Navigating the world of prescription drugs can be a little confusing especially when you’re dealing with Medicare. One of the common questions that pop up is whether Medicare covers compounded drugs. Now you might be asking, “What even are compounded drugs?” Don’t worry we’ve got you covered with everything you need to know – from coverage to costs with a few chuckles along the way!

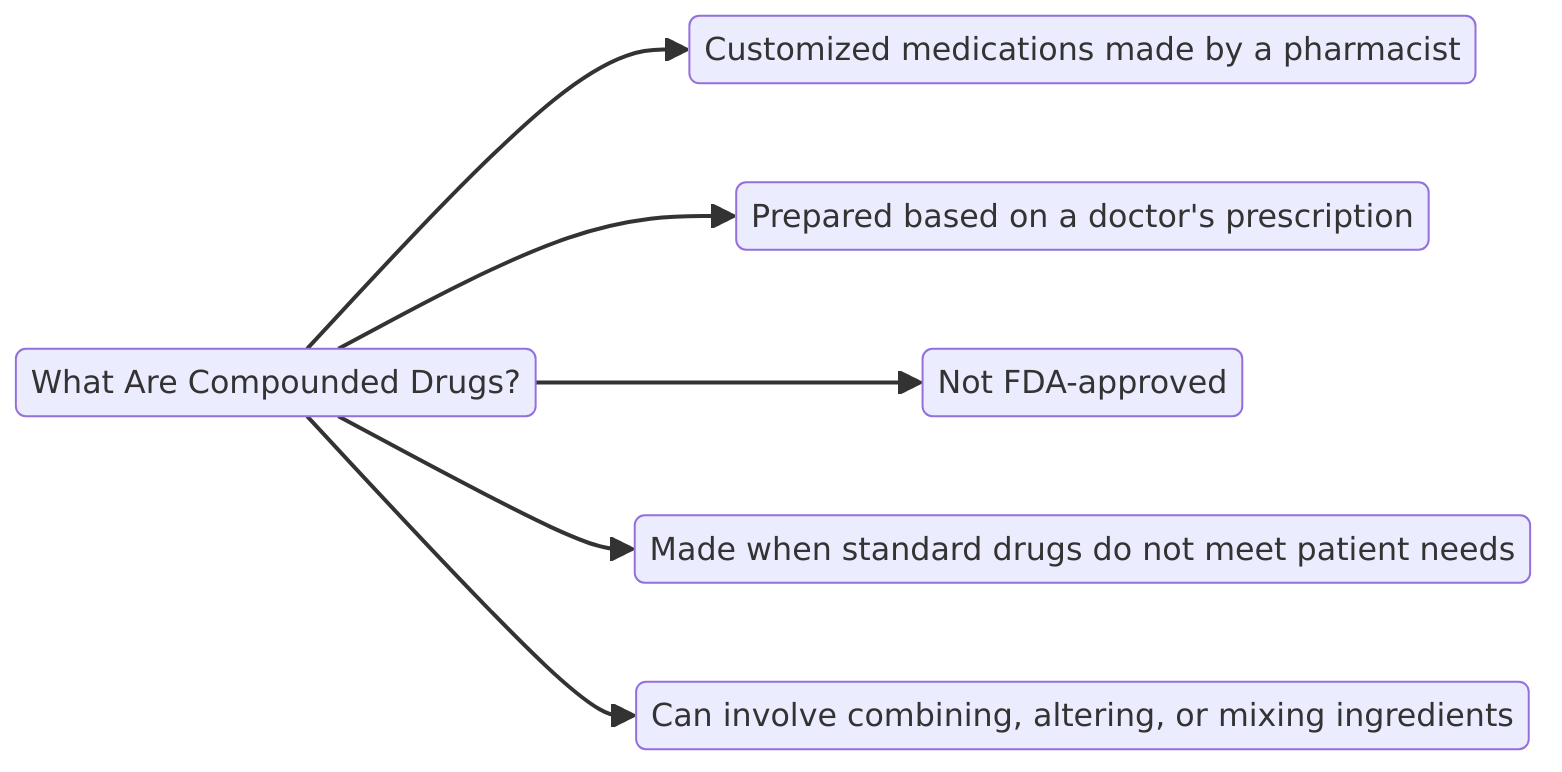

What Are Compounded Drugs?

