Finding the right Medicare agent in Joplin MO can feel like shopping for a used car in a rainstorm—frustrating confusing and slightly terrifying! But worry not We at Medicare Advisors Insurance Group LLC are here to simplify the process and make sure you get the best Medicare plan without the hassle We’re local we’re real and we’re ready to help you navigate Medicare like a pro

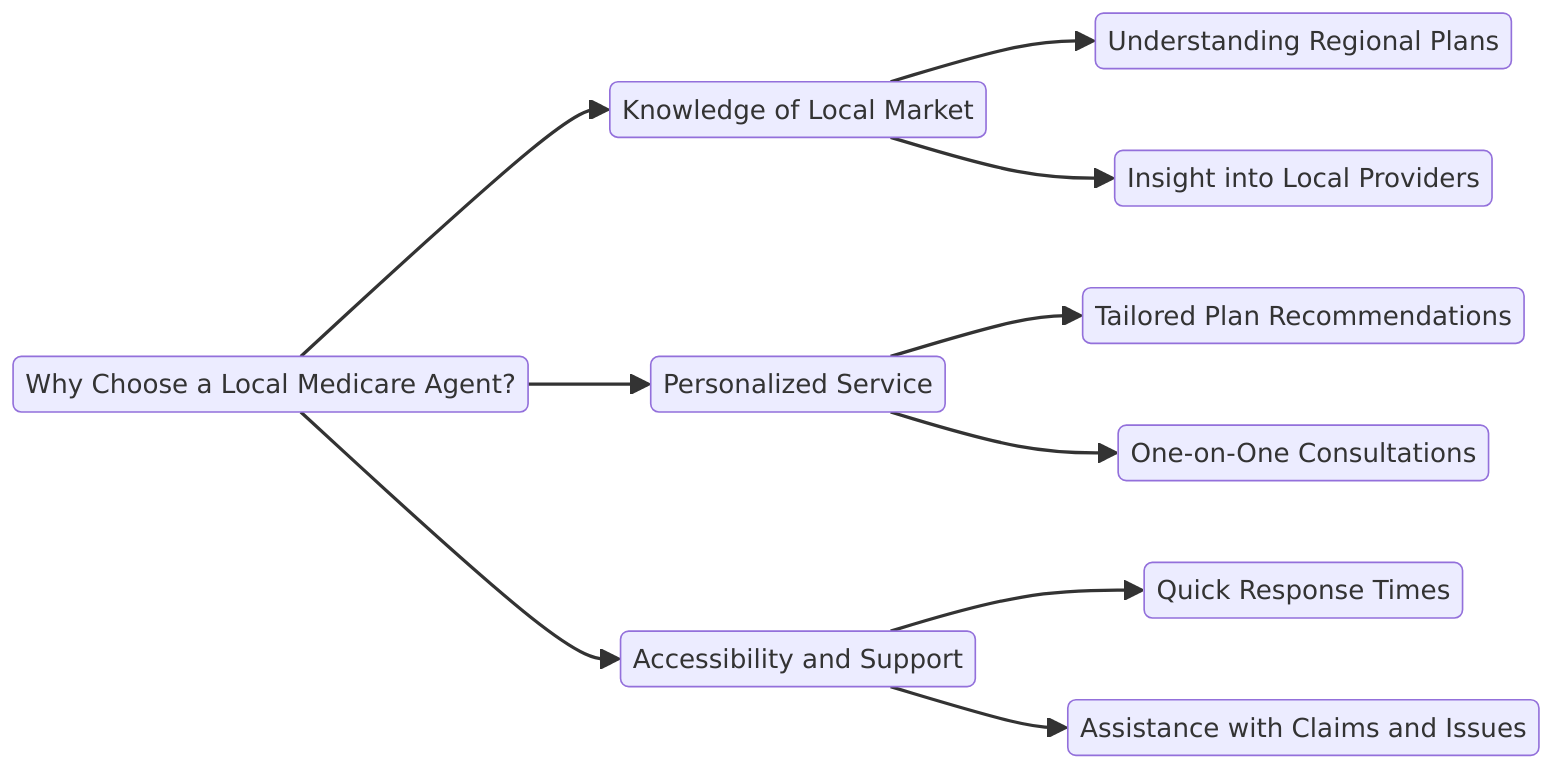

Why Choose a Local Medicare Agent?

