Medicare is a wonderful program for helping people manage their health care needs but when it comes to big-ticket medical procedures like lung transplants you might be asking “Is this covered?” It’s a valid question, especially when you’re thinking about the costs and complexities of such a major surgery. Spoiler alert: Medicare does cover lung transplants but of course there are some twists and turns on this road. Let’s dive into the details so you can be prepared.

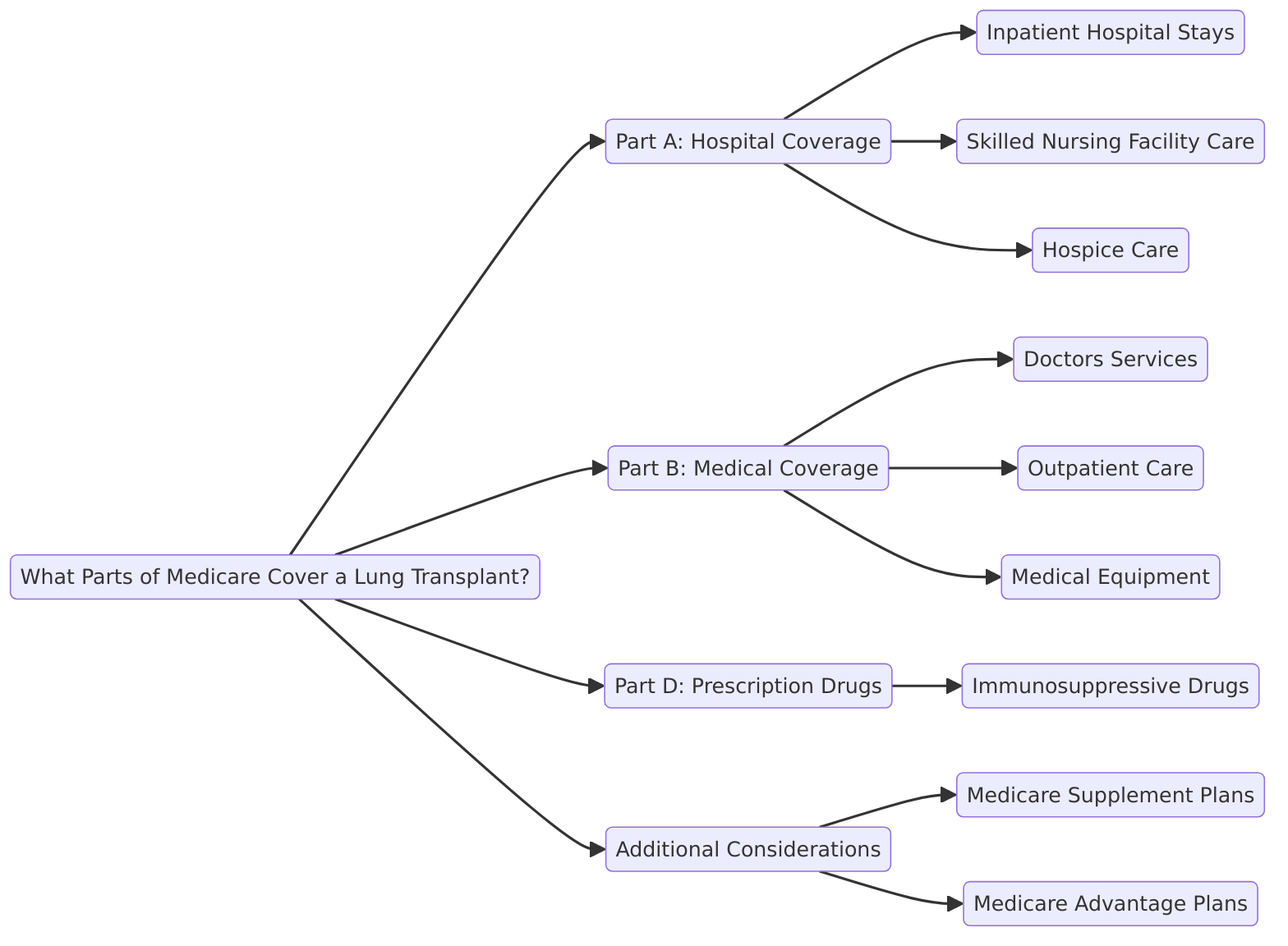

What Parts of Medicare Cover a Lung Transplant?

When talking about Medicare coverage we need to break it down into its different parts. Each part covers different aspects of the lung transplant process—because you know it’s never as simple as one-size-fits-all with healthcare.

