Lymphedema is a condition that can sneak up on you like that one friend who shows up unannounced just when you’re trying to relax. It causes swelling—usually in the arms or legs—because of a blockage in the lymphatic system. Now the question is… does Medicare cover the compression garments that help manage this frustrating condition?

Here’s where it gets tricky. Let’s dive into the coverage and potential drawbacks of relying on Medicare for those essential compression garments—and yes we’ll sprinkle in some humor because hey who said insurance had to be boring?

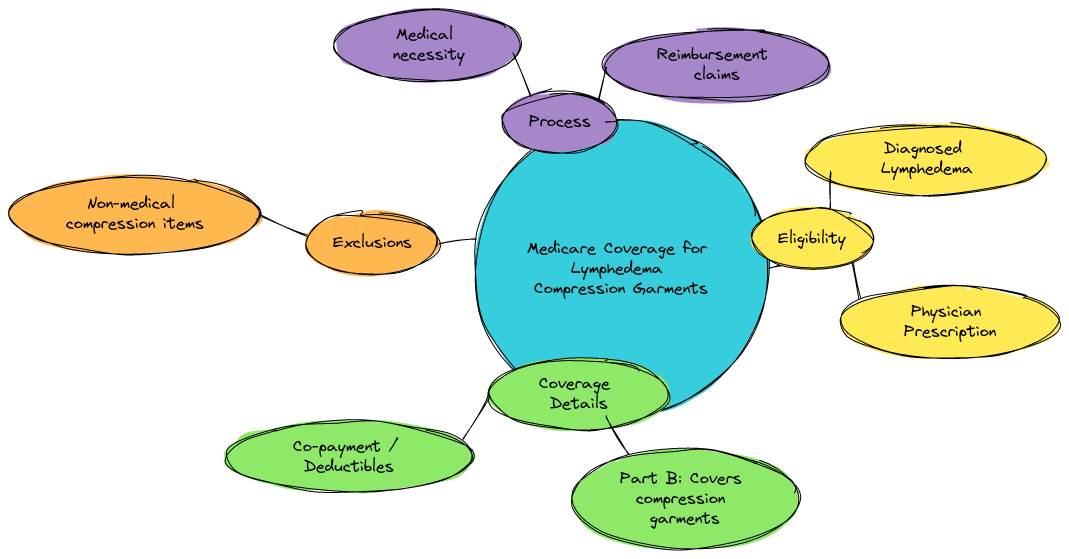

Medicare Coverage for Lymphedema Compression Garments

Medicare can be a lifesaver when it comes to many healthcare services but the truth is it’s not always a sure thing when it comes to compression garments for lymphedema.

Medicare Part B

Medicare Part B covers durable medical equipment (DME) such as walkers canes and even some types of braces. But unfortunately for compression garments it can feel a bit like you’re stuck in line at the DMV—it’s slow and not always successful.

Medicare usually only covers lymphedema treatment if a doctor says it’s medically necessary. But here’s the catch—the garments themselves often don’t fall under “medical necessity” even though your swollen legs or arms would tell you otherwise!

Lymphedema Pumps vs. Garments

Now if you’re using lymphedema pumps Medicare may cover these as part of your treatment. But when it comes to the actual compression garments you need daily it’s a bit of a gamble. Medicare will not typically cover garments like sleeves stockings or gloves unless they’re considered prosthetics. I know it’s weird but that’s Medicare for you!

According to Henry Beltran owner of Medicare Advisors Insurance Group LLC “Medicare can be a mixed bag when it comes to lymphedema care. Compression garments seem like an obvious necessity but for some reason they’re still on Medicare’s naughty list.”

Are There Any Exceptions?

There’s always that slim chance. Sometimes Medicare will cover compression garments if they’re part of an overall treatment plan from your doctor. But remember getting approval is like asking a toddler to share their candy—it can happen but don’t hold your breath.

- Tip: To improve your chances of coverage make sure your doctor submits thorough documentation showing why compression garments are essential to your treatment.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Out-of-Pocket Reality: Cost of Lymphedema Compression Garments

If Medicare doesn’t cover your garments you’re looking at paying out of pocket. And surprise surprise these aren’t your regular off-the-rack socks we’re talking about.

- Compression Sleeves: These can range from $30 to $150 depending on the type and brand.

- Compression Stockings: You’re looking at a ballpark of $50 to $200. (And no that price doesn’t come with a built-in massage feature.)

- Custom-Fitted Garments: These can get pricey upwards of $500. Talk about sticker shock for a pair of socks right?

Henry Beltran adds “Most of our clients are pretty shocked when they find out the cost of these garments especially since many think Medicare will cover it. It’s like finding out that guac is extra after they’ve already put it on your burrito.”

