If you’ve been wondering whether Medicare covers dental bridges you’re not alone. It’s a common question especially as dental health becomes more of a focus as we age. The short answer is no traditional Medicare generally doesn’t cover dental bridges or any other routine dental care. But let’s break it down and get into the details.

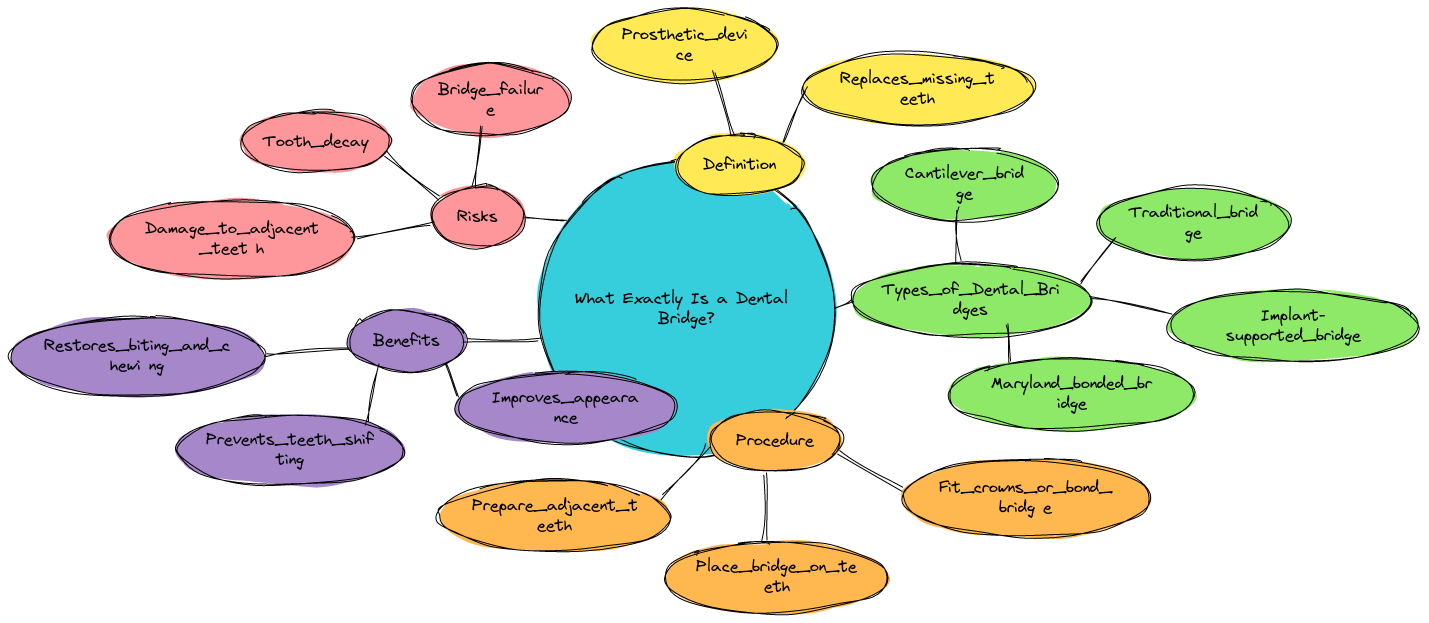

What Exactly Is a Dental Bridge?

A dental bridge is a prosthetic device used to fill a gap left by missing teeth. They “bridge” the gap by attaching artificial teeth (called pontics) to the surrounding teeth or implants. Sounds like a solid solution right? It is—but the cost can be steep especially if you’re relying on Medicare to foot the bill.

Types of Dental Bridges

- Traditional Bridges: These use crowns placed on either side of the missing tooth with the artificial tooth in the middle.

- Cantilever Bridges: Used when there’s only one tooth next to the gap. Not as common but still an option.

- Maryland Bridges: These use a framework that’s bonded to the back of the adjacent teeth.

- Implant-Supported Bridges: These use dental implants rather than natural teeth to support the bridge.

While these can be life-changing for your smile your wallet might not feel so great about it. Why? Well keep reading.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Does Medicare Help Cover Dental Bridges?

Here’s the kicker: Original Medicare (Part A and Part B) usually doesn’t cover dental care at all unless it’s related to a medical emergency or necessary for another procedure. So if you thought you could sneak that dental bridge into a hospital visit—think again.

Henry Beltran owner of Medicare Advisors Insurance Group LLC puts it bluntly: “Medicare’s stance on dental care is pretty clear. If it’s routine or preventative they’re not interested. You’ve got to find other ways to cover it.”

Why Doesn’t Medicare Cover Dental?

Medicare was originally designed to cover health emergencies and treatments related to illness. Back then dental care wasn’t seen as essential to overall health. Fast forward to today and it’s clear that your oral health impacts more than just your smile. But Medicare hasn’t caught up.