Before we dive into Medicare coverage let’s break down what compounded drugs are. These are customized medications prepared by pharmacists to meet the unique needs of a patient. Unlike mass-produced medications compounded drugs are tailored specifically for you – think of them as a medication that fits you like a glove (hopefully not literally). For example they may combine multiple medications into one or alter the dosage for people with allergies to certain ingredients.

Why Would You Need Compounded Drugs?

- Allergies or Sensitivities: Some patients are allergic to dyes preservatives or fillers in commercially available medications.

- Specific Dosage Needs: The exact dose you need might not be available commercially.

- Alternative Forms: Perhaps you can’t swallow pills – compounded meds can be made into creams liquids or gels.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

So Does Medicare Actually Cover Compounded Drugs?

The million-dollar question! Well the answer is… it depends. Medicare Part D (which covers prescription drugs) can cover compounded medications, but there’s a big catch. The drug being compounded must include at least one ingredient that is FDA-approved and that particular ingredient must be on your Part D plan’s formulary (the list of covered drugs).

Things to Keep in Mind:

- If none of the ingredients are FDA-approved: Medicare won’t cover it – you’re outta luck!

- Part B might help in rare cases: If you’re receiving the medication in a hospital or outpatient setting (and only if it’s medically necessary). But don’t hold your breath!

Here’s where things get tricky – you may end up paying out-of-pocket if Medicare denies coverage. And trust me that can burn a hole in your wallet faster than you can say “compounded.”

