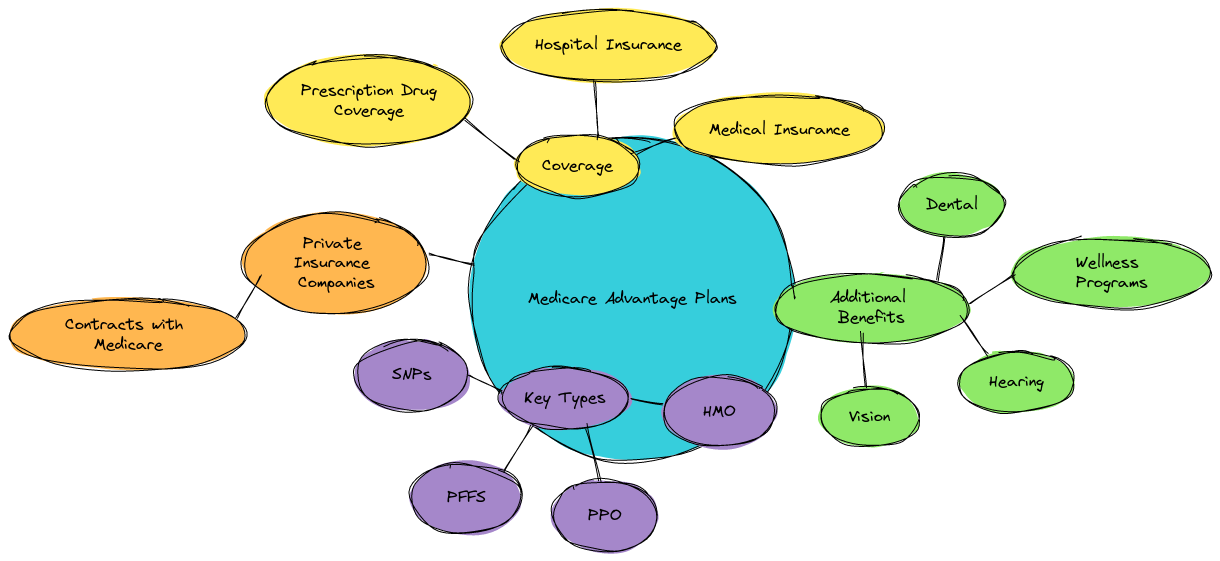

Medicare Advantage Plans are a popular option for seniors in Loch Arbour, New Jersey, offering an alternative to traditional Medicare coverage. These plans, often called Part C, are offered by private insurance companies and combine your Medicare Part A (hospital insurance) and Part B (medical insurance) into one plan. But what makes them so attractive? And are there any downsides? Let’s break it down in detail with humor thrown in for free!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What Are Medicare Advantage Plans?

Medicare Advantage Plans, also known as MA Plans or Part C, are approved by Medicare but provided by private companies. They include:

- Part A (Hospital Coverage)

- Part B (Medical Coverage)

- Extras: Vision, dental, hearing, and sometimes even fitness programs

Medicare Advantage Plans often also include Medicare Part D (prescription drug coverage) but the real draw is the additional perks.

According to Henry Beltran, owner of Medicare Advisors Insurance Group LLC, “Medicare Advantage Plans are like the all-in-one printers – they do everything, but maybe not everything perfectly.”

Types of Medicare Advantage Plans

There’s not just one size fits all Here’s a breakdown of the common types of plans you’ll encounter in Loch Arbour, NJ:

Health Maintenance Organization (HMO) Plans

- Must use a network of doctors and hospitals

- Requires a primary care physician (PCP)

- Need referrals to see a specialist

Drawback: If you’re a fan of spontaneity, HMO plans are not your best friend. You’ll need to jump through a few hoops to see a specialist, like getting a referral from your PCP. No running off to see a podiatrist for your aching feet on a whim!