- Original Medicare = No dental bridges

- Medicare Advantage (Part C) = Possibly covers dental services but varies widely

- Medigap = Nope dental isn’t in the cards here either

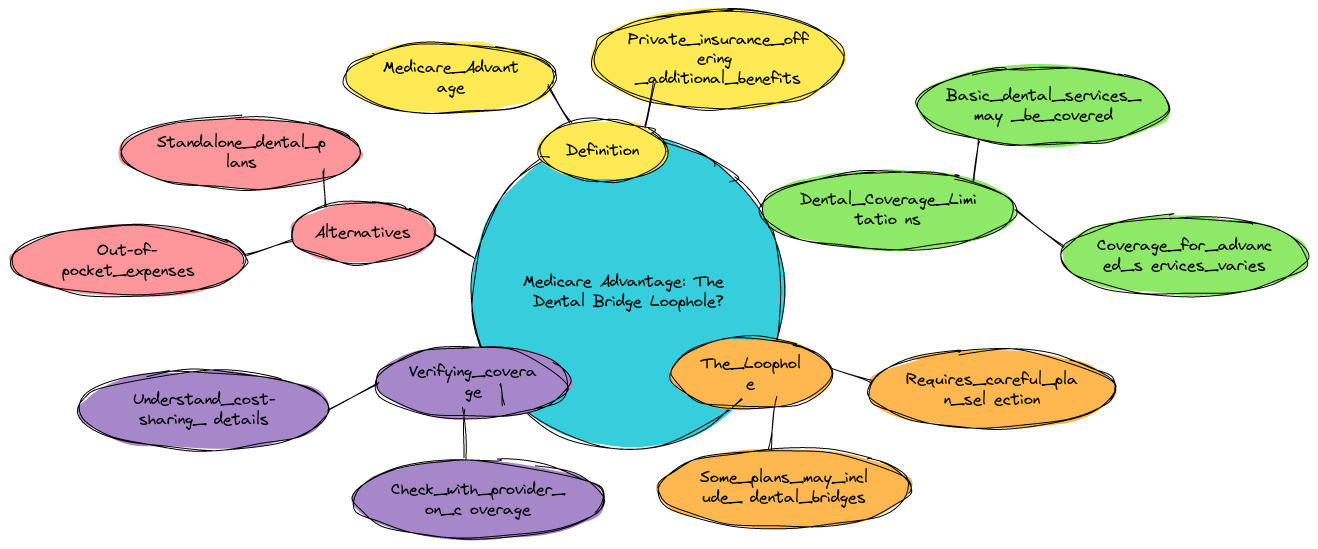

Medicare Advantage: The Dental Bridge Loophole?

While Original Medicare won’t help with your dental bills Medicare Advantage Plans could. These plans are offered by private insurers and often include some coverage for routine dental services like cleanings and dental bridges. But before you jump in thinking you’ve found the golden ticket there are a few things you should know.

What’s Covered (And What’s Not)

- Basic services like cleanings X-rays and exams might be covered

- More complex procedures like dental bridges? Maybe but there’s often annual limits which means you could still end up paying a lot out-of-pocket

So yes Medicare Advantage might help but don’t expect to waltz in and have all your dental work paid for. Henry Beltran adds “It’s like putting a band-aid on a bigger problem. You might get some help but you’re probably going to pay more than you’d like.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How Much Does a Dental Bridge Cost?

Let’s talk about the numbers. The cost of a dental bridge can vary depending on the type and materials but you’re looking at:

- Traditional or Cantilever Bridge: $2,000 to $5,000

- Maryland Bridge: $1,500 to $2,500

- Implant-Supported Bridge: $5,000 to $15,000

Now imagine paying for that out-of-pocket. Yikes. This is where Medicare Advantage might come in handy but as mentioned earlier the coverage limits can be a deal-breaker.

Potential Drawbacks of Dental Bridges

Dental bridges are a great solution but let’s not pretend they’re perfect. Here are a few drawbacks:

- They can wear down your natural teeth: The teeth next to the bridge have to do a lot of heavy lifting which can weaken them over time. So you get a great smile but those other teeth? Not so much.

- Implants are better but costlier: Dental implants are often the better choice but they come with a bigger price tag. It’s like upgrading to first class but on a dental budget. Your smile will be fancy but your bank account? Not so much.

- They don’t last forever: Dental bridges last anywhere from 5 to 15 years. So just when you’re used to your new teeth—bam it’s time for a new bridge. It’s like replacing the tires on a car right after you paid it off.

- Eating may feel weird at first: You’ll be able to eat normally after a while but that first sandwich might feel like you’re chewing with a whole new set of tools. It takes some getting used to. But hey you’ll adjust—eventually.

Alternatives to Dental Bridges

If the cost of a bridge makes you cringe there are other options. Depending on your situation you might consider:

- Dental Implants: More durable but way more expensive

- Partial Dentures: Removable and less expensive but some people find them uncomfortable

- Do Nothing: You could just live with the gap (not recommended but hey it’s an option!)

How to Get Medicare Coverage for Dental Work?

If you really need coverage for dental bridges your best bet is to look into Medicare Advantage plans or supplemental dental insurance. Henry Beltran often advises clients to “Look at all your options before assuming Medicare will handle it. A little research now can save a lot of headaches later.”

Here’s a quick guide on what to do:

- Check your current Medicare plan: Does it include any dental benefits?

- Shop around for Medicare Advantage plans: See if any cover dental bridges.

- Consider supplemental dental insurance: It may give you more flexibility for covering larger procedures like bridges.

- Ask your dentist: They might have payment plans that make the cost more manageable.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Conclusion

Medicare doesn’t cover dental bridges under traditional Medicare but there are ways to still get some help with the cost. Whether it’s through Medicare Advantage or supplemental insurance finding the right plan could make a big difference.

As Henry Beltran says “Navigating Medicare can be confusing but you don’t have to do it alone. We’re here to help you find the best solutions for your needs dental or otherwise.”

Take some time to review your options—your teeth and your wallet will thank you!