If you’re someone who needs help with daily activities and prefers care from someone you know and trust you might have come across the Consumer Directed Personal Assistance Program (CDPAP). This New York State Medicaid program allows people to hire their friends family or even neighbors to be their paid caregivers. But the big question is does Medicare cover CDPAP? Let’s dive into that and explore the nitty-gritty of this program.

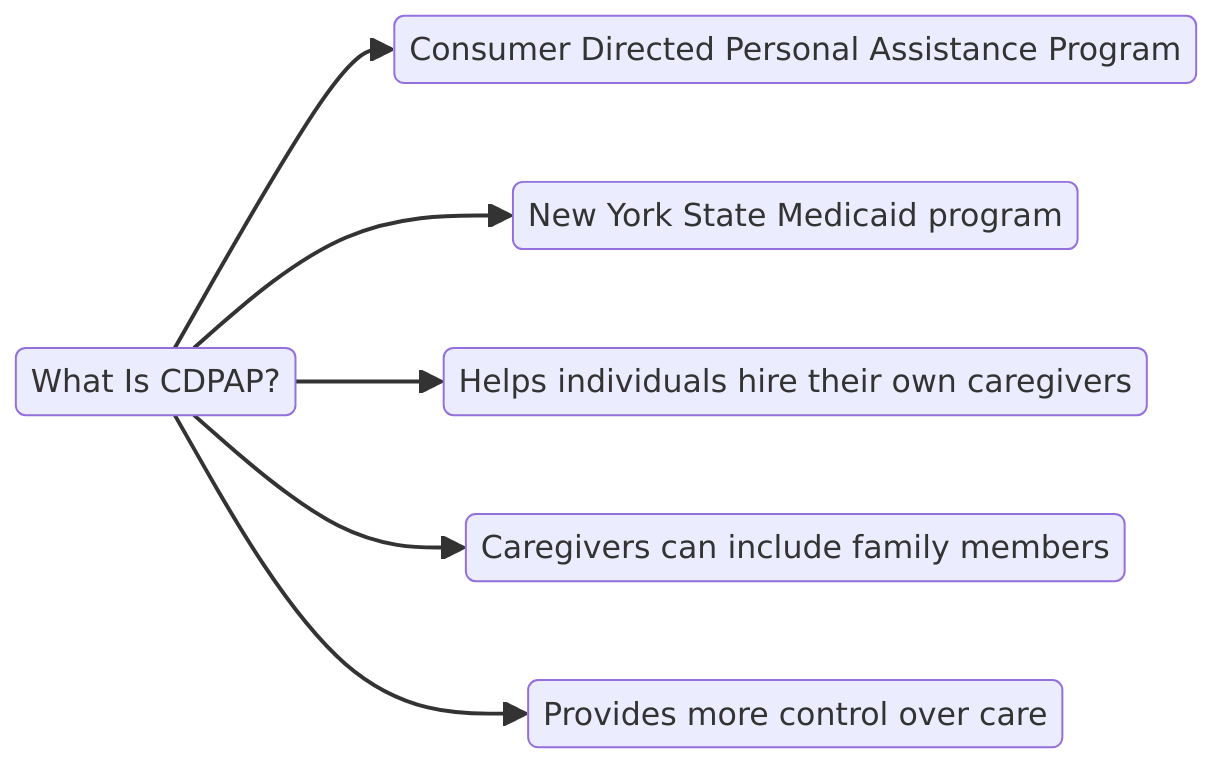

What Is CDPAP?

CDPAP lets individuals with disabilities or chronic illnesses receive personal assistance from people they choose. Instead of relying on a stranger from an agency you can get help from your cousin neighbor or even that friend who’s always offering to lend a hand. They get paid you get cared for. It’s a win-win.

Now here’s the catch: CDPAP is a Medicaid program. So if you’re hoping for Medicare to pick up the tab for this one I’ve got some news for you. Medicare typically does not cover CDPAP. If you’ve been banking on your Medicare plan to help with this specific service you might be barking up the wrong tree.

Medicare vs Medicaid

What’s the Difference?

