Car accidents can happen when you least expect it and the aftermath can leave you with a lot of questions One common question people have is “Does Medicare cover injuries from a car accident?” Well buckle up because we’re about to go for a ride through the world of Medicare and how it handles car accident-related injuries. We’ll keep it light and informative so you can understand the ins and outs of what to expect without needing a medical degree

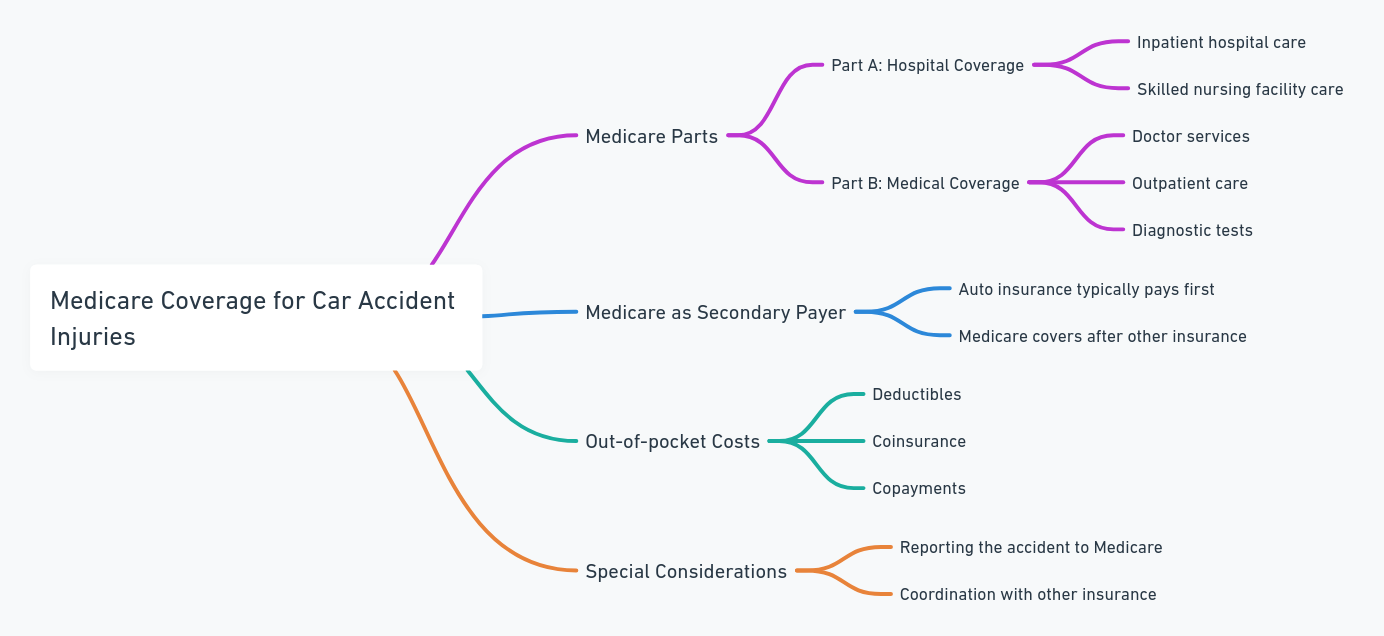

How Medicare Covers Injuries from a Car Accident

When you get into a car accident you might have injuries that need medical attention That’s where Medicare can step in But like everything with Medicare it’s not always straightforward There are a few things you need to know about what’s covered what isn’t and what costs might sneak up on you

Medicare Part A: Hospital Stays

Medicare Part A helps with hospital-related costs like inpatient care in hospitals rehab facilities or even skilled nursing care So if your injuries require you to be admitted to a hospital Part A kicks in Keep in mind though there’s a deductible you’ll need to meet before coverage starts—because nothing in life or Medicare is truly free!