Medicare Part A (Hospital Insurance)

Medicare Part A covers the hospital-related costs for a lung transplant. This includes the actual transplant surgery hospital stays and inpatient care. So you can breathe easy (pun intended) knowing that Part A covers:

- Hospital stays before during and after the transplant

- Transplant coordination services

- Care in an intensive care unit (ICU)

However here’s the catch—Part A doesn’t cover everything. You might still have to pay a deductible or coinsurance and depending on how long you’re in the hospital that can add up. Don’t even think about staying in the ICU just for the nice view. Medicare’s not paying for your bedside Netflix.

Medicare Part B (Medical Insurance)

While Part A takes care of the hospital stuff Medicare Part B steps in to cover the medical services that occur outside of that realm like:

- Doctor visits before and after surgery

- Diagnostic tests and lab work

- Medications to prevent organ rejection post-transplant (aka immunosuppressive drugs)

And let’s not forget those post-transplant follow-ups that are crucial to ensure your new lung is functioning as it should. But again Part B isn’t a freebie. You’ll still need to deal with monthly premiums and deductibles plus a 20% coinsurance for outpatient services. Not ideal but hey, at least Medicare has your back!

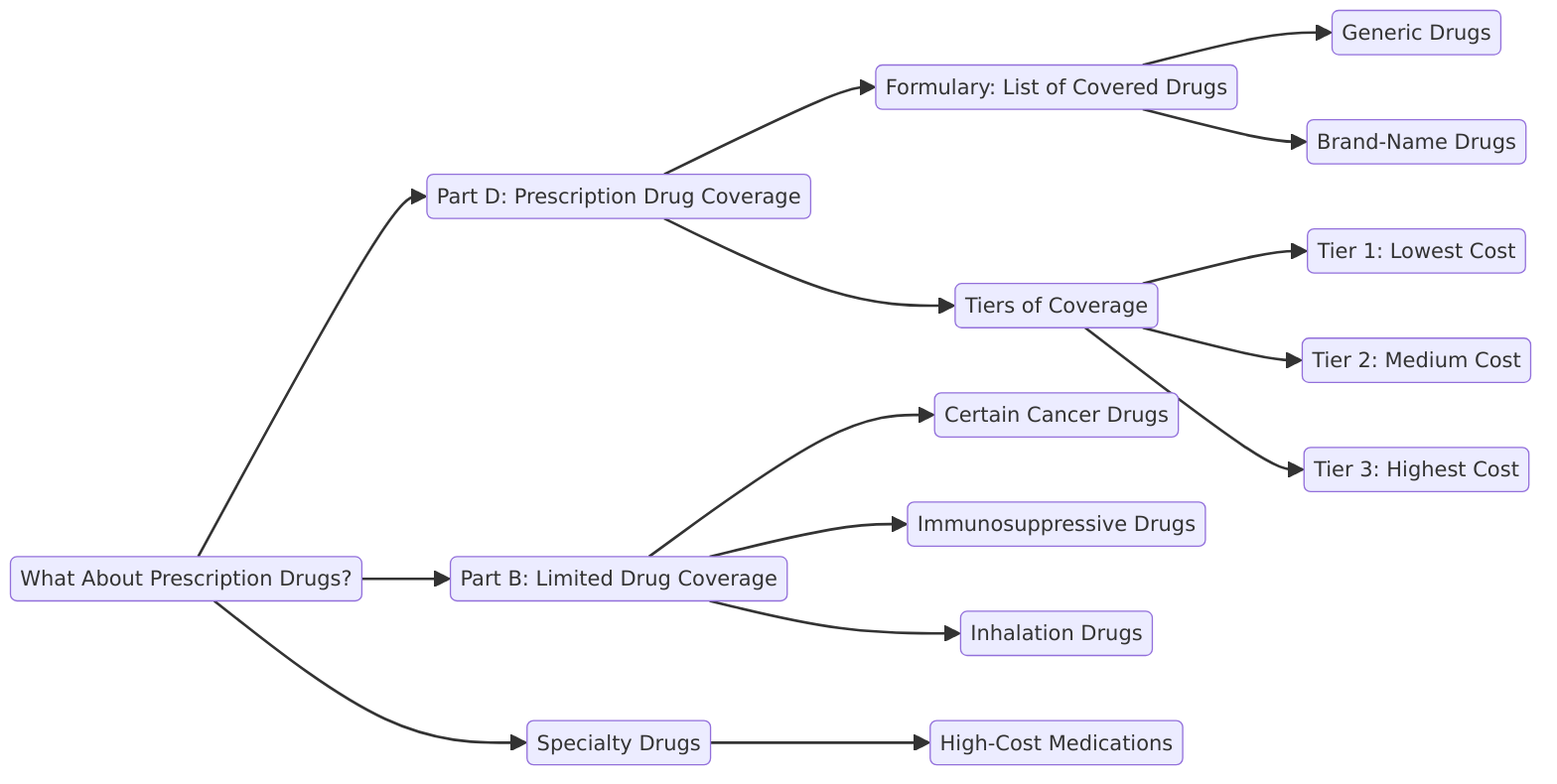

What about Prescription Drugs?

