If you’ve been prescribed Forteo for osteoporosis, you’re probably wondering if Medicare covers it. The short answer is—it depends. Let’s break down how Medicare handles Forteo, what it might cost you, and what you should know before jumping through hoops to get coverage. Spoiler alert—dealing with health insurance is a lot like putting together a piece of furniture without instructions—tricky and full of surprises.

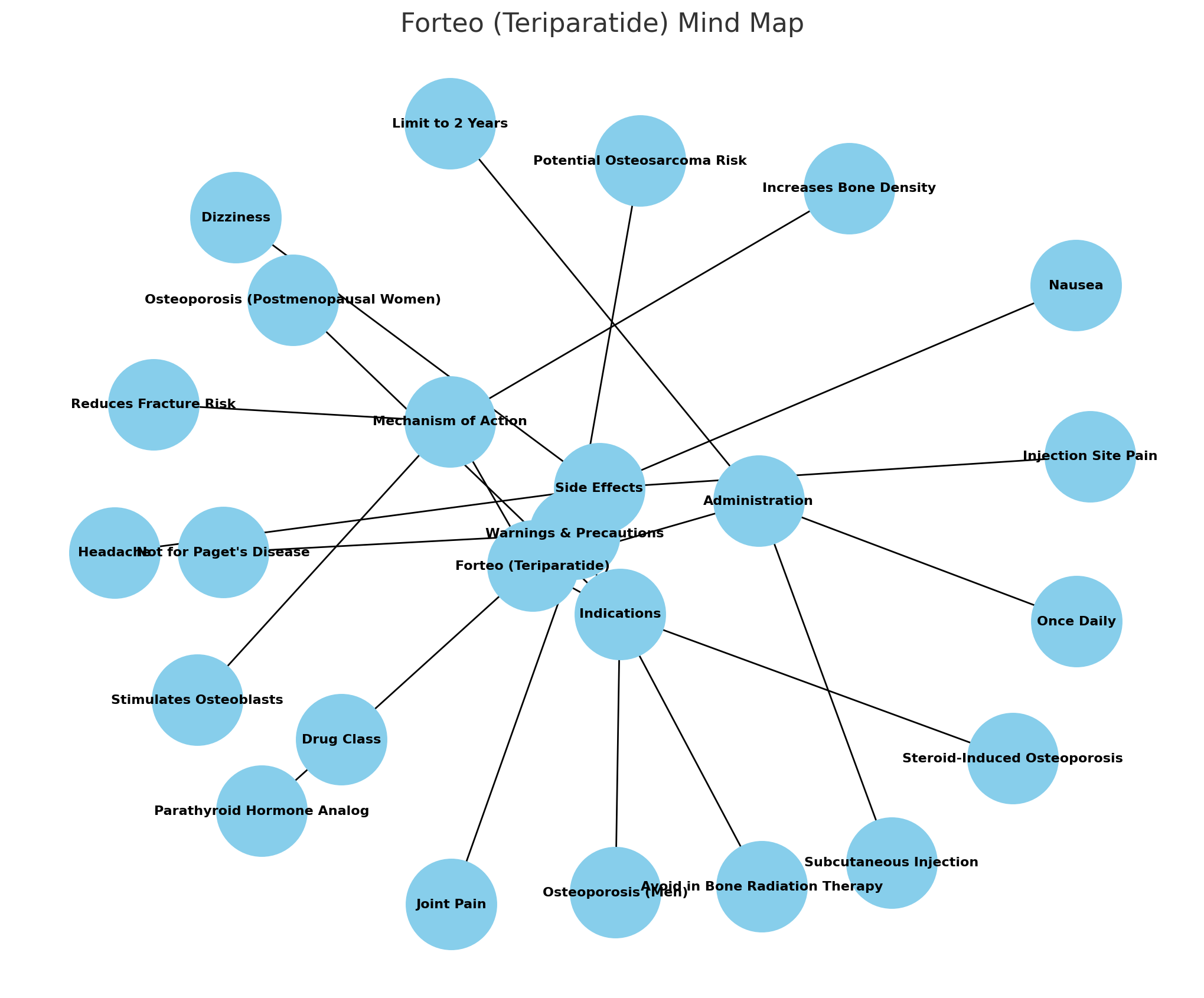

What is Forteo?

Forteo—also called teriparatide—is a prescription drug for osteoporosis, especially for people at high risk of fractures. It helps grow bone, which is really helpful for folks with severe osteoporosis. But here’s the catch—it’s crazy expensive. We’re talking around $4,000 a month. So figuring out how Medicare covers it is pretty important unless you want to take out a loan for your bones.

Does Original Medicare Cover Forteo?

Original Medicare—Parts A and B—handles hospital stays and outpatient services, but prescription drugs like Forteo? Not so much. Part A covers Forteo only if you’re getting it while you’re in the hospital, which doesn’t happen often—kind of like finding your keys right when you need them. Part B might cover it, but only in rare situations—like if a doctor gives you Forteo as part of your outpatient care. So yeah—it’s like trying to win the lottery.

Medicare Part D: The Real MVP for Forteo

If you’re on Original Medicare, you’ll likely need Medicare Part D to cover Forteo. Part D is sold by private insurance companies and specifically covers prescription drugs. But—and this is a big but—not every Part D plan will cover Forteo, so you’ll need to double-check.

Here’s the lowdown:

- Look at the plan’s formulary—which is a fancy way of saying the list of drugs they cover. Not all plans include Forteo.