But wait there’s more If you need long-term rehab due to the accident you could be looking at some serious out-of-pocket costs if you don’t have supplemental insurance Medicare will only cover skilled nursing facility care for a limited time and after that you’re on your own Henry Beltran the owner of Medicare Advisors Insurance Group LLC points out “It’s a bit like getting a rental car—sure they’ll cover you at first but eventually they want that ride back and you’re footing the bill”

Medicare Part B: Outpatient Care

Part B handles outpatient services like doctor visits diagnostic tests physical therapy and even ambulance rides after an accident But again you’ll be dealing with that 20% coinsurance that’s always lurking in the shadows Also Part B has a monthly premium and a deductible to meet so while you’re healing from that fender-bender your wallet might take a hit too

The downside? Medicare Part B doesn’t cover prescription medications unless you have Part D This means that if you need pain relief after an accident you might be surprised when the pharmacy hands you a hefty bill It’s like thinking you’re done paying for gas only to realize you also have to pay for the oil change

Medicare Part D: Prescription Drugs

Ah Part D! It’s supposed to help you with your prescription drugs but like any car with a tricky transmission it can be a bit finicky While Part D plans cover most medications there are some that might not be on your specific plan’s formulary So if your doctor prescribes something to help you recover from your accident make sure it’s covered—or prepare for some out-of-pocket costs

You don’t want to end up in the donut hole—that confusing coverage gap in Part D where suddenly your costs shoot up like that moment you realize you’ve been driving with the parking brake on “Medicare is great but it’s got a few blind spots just like every driver on the road” says Henry Beltran “That’s why you need to be aware of your plan and make sure it covers what you need before you need it”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Potential Roadblocks to Coverage

Not everything is smooth sailing when it comes to Medicare and car accidents Sometimes there are unexpected hurdles like a deer running out in front of your car—except this time it’s paperwork deductibles and denied claims

Coordination of Benefits

If you have auto insurance that covers medical expenses Medicare might not pay first In fact Medicare usually plays second fiddle to your car insurance If your car insurance covers your medical expenses Medicare waits in the wings until those benefits run out Only then does Medicare swoop in to help

This can lead to delays in getting your bills paid and let’s be honest no one likes dealing with insurance companies—even if it’s your own. Imagine trying to settle an argument about whose turn it is to pay between your auto insurer and Medicare You might feel like a referee at a never-ending soccer game

Liability Settlements

If you’re involved in a legal battle and win a liability settlement from the accident be prepared for Medicare to come knocking They’ll expect to be reimbursed for any costs they covered related to your injuries. It’s like when your friend spots you for lunch then asks for that $20 back later on Medicare’s no different They want their share

Supplemental Insurance (Medigap)

This is where Medigap plans can really save your bacon If you have one of these plans they can help cover those pesky out-of-pocket costs Medicare leaves behind like deductibles and coinsurance. It’s like having an extra set of airbags for financial protection. But again not all Medigap plans are created equal so double-check your coverage

Henry Beltran adds “If you’re serious about avoiding those big out-of-pocket surprises after a car accident a Medigap plan is your best friend It’s like having GPS—it keeps you from getting lost in a maze of medical bills”