If you’re like most people thinking “How about those expensive post-transplant meds?” Good question! Medicare Part D covers prescription drugs like those life-saving immunosuppressants you’ll need to keep your body from rejecting your new lung. But just like any insurance policy it comes with its own formulary (fancy word for a list of covered drugs). So make sure your needed meds are on that list. No one likes a surprise at the pharmacy counter right?

Medicare Advantage (Part C)

For those of you with Medicare Advantage plans it’s important to know that these plans are required to cover at least what Original Medicare covers but sometimes they offer extra benefits. Some plans might help with additional costs like transportation to medical appointments or even post-transplant home care.

However don’t get too excited. There might be network restrictions so make sure your transplant center is in-network. You don’t want to find out last minute that you’re driving halfway across the country just for your lung surgery. That’s one road trip you don’t need.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Are There Costs Medicare Doesn’t Cover?

Now here’s where things get a bit more real. While Medicare covers most aspects of the lung transplant there are still a few things you might have to foot the bill for on your own:

- Caregiver support: If you need help after surgery Medicare won’t be paying your aunt to babysit you

- Long-term lodging: If you need to stay near the transplant center for follow-up care Medicare doesn’t cover extended hotel stays

- Travel expenses: Flights hotels gas—these aren’t covered so don’t forget to budget for those if you’re traveling for surgery

Potential Drawbacks with a Lung Transplant (And A Little Humor!)

Let’s face it. No medical procedure is perfect. Here are a few potential drawbacks when considering a lung transplant and some light-hearted commentary to keep things real:

- High Risk: Lung transplants are serious business with a high risk of complications. But hey nothing says “I’m living on the edge” like carrying a spare organ.

- Rejection: Your body might not like its new lung and try to get rid of it. It’s like when your cat rejects the new expensive toy you bought. Not cool.

- Medication Side Effects: Those anti-rejection drugs come with a list of side effects. But really who doesn’t love a little nausea and mood swings?

- Lifestyle Changes: Post-transplant you might need to make serious changes like following strict medication schedules or avoiding certain foods. So maybe kiss that spicy taco goodbye.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What Does Henry Beltran Think?

According to Henry Beltran the owner of Medicare Advisors Insurance Group LLC he says “A lung transplant is a life-saving procedure but the costs can be overwhelming for anyone. That’s why understanding your Medicare coverage is crucial. You don’t want to be caught off guard by unexpected bills at such a critical time. Trust me if you’re looking at a lung transplant make sure you have the right Medicare plan in place to cover your needs.”

Henry’s right. Lung transplants aren’t something you want to leave to chance—whether it’s navigating Medicare coverage or planning for those extra costs it pays to be prepared.

Steps to Ensure Medicare Covers Your Lung Transplant

If you want to maximize your Medicare benefits for a lung transplant follow these steps:

- Consult your doctor: Make sure a lung transplant is medically necessary

- Confirm Medicare’s coverage: Speak with your Medicare Advantage or Original Medicare representatives

- Choose an approved transplant center: Medicare only covers certain transplant centers so do your research

- Plan for additional costs: Budget for travel lodging and other non-covered expenses

- Follow post-transplant care guidelines: Don’t skimp on those follow-up appointments and medications

FAQs

- Does Medicare cover the donor’s costs too? Yes. Medicare also covers the organ procurement costs like harvesting and transporting the donor’s lung.

- Will my Medicare premiums increase after a lung transplant? No. Your monthly premiums for Parts A and B won’t increase after surgery. However the costs of prescription drugs under Part D might vary depending on the drugs prescribed.

- Can I switch Medicare plans after my transplant? Yes but make sure you’re not losing essential coverage when switching from one plan to another. Timing and coverage gaps can be tricky.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Conclusion

So there you have it! Medicare does cover lung transplants but the process is filled with nuances and potential expenses outside of what’s covered. Make sure you’re well-informed about your Medicare plan and prepared for any out-of-pocket costs. And hey if you ever need a helping hand Henry Beltran and the team at Medicare Advisors Insurance Group LLC are always here to guide you.