Preferred Provider Organization (PPO) Plans

- Can see any doctor or specialist, but staying in-network is cheaper

- No need for a primary care physician

- No referrals needed to see specialists

Drawback: “Freedom!” – said every PPO plan holder who quickly realized out-of-network costs can be like paying for dinner at a five-star restaurant without checking the menu first. Sure, you can go anywhere, but that freedom isn’t free!

Private Fee-for-Service (PFFS) Plans

- You can go to any Medicare-approved doctor who accepts the plan’s terms

- Flexibility in choosing healthcare providers

Drawback: Sounds great, right? But only if your doctor agrees to the plan’s payment terms. It’s like showing up to a restaurant with a Groupon that expired last week – you might not get the deal you were hoping for.

Special Needs Plans (SNPs)

- Tailored for people with specific health conditions or characteristics

- Includes coordinated care for chronic conditions like diabetes or chronic heart failure

Drawback: If you don’t qualify, you’re out of luck. It’s like wanting to join an exclusive club but realizing they only accept members with really specific problems.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

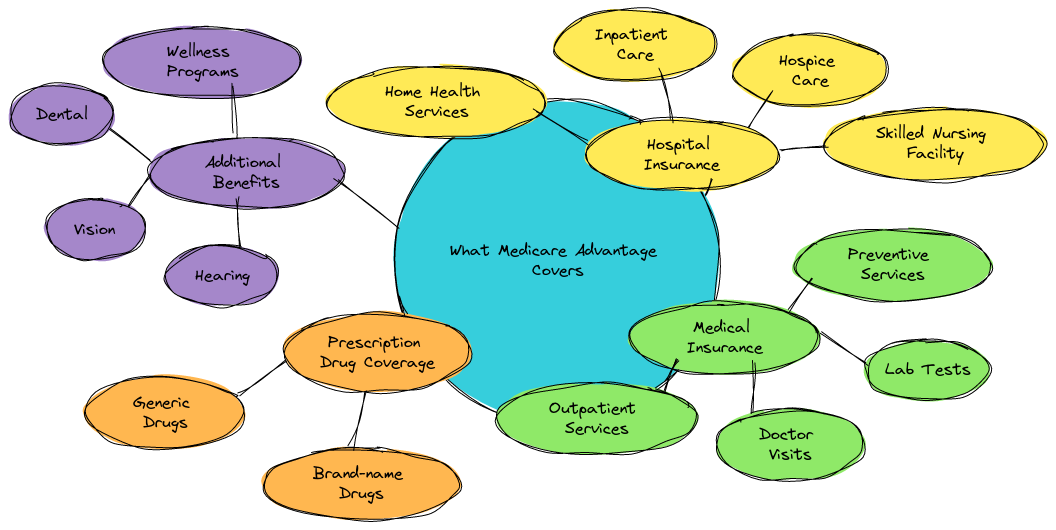

What Medicare Advantage Covers in Loch Arbour, New Jersey

In addition to the standard Medicare benefits, many Medicare Advantage Plans in Loch Arbour, New Jersey offer additional benefits, such as:

- Vision coverage (including glasses)

- Hearing exams and hearing aids

- Dental care (including cleanings, x-rays, and dentures)

- Fitness programs (like SilverSneakers)

- Transportation to medical appointments

- Over-the-counter drug allowances

How About That Part D?

Most MA Plans come with Medicare Part D included. This means your prescriptions are covered too, but make sure to check the plan’s formulary (fancy word for drug list). Some plans might cover your medications, while others might leave you paying out of pocket.

Drawback: Some drugs might be covered in one plan but not in another. It’s like picking a movie on Netflix – just when you’re ready to watch, you find out it’s not available in your country.