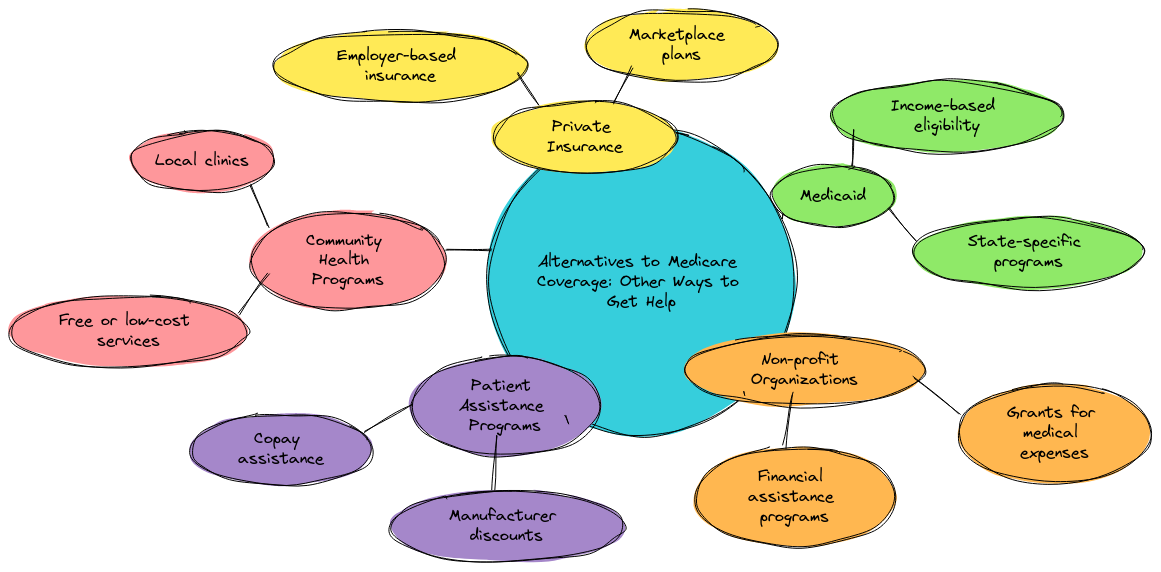

Alternatives to Medicare Coverage: Other Ways to Get Help

Now don’t lose hope! Just because Medicare may not cover your compression garments doesn’t mean you have to throw in the towel (or stocking in this case). Here are some alternatives:

- Private Insurance: Some private insurance plans might cover compression garments so it’s worth checking with your provider.

- Medicare Advantage Plans: Sometimes these plans offer additional benefits beyond what Original Medicare covers. If you’re on one of these plans ask your provider!

- State Assistance Programs: Some states offer help for lymphedema patients who need assistance with medical equipment and supplies.

- Lymphedema Foundation: Various foundations provide grants or financial assistance for those in need of compression garments.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Potential Drawbacks of Medicare Coverage for Compression Garments

Here’s the thing: while Medicare is great for many medical needs it’s not always the best when it comes to compression garment coverage. There are some potential drawbacks that can make you scratch your head or just sigh in frustration:

- It’s Not Always Clear: Medicare’s rules around what’s covered and what isn’t can feel about as clear as mud.

- Extra Costs: Even if Medicare does cover some part of your lymphedema treatment the additional costs for compression garments can add up quickly.

- Approval Process: Sometimes the approval process can be as slow as waiting for a snail to cross the road. The paperwork your doctor has to file can be a real headache.

“It’s really all about being prepared” says Henry Beltran. “Knowing what’s covered and what isn’t ahead of time helps but I still tell folks to always have a Plan B in case Medicare decides to be a little stingy with their coverage.”

FAQs About Medicare and Lymphedema Compression Garments

Let’s wrap this up with some frequently asked questions:

1. Does Medicare ever cover compression garments?

Medicare usually doesn’t cover compression garments unless they’re considered prosthetic devices.

2. Will my Medicare Advantage plan cover compression garments?

It’s possible! Medicare Advantage plans often have additional benefits beyond Original Medicare but you’ll need to check your specific plan for details.

3. Can I deduct the cost of compression garments on my taxes?

Yes in some cases the cost of medical supplies like compression garments might be tax-deductible. But always check with a tax advisor to confirm your eligibility.

4. How can I get financial help for compression garments if Medicare won’t cover them?

Check with your private insurance state assistance programs or organizations like the Lymphedema Foundation for help.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Final Thoughts

Dealing with Medicare coverage for lymphedema compression garments can be a bit of a rollercoaster ride. While Medicare Part B offers some coverage for medical devices compression garments often don’t make the cut. However by staying informed and exploring other options—whether it’s private insurance or assistance programs—you can still get the help you need without breaking the bank.

And as Henry Beltran wisely says “The key is to always know your options because when it comes to Medicare sometimes you need a little extra support—just like those compression socks!”