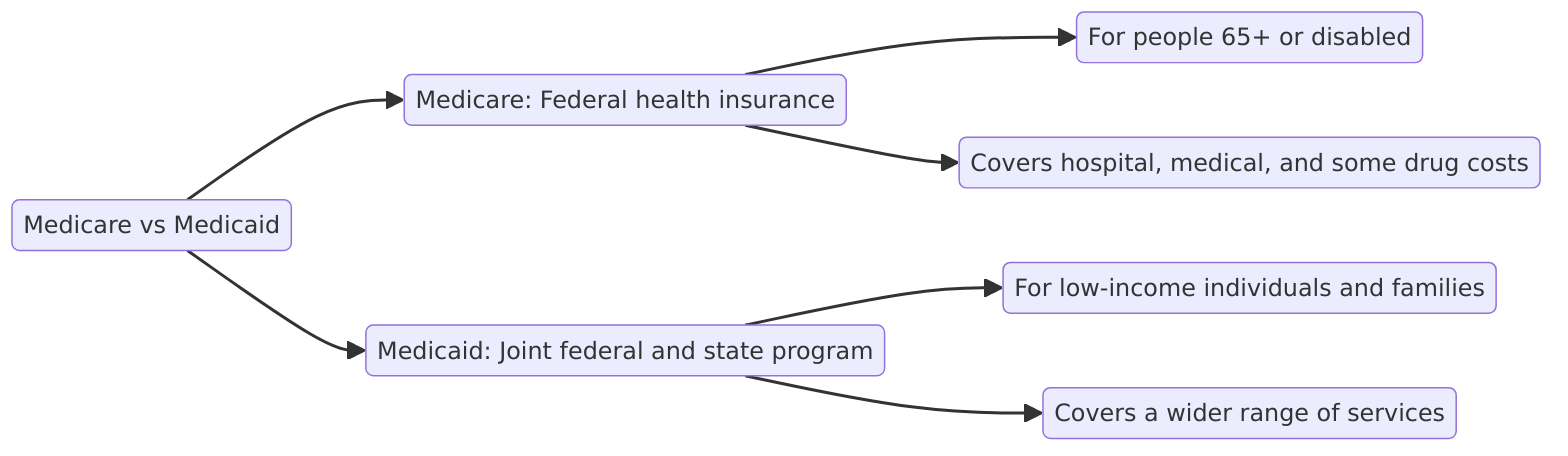

First things first let’s clear up the confusion between Medicare and Medicaid. They’re two government programs both aimed at helping people with health care costs but they’re quite different.

- Medicare: Mostly for people 65 and older or those with certain disabilities regardless of income. It’s federal and offers standardized coverage across the country.

- Medicaid: A state and federal program that offers coverage based on income. Each state administers its Medicaid program and the benefits and eligibility can vary. CDPAP falls under this category.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

So Can You Use Medicare for CDPAP?

Straight Answer: No

As much as we’d all love for Medicare to cover everything under the sun Medicare does not cover CDPAP. It’s a program designed under Medicaid in New York. Henry Beltran owner of Medicare Advisors Insurance Group LLC puts it best: “I’ve had so many clients come to me with this question and I always have to tell them Medicare just doesn’t cover it because it’s a Medicaid deal.”

But hey just because Medicare doesn’t cover CDPAP doesn’t mean all hope is lost. There might still be Medicaid options or even private insurance solutions if you qualify. That’s where having an advisor (like yours truly) can really help you figure things out.

Let’s Get Real – What are Your Options?

Here’s the deal if you’re keen on CDPAP and you’ve got Medicare but no Medicaid you’ll want to look into the following:

- Dual Eligibility: Are you eligible for both Medicare and Medicaid? Some folks are! If your income is low enough Medicaid can fill in the gaps where Medicare leaves off.

- Private Insurance: In some cases long-term care insurance might be able to provide some of the same types of benefits as CDPAP but you’d have to dig into your plan to see what’s covered.

- State Medicaid: If you’re not in New York and wondering about similar programs in your state Medicaid does vary. Some other states may have similar options but again Medicare won’t cover these.

