For anyone who requires intermittent catheters, it’s natural to wonder whether Medicare will cover them. After all, medical costs can be overwhelming, especially for items you need daily. So let’s get down to it. Does Medicare cover intermittent catheters? The short answer is yes. But as with many things in life—like trying to fold a fitted sheet or figuring out which end of the toothpaste tube is best to squeeze—the long answer is a bit more complicated. But don’t worry I’m here to unravel this for you.

What Are Intermittent Catheters?

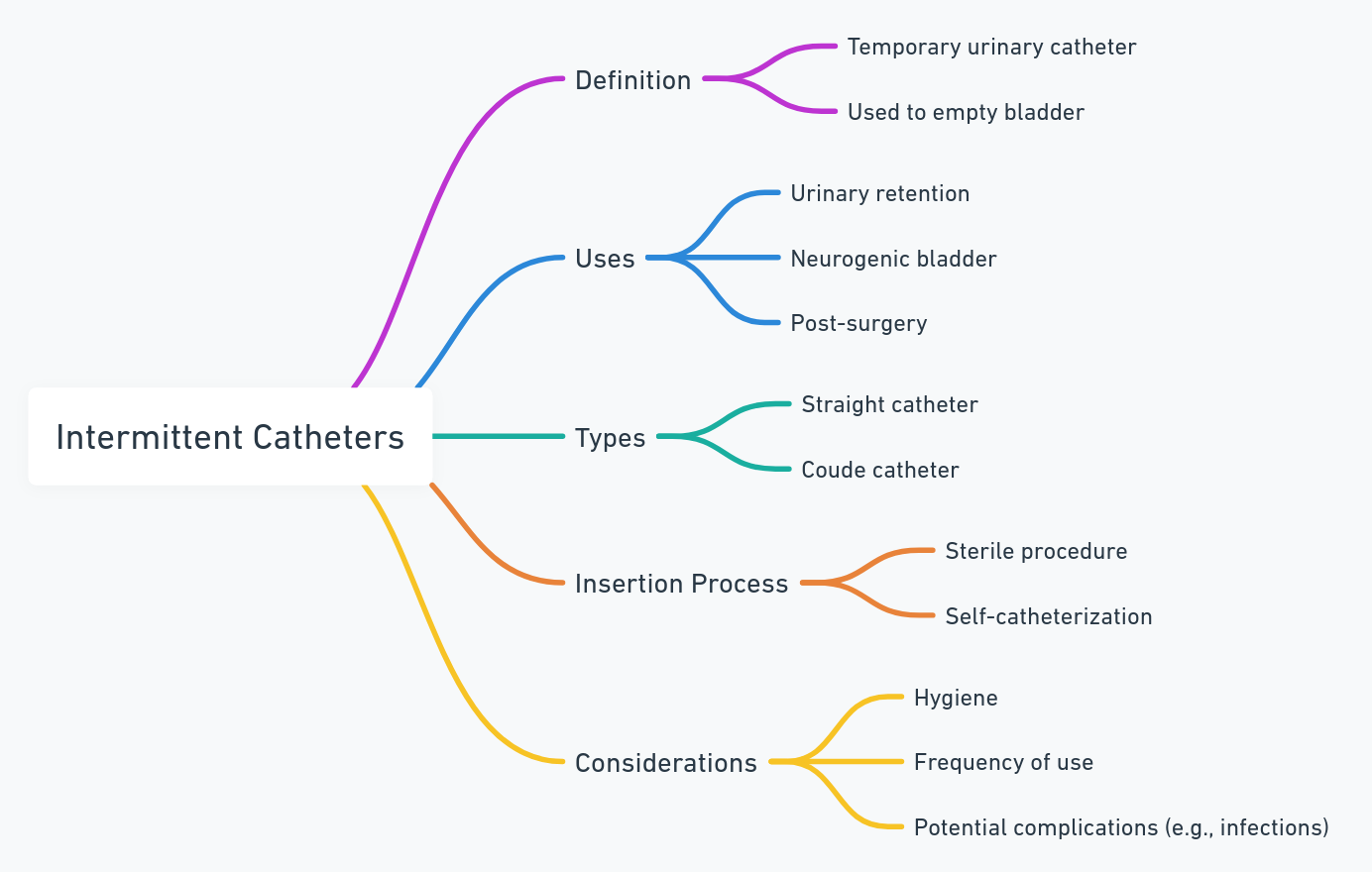

First off let’s define what we’re dealing with here. Intermittent catheters are medical devices used by people who can’t empty their bladder normally. They’re inserted into the bladder to help drain urine and typically are used on a regular schedule. Sounds pleasant right? Not exactly but it’s better than the alternative of not being able to go.

Types of Intermittent Catheters

There are several types of intermittent catheters on the market which might seem confusing but don’t worry. They all serve the same purpose with just slight differences in how they’re used:

- Straight catheters: The “basic” model. It’s a no-frills kind of catheter.