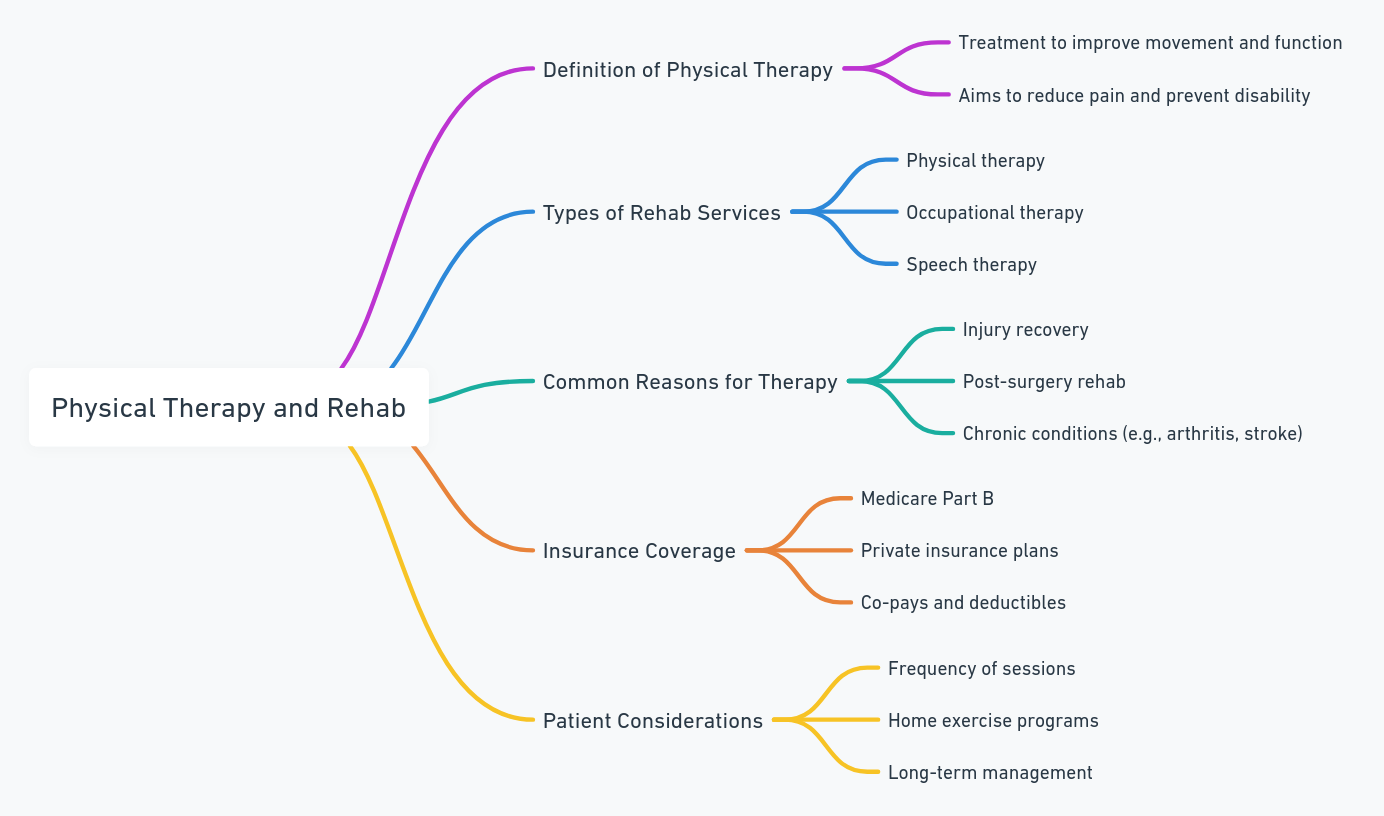

What About Physical Therapy and Rehab?

If your accident leaves you needing physical therapy or rehabilitation services Medicare Part B can cover some of those costs. However you might hit some speed bumps here too Medicare will only pay for services that are considered medically necessary so if your therapist recommends extra sessions you could be on the hook for that

Home Health Care

If you need home health care after an accident Medicare will cover some of it but you’ll need a doctor’s certification. Also Medicare’s home health benefits are limited to medically necessary part-time care—so if you’re hoping for full-time assistance you’ll need to look elsewhere

Things to Keep in Mind After a Car Accident

It’s important to know that Medicare won’t cover everything Here’s a quick rundown of what you might need to prepare for:

- Deductibles under both Part A and Part B

- Coinsurance (usually 20% of the approved amount)

- Out-of-pocket costs if you don’t have Medigap or a Medicare Advantage plan

- Potential delays if your auto insurance has to pay first

- Prescription drug costs if you don’t have Part D

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Final Thoughts from Henry Beltran

“Medicare does a lot but when it comes to car accidents it’s like a car without air conditioning—it’ll get you where you need to go but you might sweat a little on the way” says Henry Beltran. “That’s why it’s so important to review your coverage regularly and make sure you’ve got everything you need in case life throws you a curveball—or a car crash”

Remember to always check with your specific Medicare plan or speak to a Medicare advisor before any accident happens It’s like checking your tire pressure before a road trip—it could save you a lot of headaches down the line