It’s easy to get lost in the sea of Medicare options Especially if you’re trying to compare plans on your own—a bit like trying to fix your car with a YouTube video It’s not impossible but who really has the time? Here’s where a local Medicare agent steps in We understand Joplin’s unique needs and can guide you toward the best choices for your health and your wallet

Personalized Service Matters

Let’s face it when you call those 1-800 numbers you end up talking to someone miles away who might not even know where Missouri is let alone Joplin! A local agent knows your community understands local healthcare providers and will meet you face to face if needed

“Choosing the right Medicare plan isn’t one-size-fits-all I believe in sitting down with my clients over a cup of coffee and helping them pick a plan that’s perfect for them—not just what’s trending on TV” says Henry Beltran the proud owner of Medicare Advisors Insurance Group LLC

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Medicare Options in Joplin MO

You might feel like there are more Medicare options than barbecue joints in Missouri—and that’s saying something! Here’s a quick breakdown of what you can expect when choosing a plan

Medicare Part A and Part B

These are the basics—Original Medicare Think of it as the frame of a car sturdy reliable but it’s missing some features No dental vision or drug coverage included—it’s like buying a car without a radio and AC

Medicare Advantage (Part C)

Ah yes Medicare Advantage plans These are popular because they offer all-in-one coverage but here’s the catch It’s like getting a car with all the bells and whistles but there’s always a chance the GPS will lead you into a cornfield laughs Medicare Advantage plans often have network restrictions which means you may need to stick to certain doctors and hospitals

- Pros: Combines Medicare Part A B and often D into one plan Might include extras like dental vision and hearing coverage

- Cons: Network restrictions High out-of-pocket costs if you go outside the network And we all know how annoying it is when your car GPS gives you the “recalculating” message!

Medicare Supplement (Medigap)

Now if you want to avoid surprises and prefer smooth sailing like a well-maintained classic car you might opt for Medigap It covers what Original Medicare doesn’t—co-pays coinsurance deductibles Just keep in mind it doesn’t include prescription drug coverage

- Pros: Predictable costs No networks so you can see any doctor who accepts Medicare

- Cons: Doesn’t cover prescription drugs and the premiums can be higher But hey at least it won’t steer you into a ditch!

Medicare Part D (Prescription Drug Plans)

If you love surprises you’ll love Medicare Part D Just kidding—nobody likes surprises when it comes to drug costs That’s why you need a standalone prescription drug plan if you stick with Original Medicare or a Medigap policy These plans vary by insurer but the good news is we can help you find the best one