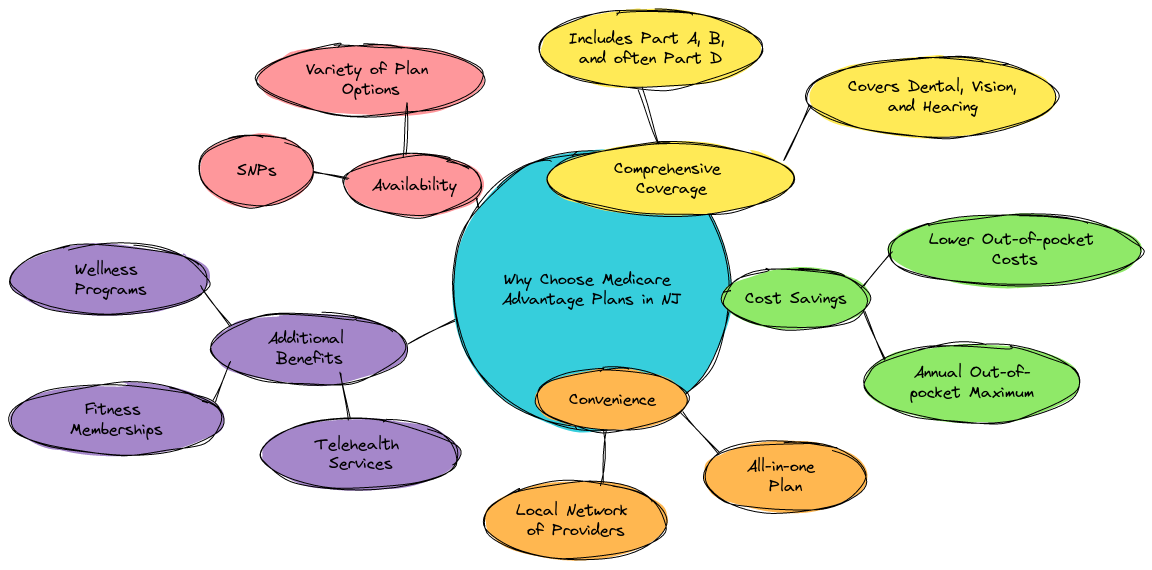

Why Choose Medicare Advantage Plans in Loch Arbour, NJ?

So why should you consider a Medicare Advantage Plan in Loch Arbour, New Jersey? Well there’s quite a list of benefits that might make your life a little easier:

- All-in-one convenience: Part A, B, and often D all bundled together

- Extra benefits: Vision, hearing, dental – things Original Medicare doesn’t cover

- Cost savings: Most plans have a cap on out-of-pocket costs

- Flexibility: With some plans, you can go outside the network if needed

- Coordinated care: Especially in Special Needs Plans which offer a more holistic approach to managing chronic conditions

Henry Beltran emphasizes, “Medicare Advantage Plans give you more bang for your buck but just make sure you understand how it works. Some people think it’s an open buffet, but it’s more like a set menu – still good, just know what you’re getting.”

Enrollment Periods

When can you sign up for a Medicare Advantage Plan? Here are the key times:

- Initial Enrollment Period (IEP): Starts 3 months before you turn 65 and ends 3 months after your 65th birthday

- Annual Enrollment Period (AEP): October 15 to December 7 – your chance to switch, drop, or join a Medicare Advantage Plan

- Medicare Advantage Open Enrollment Period: January 1 to March 31 – if you’re already in a Medicare Advantage Plan, you can switch to another MA Plan or back to Original Medicare

