If you’re wondering “Does Medicare cover a hysterectomy?” you’re not alone! Hysterectomies are common procedures, often used to treat conditions like fibroids endometriosis or even certain types of cancer. So let’s break it down: yes Medicare does cover a hysterectomy but—like everything else with health insurance—there are some caveats. Let’s dive into the details to help you understand how Medicare works when it comes to this important surgery.

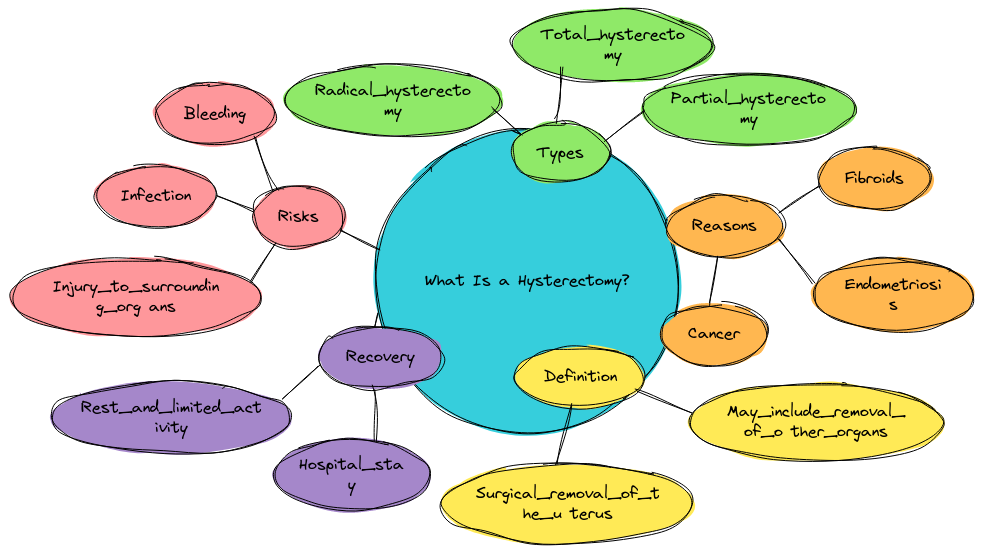

What Is a Hysterectomy?

A hysterectomy is the surgical removal of the uterus. It can be done for a variety of reasons including:

- Uterine fibroids

- Endometriosis

- Uterine cancer or cervical cancer

- Severe chronic pelvic pain

- Heavy menstrual bleeding not manageable with other treatments

The procedure itself can vary—sometimes just the uterus is removed other times the ovaries and fallopian tubes are also taken out. In any case this is a major surgery so understanding how Medicare helps cover the costs is essential.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Does Medicare Cover the Cost of a Hysterectomy?

Part A Coverage (Hospital Insurance)

Medicare Part A typically covers hospital inpatient costs when a hysterectomy is deemed medically necessary. So if your hysterectomy requires a hospital stay—which it usually does—Part A will help cover costs like:

- Hospital room and board

- General nursing care

- Medications you need while in the hospital

However you’ll still need to pay your deductible before Medicare kicks in. In 2024 for example the deductible is $1 632 for each benefit period.

Part B Coverage (Medical Insurance)

Medicare Part B steps in to cover the costs of the doctors and specialists involved in your hysterectomy. This includes:

- Surgeon fees

- Pre-surgery lab tests and doctor visits

- Post-surgery care like follow-up appointments

Keep in mind with Part B you’re on the hook for 20% of the Medicare-approved amount after meeting the $226 yearly deductible. You may want to plan ahead—20% can add up when you’re dealing with a major surgery like a hysterectomy.

What About Medicare Advantage?

If you’ve got a Medicare Advantage plan (Medicare Part C) your coverage for a hysterectomy might be different. Advantage plans are offered by private insurers but they have to provide at least the same level of coverage as Original Medicare. Some plans might offer additional benefits but you’ll need to check with your plan provider for details.

According to Henry Beltran owner of Medicare Advisors Insurance Group LLC “Medicare Advantage plans are a great option for those who want to potentially reduce their out-of-pocket costs but they also come with networks which can limit your choice of doctors. It’s a give and take.”

What Isn’t Covered?

While Medicare helps cover a medically necessary hysterectomy certain related costs may not be covered including:

- Elective or preventive hysterectomies (if it’s not medically necessary)

- Private hospital rooms (unless it’s medically required)

- Personal comfort items (like TV or phone use during your stay)

Be sure to ask your doctor and Medicare about what will be covered before the procedure to avoid surprises.