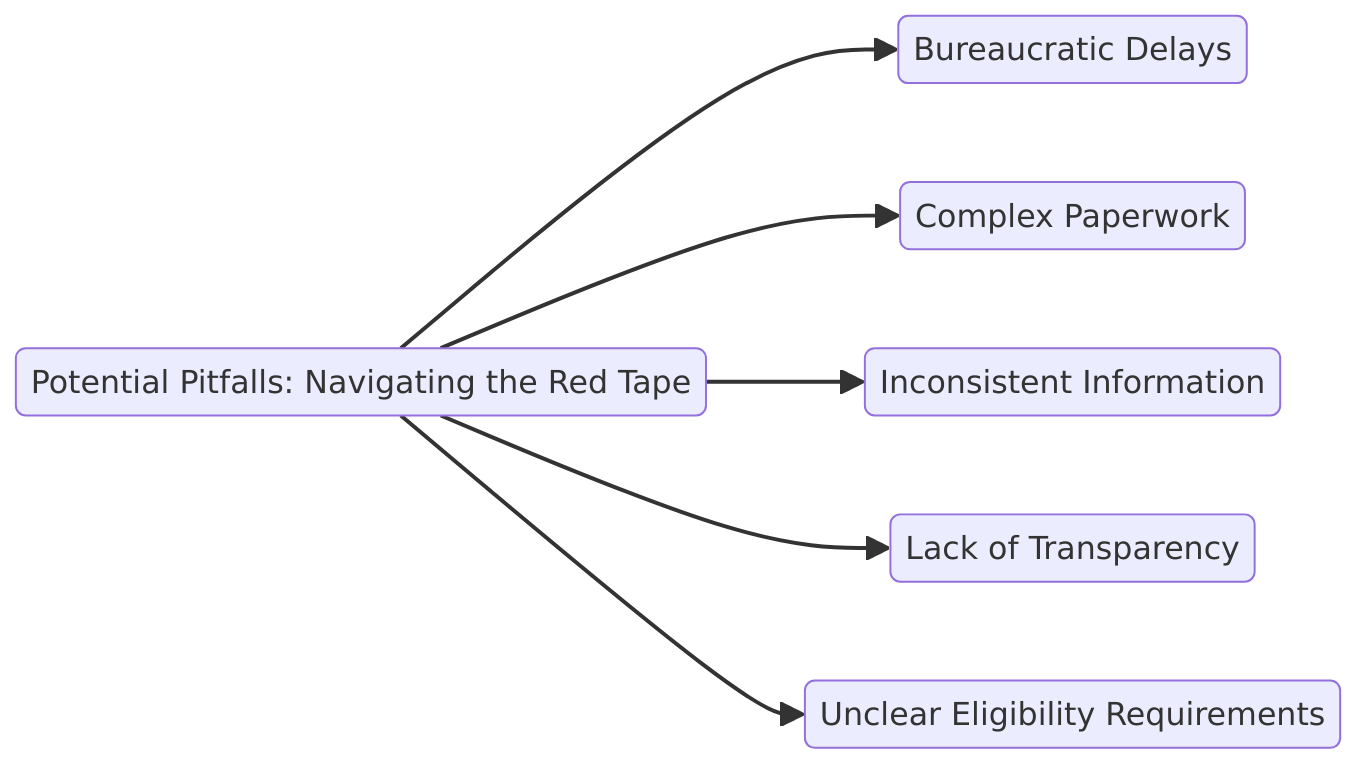

Potential Pitfalls: Navigating the Red Tape

Ah the joys of dealing with insurance! The main drawback of getting Medicare to cover compounded drugs is the bureaucratic gymnastics you’ll need to perform. Not all pharmacies are on board with compounded meds – and even when they are you’ll need to jump through hoops like prior authorization and other paperwork.

Challenges You Might Face

- Prior Authorization: Some plans may require prior authorization before covering compounded meds. Think of it like asking permission to throw a party – except instead of confetti you’re dealing with a medication cocktail.

- High Costs: If Medicare doesn’t cover it you could be staring at some hefty bills. Depending on the medication your costs could skyrocket.

- Limited Pharmacies: Not all pharmacies can or will do compounding. So you might need to go on a bit of a pharmacy scavenger hunt.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What Does Henry Beltran Say?

As Henry Beltran owner of Medicare Advisors Insurance Group LLC puts it “It’s always a good idea to ask questions and get informed before making decisions. Compound drugs are a great option for some people but you need to make sure you’re covered first.” He adds with a chuckle “I’ve had clients think they’re getting a deal only to be surprised when the bill arrives – that’s the kind of surprise nobody wants!”

How Can You Check if Your Drug is Covered?

Now that you’re concerned about coverage you’re probably wondering how to check if your drug is covered. It’s not rocket science but you will need to put in a little legwork.

Steps to Check:

- Review Your Plan’s Formulary: Look up the drug’s active ingredient in your plan’s list of covered drugs.

- Contact Medicare: They can tell you whether the compounded drug is covered or not.

- Ask Your Doctor: Sometimes your doctor might know if it’s covered based on previous cases.

Tips for Managing Compounded Drugs with Medicare

- Always Check First: Before filling a prescription for a compounded drug check with Medicare and your pharmacist to see if it’s covered.

- Get Prior Authorization if Needed: If your plan requires prior authorization for compounded drugs make sure your doctor submits the paperwork.

- Ask About Generics: Sometimes a generic alternative exists that doesn’t need compounding – this could save you money and headache.

- Consider Compounding Pharmacies: These pharmacies specialize in making compounded drugs and might be more familiar with navigating Medicare’s rules.

Are There Any Affordable Alternatives?

Let’s face it compounded drugs can be expensive especially when Medicare says “nope.” So what are your options?

Alternatives You Can Consider

- Look for FDA-approved drugs: Instead of compounding see if an FDA-approved drug works for your needs.

- Ask About Discounts: Some pharmacies offer discounts for compounded medications.

- Shop Around: Prices for compounded drugs vary – you might find a better deal at a different pharmacy.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Humorous Drawbacks (Because Who Doesn’t Love a Laugh?)

- Sticker Shock: “Surprise” might be fun at birthday parties but when it comes to a pharmacy bill not so much. Imagine expecting a $10 copay but getting a $300 bill instead. That’s like ordering a cheeseburger and getting charged for a steak!

- Pharmacy Hide-and-Seek: Trying to find a pharmacy that compounds drugs can feel like a game of hide-and-seek. Spoiler: the pharmacy usually wins.

- Prior Authorization Wait Times: Ever waited on hold for customer service? Now imagine doing that but with your medication on the line. Fun right?

Closing Thoughts

When it comes to compounded drugs and Medicare coverage there’s no one-size-fits-all answer. Coverage varies based on your plan the ingredients in the drug and a whole host of other factors. But with a little patience (and maybe a lot of paperwork) you can figure out whether Medicare will help with the cost.

Henry Beltran offers some final advice “Always do your research. It’s better to know upfront whether your medication is covered than to be stuck with a bill you weren’t expecting. Trust me your future self will thank you!”

So before you get a compounded drug prescription filled make sure to check if you’re covered ask questions and prepare yourself for the possibility of paying out-of-pocket. And if Medicare gives you a hard time just remember you’re not alone!