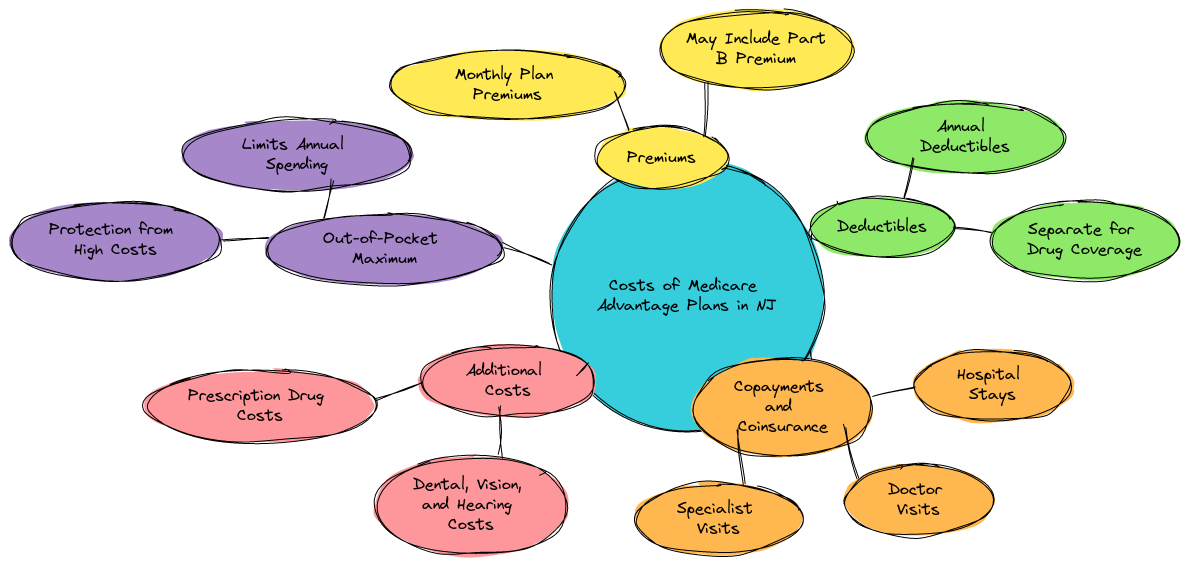

Costs of Medicare Advantage Plans in Loch Arbour, NJ

Let’s talk about costs because who doesn’t love discussing money? Medicare Advantage Plans can vary in price but here’s what to expect:

Premiums

Some Medicare Advantage Plans in Loch Arbour, New Jersey have $0 premiums, but others may have a premium that can range anywhere from $15 to over $100. Remember that even if the plan’s premium is $0 you’ll still need to pay your Part B premium which is set by the federal government.

Deductibles

- Plan Deductibles: Some plans have deductibles you must meet before they pay out for services

- Drug Deductibles: Many Part D plans also come with a deductible for your prescriptions

Drawback: It’s easy to get excited about the $0 premium but don’t forget about those sneaky deductibles. It’s like getting a free sample, only to find out you need to buy the full-sized version for it to actually work!

Copayments and Coinsurance

- Copayments: Fixed amounts you pay for services like doctor visits

- Coinsurance: A percentage of the cost of a service you’re responsible for after meeting your deductible

Drawback: That small copay might seem harmless until you’ve gone to the doctor five times in one month. Suddenly, it feels like you’re funding your doctor’s next vacation.

Out-of-Pocket Maximums

- Medicare Advantage Plans cap your annual out-of-pocket spending

- Once you hit the cap the plan covers 100% of your services for the rest of the year

Drawback: That cap is great but reaching it might feel like you’re swimming against the current in quicksand. You’ll get there, but it won’t be pleasant.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