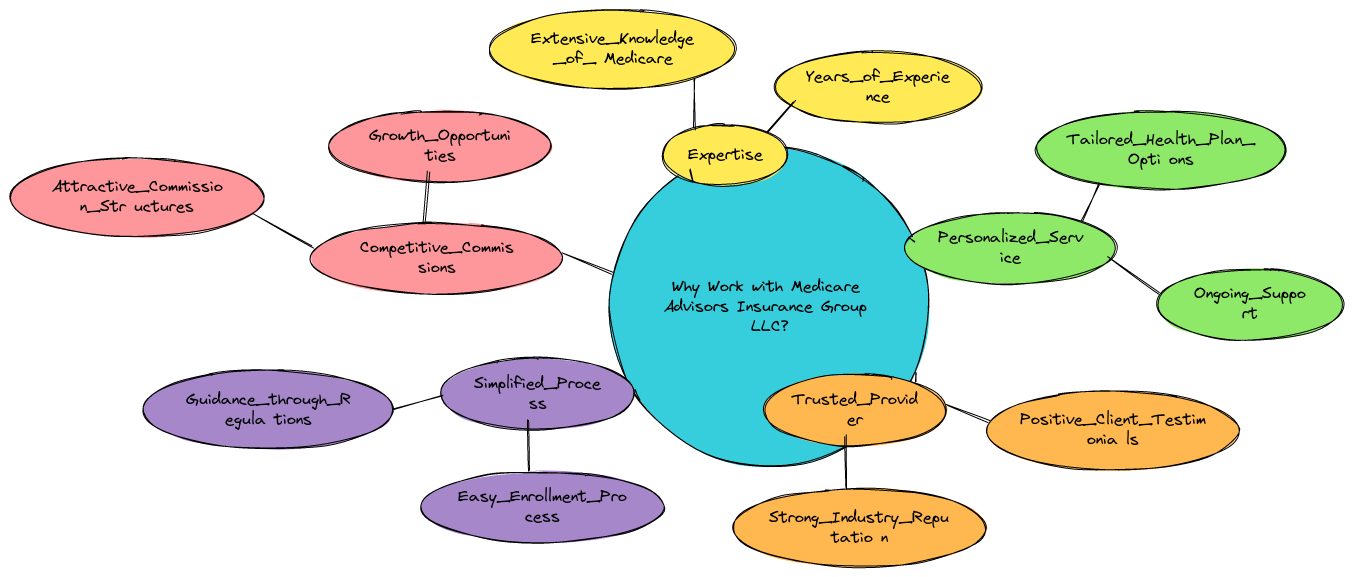

Why Work with Medicare Advisors Insurance Group LLC?

At Medicare Advisors Insurance Group LLC we’re not just some faceless agency based in who-knows-where We’re right here in Joplin ready to answer your questions and provide personalized service You won’t find cookie-cutter plans here just tailored advice based on your unique needs

- We offer free consultations so you can understand your options

- We help compare all available plans including those from major carriers

- We provide ongoing support because let’s be honest no one should have to deal with Medicare alone—it’s more confusing than putting together IKEA furniture without the manual!

Henry Beltran sums it up perfectly “I started Medicare Advisors Insurance Group to help people—plain and simple My team and I love nothing more than helping folks from Joplin pick a Medicare plan they feel good about”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Potential Drawbacks of Medicare Plans (With a Twist!)

Because hey even the best cars have quirks!

Original Medicare: The Bare Bones Ride

- Pros: Reliable and straightforward You always know what you’re getting

- Cons: No frills! It’s like driving a car with roll-down windows—solid but a bit outdated

Medicare Advantage: The Fully Loaded Option

- Pros: Everything you need in one package

- Cons: It’s like having that fancy backup camera that only works half the time—looks great but sometimes you miss out on the real action (or in this case out-of-network coverage)

Medigap: The Smooth Ride

- Pros: No surprises just smooth predictable coverage

- Cons: Premiums can be pricey but it’s like owning a luxury car—you pay a bit more but it’s worth the comfort right?

How to Get Started

So you’re ready to find the perfect Medicare plan? Well we’re ready to help! Here’s how to get started

- Contact us for a free consultation You can reach us at our Joplin office or give us a call

- Review your options We’ll help you compare the best plans for your healthcare needs and budget

- Enroll with confidence Once you’ve picked a plan we’ll walk you through the enrollment process step-by-step

In the words of Henry Beltran “We believe in transparency honesty and making sure every person walks away feeling confident about their Medicare choice”

Common FAQs About Medicare

Can I change my Medicare plan after I enroll?

Yes you can make changes during Medicare’s Annual Enrollment Period which runs from October 15th to December 7th each year

What if I need help paying for my Medicare plan?

There are programs like Extra Help and Medicare Savings Programs designed to assist people with low incomes We can help you see if you qualify

Do I need Medicare Part D if I don’t take medications?

Even if you don’t take medications now it’s a good idea to enroll in Medicare Part D to avoid penalties later down the line Plus you never know when you might need it—it’s like keeping a spare tire in your trunk just in case!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Conclusion

Navigating Medicare doesn’t have to be a bumpy ride With the help of a local Medicare agent in Joplin MO you can steer clear of confusion and feel confident you’re making the best choice for your health and future Whether you’re looking for Original Medicare Medicare Advantage or a Medigap policy we’re here to help you every step of the way

As Henry Beltran says “Your health is your most valuable asset Let’s make sure your Medicare plan protects it”