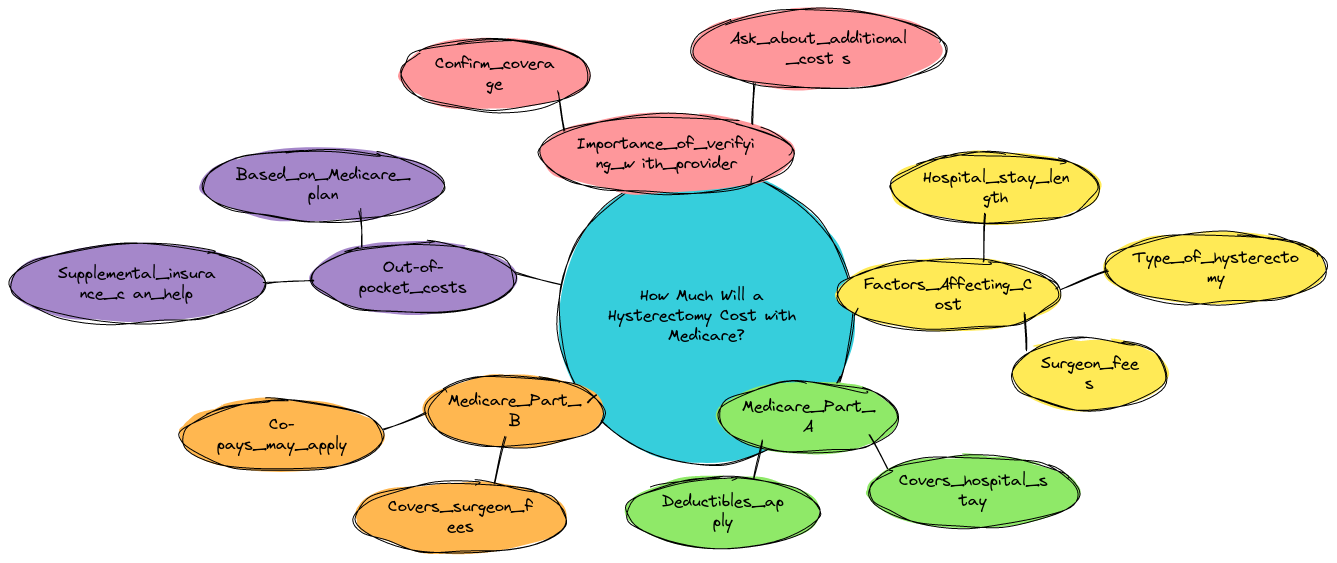

How Much Will a Hysterectomy Cost with Medicare?

It’s hard to pinpoint an exact cost but according to recent data a hysterectomy can cost anywhere from $10,000 to $20,000 or more. With Medicare coverage though your costs will likely be a fraction of that—depending on what parts of Medicare you have and whether you’ve met your deductibles.

Here’s what to expect:

- Medicare Part A deductible: $1 632 for a hospital stay

- Medicare Part B deductible: $226 for outpatient services

- 20% co-insurance for any Part B services

- Additional co-pays or premiums if you have a Medicare Advantage plan

It all adds up pretty quick but Medicare still takes a good chunk of the financial burden off your plate.

Potential Drawbacks of Each Medicare Part (Humor Alert!)

- Part A: Sure it covers your hospital stay but don’t forget that deductible! It’s like getting invited to a party but they charge you at the door.

- Part B: You’ll pay 20% of the doctor’s bill. That may sound fair but when you see the bill you might wish they’d just left it at 10%.

- Medicare Advantage: You get extra benefits but you’ll be navigating a network of doctors. Think of it like picking a restaurant—your favorite one might not be on the list!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How to Prepare for Your Hysterectomy with Medicare

Talk to Your Doctor

Before you schedule your surgery make sure your doctor confirms that the procedure is medically necessary. This is key to making sure Medicare will cover it. Without that “medically necessary” stamp you could end up paying out of pocket.

Double-Check Your Coverage

Give Medicare Advisors Insurance Group LLC a call before your surgery to double-check that you’re covered. Henry Beltran always recommends “It’s better to ask all the questions upfront than to be caught off guard later by unexpected bills.” Trust me, nobody wants that kind of surprise.

Consider a Medigap Plan

If you’re worried about out-of-pocket costs a Medigap policy can help cover the gaps. Medigap plans are supplemental policies that help cover things like Part A and Part B deductibles and co-insurance. They can be a real lifesaver for major surgeries like a hysterectomy.

Conclusion

So does Medicare cover a hysterectomy? Yes—but only if it’s medically necessary and you’ve got your Part A and Part B in order. Whether it’s for cancer fibroids or another condition a hysterectomy can be a life-saving surgery and Medicare can help lighten the financial load.

As always be sure to consult with your doctor and Medicare advisor (like Medicare Advisors Insurance Group LLC) to ensure you’re fully prepared.

And remember—while navigating Medicare can feel like trying to put together an Ikea bookshelf (who actually reads the instructions?) with the right guidance you can be on your way to better health without breaking the bank.

If you have more questions or need assistance with Medicare planning feel free to contact Henry Beltran at Medicare Advisors Insurance Group LLC for expert advice tailored to your needs.