- Prior authorization—you might need to ask your plan for approval before they’ll pay for Forteo. Yeah—it’s as fun as it sounds.

- Costs—you’ll still have copays—deductibles—and coinsurance. And for Forteo, it’s not going to be cheap.

Medicare Advantage (Part C) and Forteo

If you’re signed up for Medicare Advantage—Part C—it’s like getting the full Medicare package with some extras like dental and vision. Many Advantage plans also cover prescriptions, including Forteo. But just like with Part D, you need to check your plan’s formulary to see if Forteo is covered.

Henry Beltran—owner of Medicare Advisors Insurance Group LLC—says, “People think Medicare Advantage is a one-size-fits-all, but it’s not. Every plan’s different—especially with pricey drugs like Forteo. You gotta read the fine print.”

Coverage with Medicare Advantage

- Prescription drug coverage—usually included but always check if Forteo’s there.

- Out-of-pocket costs—you’ll still deal with copays—coinsurance—and deductibles.

- Network restrictions—some plans only cover Forteo if you use specific pharmacies or doctors.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

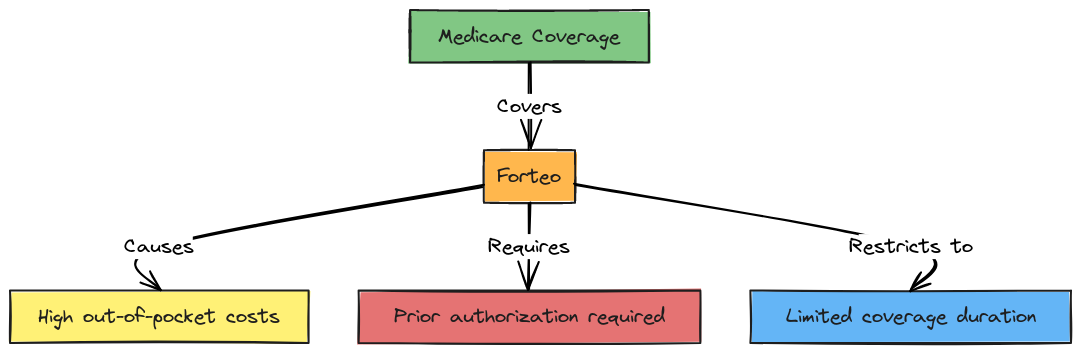

What Will Forteo Cost You?

Even with Part D or Medicare Advantage, Forteo isn’t exactly a steal. You’re still going to pay some of the costs. Here’s what might come out of your pocket:

- Deductibles—the amount you pay before your plan steps in.

- Copays or Coinsurance—this is your share of the cost, and with Forteo, it’s not exactly pocket change.

- The donut hole—if you spend a certain amount, you fall into this coverage gap where you’ll pay more until you hit catastrophic coverage.

The Donut Hole: Not as Sweet as It Sounds

Ever heard of the Medicare donut hole? It’s a dreaded coverage gap where after you and your plan spend a certain amount—you pay more out-of-pocket for your drugs. For an expensive med like Forteo, this could mean forking over a big chunk of change until you hit catastrophic coverage.

Ways to Lower Forteo Costs

Before you panic about the price—there are a few ways to bring those costs down:

- Patient assistance programs—Eli Lilly—the maker of Forteo—offers help if you qualify.

- Medicare Extra Help—this program can help lower drug costs if your income’s tight.

Henry Beltran adds, “I’ve seen clients save hundreds just by signing up for programs they didn’t know existed. Don’t assume you’re stuck paying full price—there are ways to save.”

Drawbacks of Medicare Coverage for Forteo

When it comes to Medicare, it’s not all smooth sailing—there are a few hiccups to watch out for:

- High costs—even with coverage, Forteo’s still expensive—like buying a fancy car expensive.

- Formulary problems—some Part D or Advantage plans don’t cover Forteo at all, leaving you in the lurch.

- Prior authorization hassles—you might have to jump through hoops to get coverage. It’s like trying to get a refund for a concert ticket—it takes time and patience.

Henry jokes, “The Medicare system has its quirks—Forteo’s a prime example. I always tell clients, navigating Medicare is like going through a maze—just gotta know the right turns.”

Alternatives to Forteo

If Forteo’s out of reach financially, you might want to talk to your doctor about alternatives. Other osteoporosis meds are more affordable—but keep in mind Forteo is in a class of its own when it comes to stimulating bone growth, so alternatives might not work exactly the same.

Key Takeaways

If you’ve been prescribed Forteo for osteoporosis, here’s what you need to know:

- Medicare Part A won’t help unless you’re in the hospital.

- Medicare Part B rarely covers it unless it’s administered by a healthcare provider.

- Medicare Part D or Medicare Advantage are your best bets for coverage.

- Out-of-pocket costs will still be high.

- Look for patient assistance programs or Extra Help to cut your costs.

Always check your Medicare plan’s formulary and talk with your doctor or a Medicare advisor to see if Forteo is covered—and what steps you might need to take to get it.

Henry Beltran sums it up, “Navigating Medicare is like solving a puzzle without the picture. But with the right advice—and maybe a little humor—you can make sense of it.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Final Thoughts

Medicare does cover Forteo—but it depends on your plan. Whether you’re trying to dodge the donut hole or save some money, you’ve got options. Take it one step at a time—and if you get stuck in the Medicare maze—call Medicare Advisors Insurance Group LLC—we’ll help you find the right path.