure they’ve got that payer ID on hand. You’ll be saving yourself and them a lot of headaches!