- Coudé catheters: These have a slight bend at the tip for navigating tight spots in the urinary tract. Think of it as the catheter version of a sports car.

- Hydrophilic catheters: These come pre-lubricated, saving you the hassle of applying lubrication yourself. It’s like the “self-driving” car of catheters.

- Closed system catheters: These come with a urine collection bag and are designed to minimize the risk of infection. The “luxury sedan” of catheters.

Each type of catheter has its own pros and cons. For example, the closed system catheter reduces infection risks but can feel like carrying around a science project in your bag. The hydrophilic catheter is smooth and easy to use but may sometimes feel like you’re paying extra for bells and whistles.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Does Medicare Actually Cover These Catheters?

Medicare Part B Coverage

So here’s the thing Medicare Part B covers intermittent catheters if they’re deemed medically necessary. According to Medicare’s guidelines catheters fall under durable medical equipment (DME). You can qualify if your doctor certifies that you need them for a medical condition. Medicare will cover up to 200 catheters per month (that’s about 6-7 catheters per day).

If you have Medicare Advantage (Part C), coverage might be a little different but in general, most plans also cover intermittent catheters.

Requirements for Coverage

Now before you go ordering catheters in bulk there are a few key requirements:

- You must have a prescription from a doctor.

- Your condition must be long-term or require regular use of a catheter.

- The supplier of the catheters must accept Medicare.

“People sometimes assume that because something is medically necessary it’ll be covered no questions asked” says Henry Beltran, owner of Medicare Advisors Insurance Group LLC. “But with Medicare there’s always some paperwork and jumping through hoops.”

Costs and Out-of-Pocket Expenses

You might be thinking “Okay so Medicare covers them but what’s this going to cost me?” Good question. Here’s the deal:

- Medicare covers 80% of the cost after you meet your Part B deductible. In 2024 that deductible is $226.

- You’re responsible for the remaining 20%. If your catheter is a little more high-end (looking at you hydrophilic catheter) then expect to shell out a bit more.

And if you’re going for those premium catheter models like the hydrophilic or closed system you might feel like you’re paying for heated seats in a car you don’t drive. But at least you’re comfortable right?

Medicare Supplement (Medigap)

If that 20% is making your wallet cry there’s good news. A Medicare Supplement (Medigap) plan can help cover those costs. Medigap policies cover some or all of the 20% that you would normally have to pay out of pocket.

Henry Beltran adds: “This is where a lot of people get confused. They think Medicare pays for everything but there’s usually a gap and that’s where Medigap steps in.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Potential Drawbacks of Medicare Coverage

We’d be lying if we said everything was smooth sailing. There are some potential drawbacks:

- Paperwork Galore: Getting coverage isn’t as simple as walking into a store and picking up catheters like groceries. There’s a process involving doctor prescriptions forms and paperwork.

- Limited Supplier Options: You’ll need to find a supplier that accepts Medicare. Not all suppliers do and some might even limit the types of catheters they offer to Medicare patients. It’s like being told you can only shop from the bargain bin.

- Quantity Limits: Medicare’s coverage is based on medical necessity. So if you use more than 200 catheters a month—well you’re paying out of pocket for those extra “luxury” catheters.

Choosing a Supplier: What You Need to Know

Once you’re approved it’s important to find the right Medicare-approved supplier. Here’s what to look for:

Things to Ask the Supplier

- Do you accept Medicare? Some suppliers just don’t.

- Are there any additional costs? You might run into hidden fees. Be sure to ask upfront.

- How fast is delivery? You don’t want to run out when you need them.

Choosing the right supplier can feel like buying a car: some companies are straightforward while others try to upsell you on features you don’t need. It’s always good to ask questions and shop around.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Wrapping It Up (With a Bow)

In short yes Medicare covers intermittent catheters but like anything in life there are caveats. You’ll need a prescription navigate some paperwork and be prepared for a bit of out-of-pocket costs depending on your plan. Also make sure you find a Medicare-approved supplier to avoid surprises down the road.

Henry Beltran likes to remind people: “Medicare is great but it’s not magic. You’ve still got to do your homework to make sure you’re covered and not paying more than you have to.”

So next time you’re sitting there wondering whether your catheter is covered remember it’s just like buying a car. Sometimes you get the basic model and sometimes you spring for the one with all the bells and whistles. Either way it’s all about finding what works best for you.

Quick Takeaways:

- Yes Medicare covers intermittent catheters but requires a prescription.

- Part B will cover 80% after your deductible but you’ll need to cover the remaining 20%.

- There are several types of catheters to choose from but not all are created equal when it comes to cost.

- Medigap plans can help with the out-of-pocket expenses.

- Make sure you find a Medicare-approved supplier to avoid extra costs.

Now you’re all set! If you still have questions about your specific situation don’t hesitate to give us a call at Medicare Advisors Insurance Group LLC—we’re here to help guide you through the Medicare maze.