When it comes to foot health there’s one question that we hear all the time—Does Medicare cover arch supports? Whether you’re dealing with pain from flat feet or looking for ways to help manage plantar fasciitis many people are hoping Medicare will step in and lend a hand—or a foot in this case.

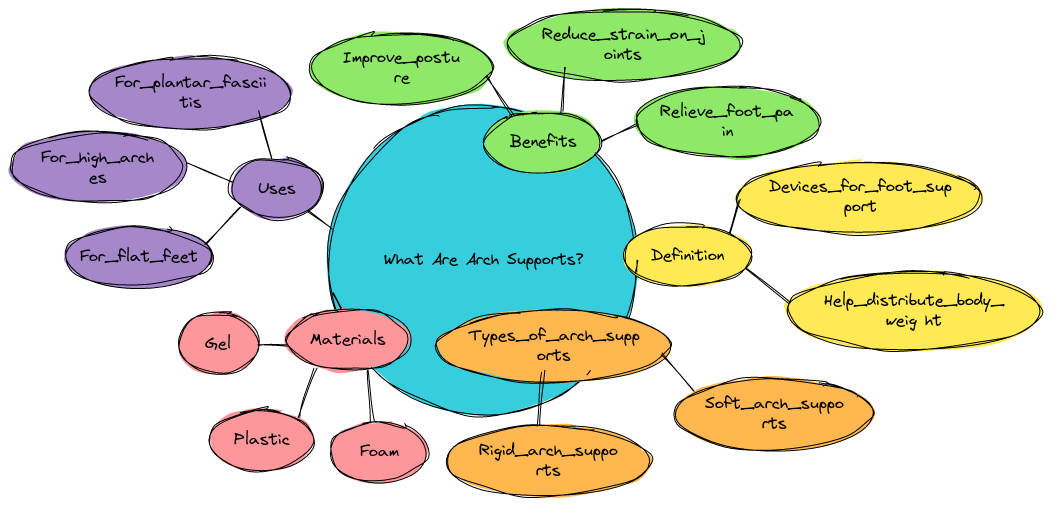

What Are Arch Supports?

Arch supports are those helpful little inserts you slip into your shoes to provide extra support for your feet. They can be bought off the shelf or custom-made depending on the level of support you need. Most people turn to them when they’re dealing with chronic foot pain caused by things like flat feet or plantar fasciitis (basically your feet hurt a lot). These inserts help align your feet properly relieve pressure and make walking more comfortable.

How Do Arch Supports Help?

- They help distribute weight evenly across your foot

- They reduce strain on your feet’s arches

- They can relieve pain caused by flat feet

- They improve overall balance and foot alignment

- They can prevent other issues like knee and back pain from improper posture

But here’s where things get tricky: Not all foot pain is created equal and not all treatments get Medicare’s stamp of approval.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Does Medicare Cover Arch Supports?

The short answer? Not usually. Medicare Part B typically covers “durable medical equipment” (DME) that a doctor prescribes for use at home. However arch supports don’t usually make the cut because they are often classified as “comfort items.” This means that unless you have a specific medical condition (like diabetes-related foot issues) Medicare isn’t going to foot the bill.

When Does Medicare Cover Foot Care?

Medicare does cover foot care for people with certain medical conditions especially those related to diabetes. If you have diabetes and your foot health is at risk Medicare will cover custom-molded shoes and inserts that are considered medically necessary.

Here’s a quick breakdown of what Medicare might cover:

- Diabetic Shoes: If you have severe diabetes that affects your feet Medicare Part B might cover specially designed diabetic shoes

- Orthotics: Custom orthotic inserts may be covered for people with specific foot conditions or deformities as long as a doctor deems them necessary

- Routine Foot Exams: Covered for those with diabetes or conditions that put their feet at risk

However if you’re just looking for relief from your everyday aches and pains and your foot doctor recommends over-the-counter arch supports Medicare likely won’t cover those.

Potential Drawbacks of Arch Supports (With a Smile)

Let’s be real—while arch supports can be a game-changer they’re not without their quirks.

- They’re Not Always a Perfect Fit: Custom orthotics are great but they can sometimes feel like wearing bricks in your shoes at first. It’s like asking a clown to walk a tightrope. Humorously clunky!

- Pricey When Not Covered: Those custom arch supports? They can cost a pretty penny and since Medicare doesn’t always cover them you might find yourself trying to justify the expense. “Do I really need these or can I just stuff some extra socks in my shoes?” (Hint: socks don’t work as well).

- They Can Wear Out Quickly: Depending on the material arch supports can wear out faster than you expect. It’s like buying a fancy car and finding out the tires go flat after a few months. Not ideal for the long haul!

Alternatives to Arch Supports

If Medicare isn’t going to cover arch supports and you’re not ready to fork over the cash there are other options. Here are some alternatives:

- Over-the-counter arch supports: You can pick these up at your local pharmacy for a fraction of the cost of custom orthotics

- Foot exercises: Strengthening the muscles in your feet can help reduce pain and improve arch support naturally

- Shoes with built-in support: Look for shoes designed with arch support in mind—sometimes a good pair of shoes can make all the difference

- Physical therapy: A professional can guide you through exercises to improve your foot alignment and relieve pain

Henry Beltran’s Take on Medicare and Arch Supports

Henry Beltran the owner of Medicare Advisors Insurance Group LLC offers his take on the situation. “I get a lot of calls from people hoping that Medicare will cover their arch supports but unfortunately it’s not usually the case. Medicare’s rules around what they cover can be pretty strict especially when it comes to foot care.”

Henry adds with a chuckle “But hey if your feet are hurting and you’ve got a prescription from your doctor it’s always worth asking—it doesn’t hurt to check. But be ready for some out-of-pocket expenses if they say no!”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How to Get Help Paying for Arch Supports

If you find yourself in need of arch supports but Medicare isn’t covering them here are some options:

1. Check with Your Supplement Insurance

Medicare Supplement Plans (Medigap) can sometimes help with costs that original Medicare won’t cover. It’s always worth checking with your insurance provider to see if you have any coverage.

2. Look for Discounts

There are often discount programs available through certain retailers or manufacturers for orthotics and arch supports. You can even ask your foot doctor if they know of any programs.

3. Use Flexible Spending Accounts

If you have a Flexible Spending Account (FSA) or Health Savings Account (HSA) you might be able to use those funds to cover the cost of arch supports.

What If You Need Arch Supports for a Medical Condition?

If you have a medical condition like severe flat feet or you’re diabetic and dealing with foot pain you might qualify for custom orthotics covered by Medicare. Your doctor can help you navigate the process to see if Medicare will cover some or all of the cost.

Steps to Take:

- Get a prescription from your doctor

- Ask about Medicare-approved suppliers

- Confirm coverage before purchasing

If you’re struggling with chronic foot pain and you think you might need custom orthotics talk to your doctor. They’ll be able to give you the best advice based on your specific condition.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Conclusion

While Medicare isn’t the best friend when it comes to covering arch supports it doesn’t mean all hope is lost. Whether you’re looking for alternatives like over-the-counter options or trying to find ways to get coverage through a supplemental insurance plan it’s always worth investigating all the routes. And if all else fails you can still slip a pair of arch supports into your shoes and walk a little more comfortably—even if you have to pay out of pocket.

As Henry Beltran says “It’s always worth checking with your insurance provider because you never know what they might cover. And in the meantime keep those feet happy!”

So step out confidently—just don’t expect Medicare to cover the bill unless you’ve got the right condition!