Choosing a Medicare Advantage plan (also known as Medicare Part C) can be a smart move for many seniors—but only if it’s done correctly. Every year, thousands of beneficiaries enroll in plans that don’t fully meet their healthcare or financial needs, often because of small but costly mistakes.

At Medicare Advisors, we help individuals avoid these pitfalls and confidently select the Medicare Advantage plan that truly works for them. Below, we break down the most common mistakes people make when enrolling—and how you can avoid them.

1. Choosing a Plan Based Only on the Monthly Premium

One of the biggest mistakes is focusing only on a $0 or low monthly premium. While attractive, these plans may come with:

- Higher copayments

- Large out-of-pocket maximums

- Limited coverage for services you frequently use

A plan with a small monthly premium might cost you much more over the year if you need regular care, prescriptions, or specialist visits.

The smarter approach is to evaluate total annual healthcare costs, not just the monthly price.

2. Not Checking If Your Doctors Are In-Network

Medicare Advantage plans typically use provider networks (HMO or PPO). Enrolling without confirming that your doctors and hospitals are included can lead to:

- Higher out-of-pocket costs

- Forced provider changes

- Delayed or denied care

Before enrolling, always verify that your primary care doctor, specialists, and preferred hospitals are part of the plan’s network.

3. Ignoring Prescription Drug Coverage Details

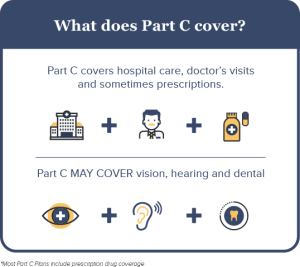

Many Medicare Advantage plans include prescription drug coverage (MAPD), but not all drug coverage is the same.

Common mistakes include:

- Not checking if your medications are covered

- Overlooking tier placement (which affects cost)

- Ignoring pharmacy network restrictions

Even if a plan includes drug coverage, it may not be the right coverage for your specific prescriptions. Reviewing the formulary is critical.

4. Missing Enrollment Deadlines

Medicare has strict enrollment periods, and missing them can limit your options or cause penalties.

Key enrollment periods include:

- Initial Enrollment Period (IEP)

- Annual Enrollment Period (AEP): October 15 – December 7

- Medicare Advantage Open Enrollment Period

Enrolling late or at the wrong time can mean waiting months before coverage begins—or being locked into a plan that isn’t ideal.

5. Not Understanding Plan Rules and Restrictions

Many beneficiaries enroll without fully understanding how their plan works. Medicare Advantage plans may require:

- Referrals to see specialists

- Prior authorization for procedures

- Step therapy for medications

Failing to understand these rules often leads to frustration when care is delayed or denied.

6. Assuming Extra Benefits Are Always Free

Medicare Advantage plans often advertise extras like:

- Dental

- Vision

- Hearing

- Fitness memberships

However, these benefits usually come with limits, waiting periods, or coverage caps. Assuming they are unlimited or fully free can lead to disappointment later.

Always review benefit details carefully—not just the headline features.

7. Overlooking Out-of-Pocket Maximums

One major advantage of Medicare Advantage plans is the annual out-of-pocket maximum. But many people overlook how high this number can be.

If you have chronic conditions or anticipate frequent medical care, a plan with a high out-of-pocket limit may expose you to significant financial risk—even if monthly premiums are low.

8. Not Comparing Plans Annually

Medicare Advantage plans change every year. Costs, benefits, provider networks, and drug coverage can all be updated.

Staying in the same plan year after year without reviewing changes can result in:

- Higher costs

- Lost benefits

- Reduced coverage

An annual plan review is essential to ensure your plan still fits your needs.

9. Trying to Navigate Medicare Alone

Medicare is complex, and trying to make sense of it without expert guidance often leads to costly mistakes.

Working with a licensed Medicare insurance broker gives you:

- Side-by-side plan comparisons

- Unbiased guidance

- Help with enrollment and ongoing support

Best of all, broker assistance typically comes at no additional cost to you.

How Medicare Advisors Helps You Avoid These Mistakes

At Medicare Advisors, we specialize in helping seniors choose Medicare Advantage plans with confidence. We take the time to understand your healthcare needs, prescriptions, doctors, and budget—then match you with the most suitable plan available in your area.

We don’t just help you enroll—we support you throughout your Medicare journey.

Frequently Asked Questions

Is Medicare Advantage better than Original Medicare?

It depends on your needs. Medicare Advantage offers bundled coverage and added benefits, but it also comes with network rules and restrictions.

Can I change my Medicare Advantage plan later?

Yes, but only during specific enrollment periods unless you qualify for a Special Enrollment Period.

Do $0 premium plans really cost nothing?

Not necessarily. You may still pay copays, coinsurance, and other out-of-pocket costs.

Will my prescriptions always be covered?

Coverage can change yearly, which is why reviewing drug formularies annually is important.

Do I need a broker to enroll?

No, but working with a broker helps you avoid mistakes and ensures you choose the best plan for your situation.

Get Expert Help Before You Enroll

Avoid costly Medicare Advantage enrollment mistakes by speaking with a licensed expert today.

📞 Phone: +1 (877) 255-0284

📧 Email: info@mymedicareadvisors.com

🌐 Website: https://medicareabc.com/

At Medicare Advisors, we’re here to make Medicare simple, clear, and stress-free—so you can focus on your health, not paperwork.