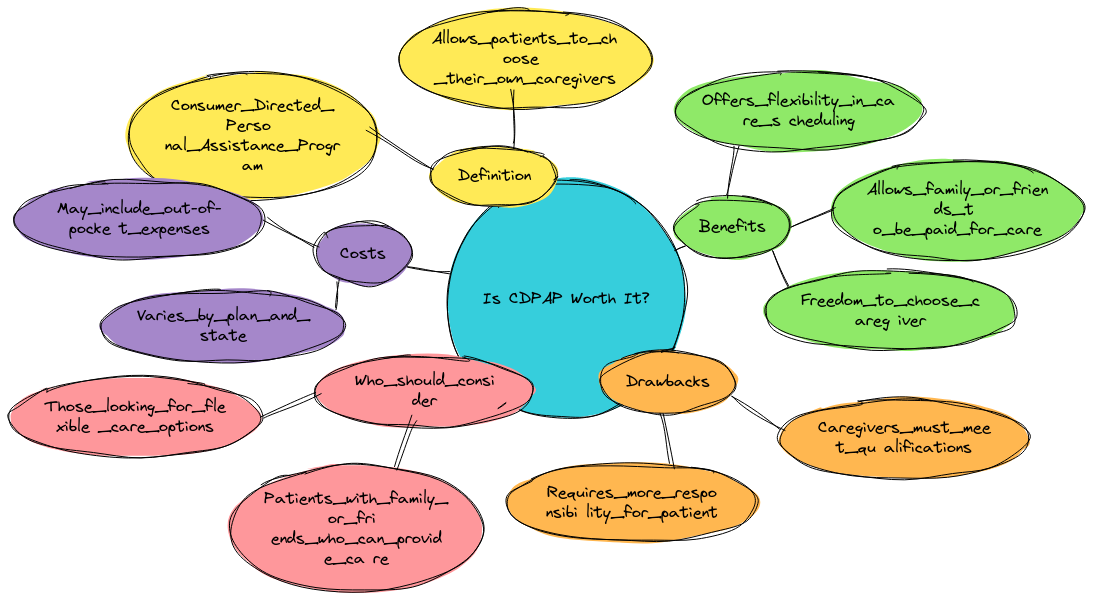

Is CDPAP Worth It?

Let’s talk about whether it’s worth jumping through the hoops to get Medicaid to cover CDPAP. If you’ve got a loved one who can provide care and you’re eligible for Medicaid it’s a great option. You’ll get care from someone you trust and that person gets paid – no one’s losing here.

Pros

- You choose your caregiver: No awkward moments with a stranger trying to figure out how you like your coffee.

- Flexibility: You can get help when you need it and from someone who already knows your needs.

- Personal connection: Care is way more comfortable when you’re working with someone who’s got your back.

Cons (And Here Comes the Fun Part)

Now I know this program sounds amazing but like anything in life it’s not perfect. Let’s have a chuckle at some of the potential drawbacks (because hey if we can’t laugh what can we do?).

- Training? What’s that?

- Sometimes the person you choose to be your caregiver doesn’t exactly have a medical degree. Sure they make great lasagna but when it comes to wound care? Ehh… better cross your fingers.

- Hello paperwork!

- Medicaid isn’t exactly known for being a breeze. Get ready to jump through hoops fill out forms and wait on hold for what feels like forever. By the time you’re done you’ll be a professional in red tape.

- Family drama? Never heard of it!

- Hiring a family member to be your caregiver sounds sweet until they start treating your care like a 9-to-5. Aunt Karen might want to leave right at 5 PM sharp and let’s just say that won’t always fly if you need help in the evening.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Conclusion

In short Medicare does not cover CDPAP but that doesn’t mean you’re out of options. If you’re eligible for Medicaid or even a combination of Medicare and Medicaid this could still be a fantastic program to look into. And hey even if you’re just on Medicare don’t give up! There are other routes you can take like private insurance or state programs.

Henry Beltran adds “Look navigating these programs can be a headache but when you have the right people guiding you it makes all the difference. That’s what we’re here for at Medicare Advisors Insurance Group LLC.”

So let’s keep things clear while Medicare won’t cover CDPAP it’s still a solid option if you can qualify through Medicaid. And remember if you need any help give us a call! We’ve got your back.