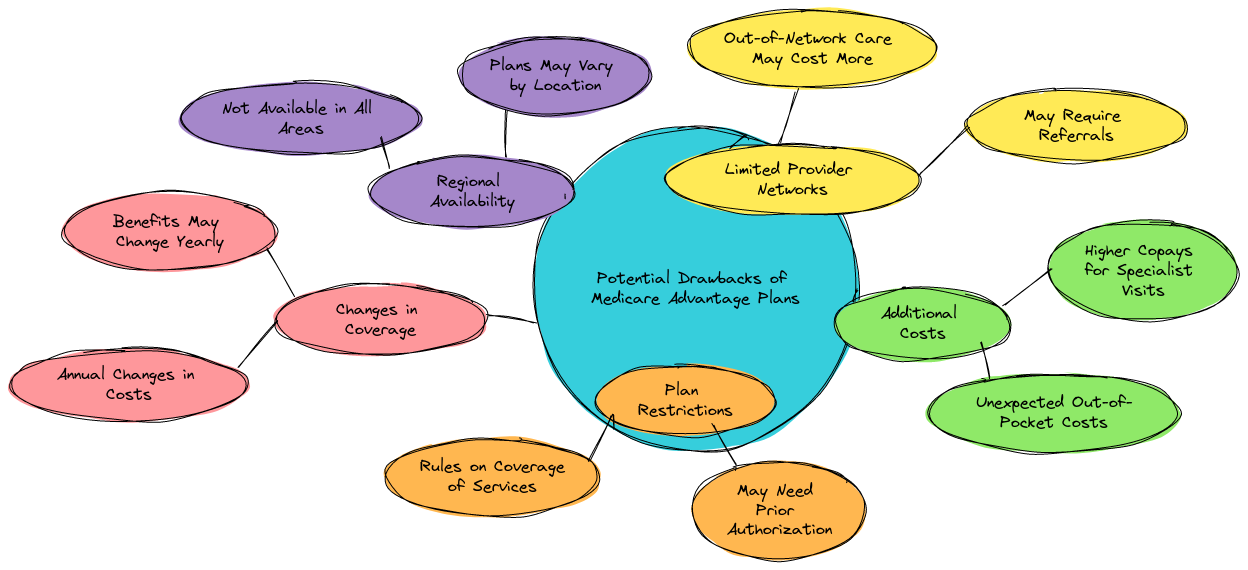

Potential Drawbacks of Medicare Advantage Plans

Now before you run off and sign up, let’s go over some potential drawbacks of Medicare Advantage Plans in Loch Arbour, New Jersey:

Network Restrictions

- HMO Plans require you to stay in-network

- PPO Plans are more flexible but still cheaper in-network

Humorous Twist: It’s like going to your favorite pizza place only to find out your favorite toppings are extra. You can still get them, but it’s going to cost you more.

Referrals for Specialists

- HMOs require you to get a referral from your primary doctor before seeing a specialist

- PPOs don’t require referrals but it’s still best to stay in-network for lower costs

Humorous Twist: Imagine needing a permission slip to see the specialist for that weird rash on your foot. Your primary doctor’s the hall monitor in this scenario.

Prior Authorization

- Some services may require prior authorization from the plan

- This can delay your treatment while the plan decides if it will cover it

Humorous Twist: It’s like asking your mom if you can go to the movies with friends and waiting anxiously for a “yes” or “no”. Except in this case, the answer might take longer and be less fun.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

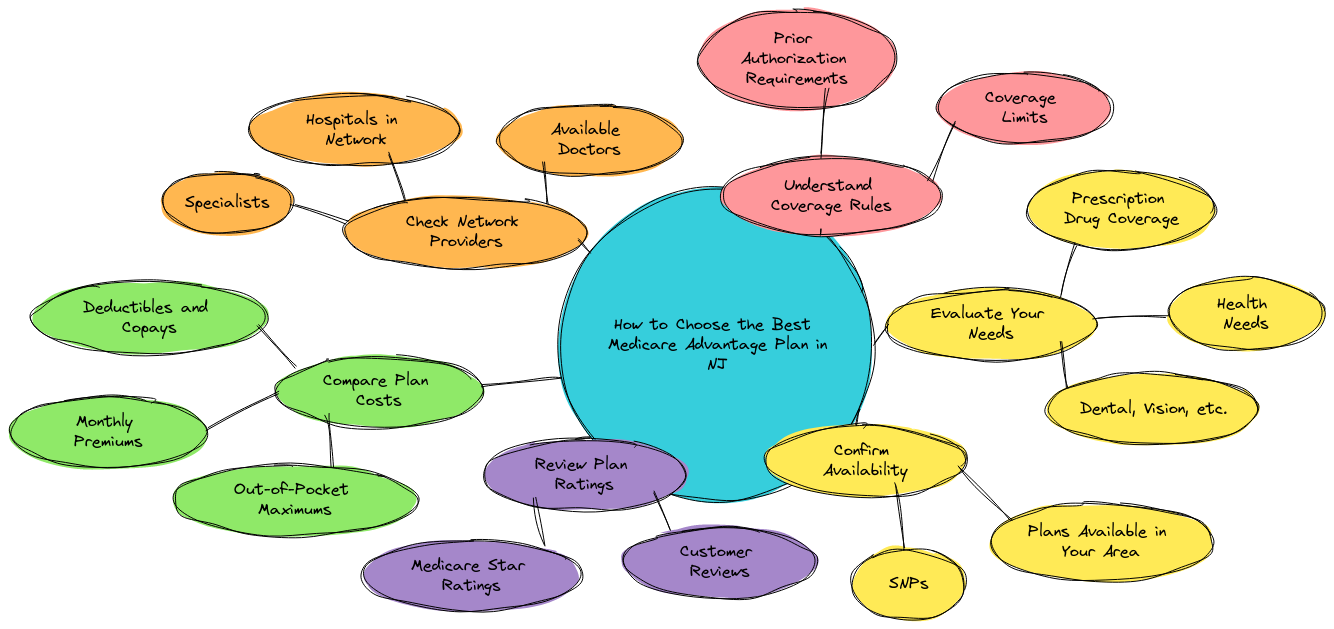

How to Choose the Best Medicare Advantage Plan in Loch Arbour, NJ

Choosing the right plan doesn’t have to be overwhelming. Here are some tips to help:

- Check the network: Make sure your favorite doctors and hospitals are included

- Look at the extras: Need vision or dental care? Choose a plan that includes these

- Review the drug formulary: Ensure your medications are covered under the plan

- Compare costs: Premiums are just one piece of the puzzle – consider copays, deductibles, and out-of-pocket maximums

- Read the fine print: Prior authorizations and referrals might be required – know what you’re signing up for!

Henry Beltran suggests, “Take your time to research. Medicare Advantage Plans are great for a lot of people, but don’t just pick the first plan you see on TV because the guy looks friendly.”

FAQs on Medicare Advantage Plans in Loch Arbour, NJ

Can I switch back to Original Medicare?

Yes, during the Medicare Advantage Open Enrollment Period from January 1 to March 31, you can switch back to Original Medicare.

Are there special plans for people with chronic conditions?

Yes, Special Needs Plans (SNPs) are available for people with specific conditions like diabetes or heart failure. They provide extra care coordination for managing these conditions.

Will my doctors accept my Medicare Advantage Plan?

It depends on the plan’s network. Always check if your doctors are in-network before signing up!

Conclusion

Medicare Advantage Plans in Loch Arbour, NJ offer a comprehensive, all-in-one option for seniors looking for more than what Original Medicare covers. While they have a lot of benefits, such as added coverage for dental, vision, and hearing, there are also some potential drawbacks, especially if you prefer out-of-network care or dislike prior authorizations.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Henry Beltran sums it up nicely: “Medicare Advantage Plans are like smartphones – they have a ton of features, but if you only need to make calls, you might not need all the bells and whistles.”

For more information or personalized guidance in choosing a Medicare Advantage Plan in Loch Arbour, New Jersey, reach out to Medicare Advisors Insurance Group LLC – we’re here to help guide you through the process, even if we make a few typos along the way!

References

- Centers for Medicare & Medicaid Services: Medicare Advantage Plans

- Medicare.gov: Types of Medicare Advantage Plans

- NJ Department of Banking and Insurance: Medicare Information

- American Association for Medicare Supplement Insurance: 2023 Medicare Advantage Plans Data