When you hear about sclerotherapy, you might wonder if it’s covered by Medicare. After all who doesn’t want their spider veins to disappear without breaking the bank? But let’s be honest – dealing with Medicare can feel like navigating a maze and you just want a straight answer right? Well I’m here to help break it down as clearly as possible with a bit of humor on the side (because who said Medicare can’t be fun?).

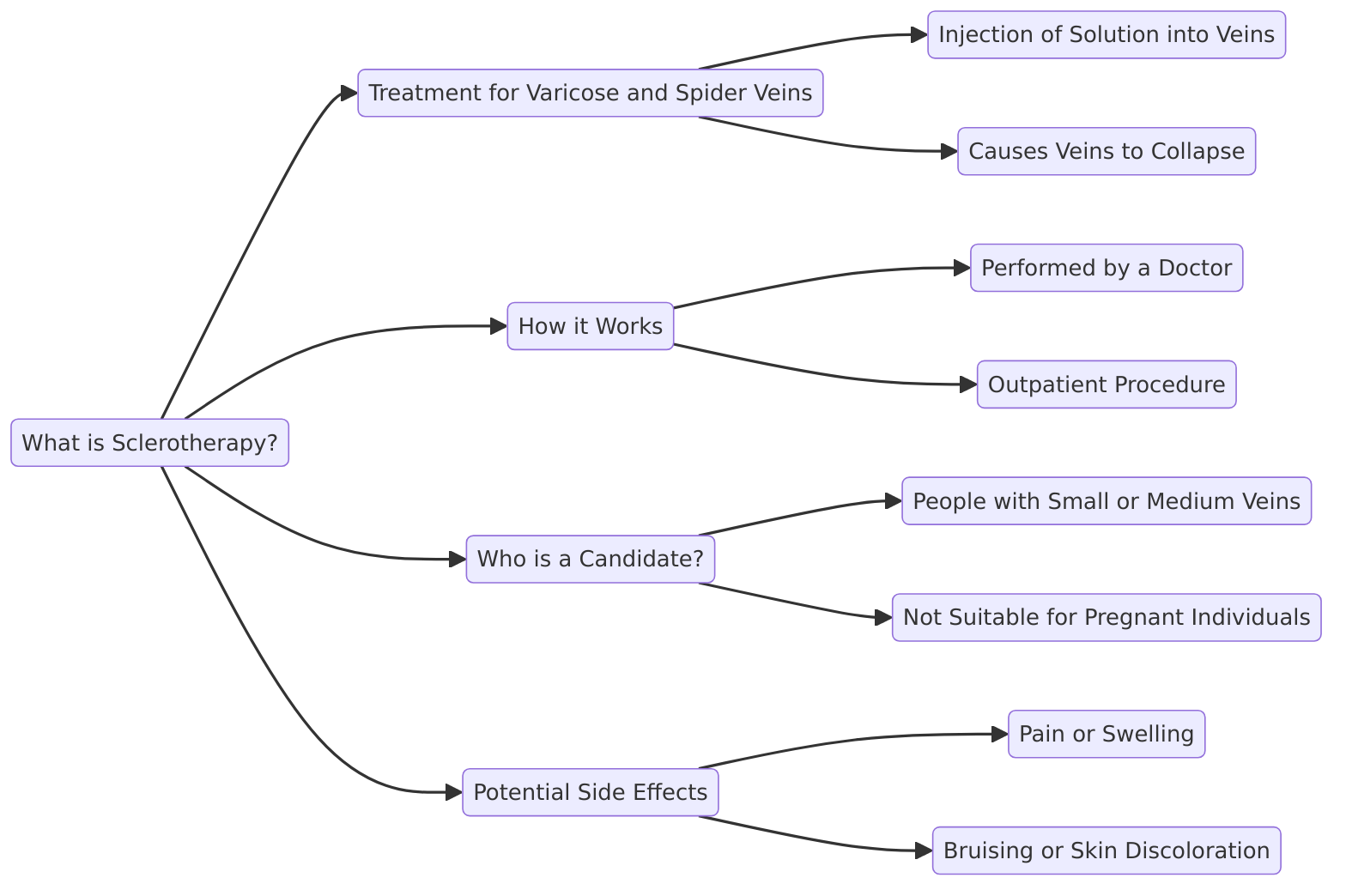

What is Sclerotherapy?

Sclerotherapy is a common medical procedure used to treat varicose veins or spider veins. It involves injecting a solution directly into the affected veins causing them to collapse and eventually disappear. This might sound like a magic trick but I assure you it’s very real and very effective (most of the time). But before you rush off to book your appointment there’s a burning question you’re probably asking…

Does Medicare Cover Sclerotherapy?

The simple answer is… it depends. Yes I know not exactly what you wanted to hear but stay with me here.

Medically Necessary vs Cosmetic

Medicare usually covers procedures that are considered medically necessary. So if your varicose veins are causing symptoms like pain swelling or ulcers then sclerotherapy may be covered under Medicare Part B as a treatment for vascular disease. However if you’re simply trying to get rid of a few spider veins for cosmetic reasons unfortunately Medicare doesn’t cover that. You’ll have to pay out-of-pocket if you just want smoother legs to show off at the beach!

What are the criteria for Medicare coverage?

Here’s a quick breakdown of what typically qualifies for Medicare coverage for sclerotherapy:

- Medically necessary – Your doctor must document that your varicose veins are causing symptoms like pain or discomfort.

- Conservative treatments first – Medicare will usually only cover sclerotherapy if you’ve already tried other treatments like compression stockings and they didn’t work.

- Vascular disease – If your varicose veins are related to a bigger issue like chronic venous insufficiency then Medicare may consider the treatment necessary.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Potential Drawbacks (With a Twist)

Now let’s look at some potential drawbacks of sclerotherapy (with a humorous twist) because what’s life without a little humor right?

- You might need more than one treatment: One injection won’t fix everything so be prepared for multiple sessions. It’s like the potato chip of medical treatments you can’t stop at just one!

- Temporary bruising: Your legs may look like a road map for a while after the procedure. If anyone asks just tell them you’re participating in an avant-garde art project.

- It’s not for everyone: If your veins are too big or too small or just right (wait is this Goldilocks?) you may not be a candidate for sclerotherapy. In that case you’ll need to explore other options.

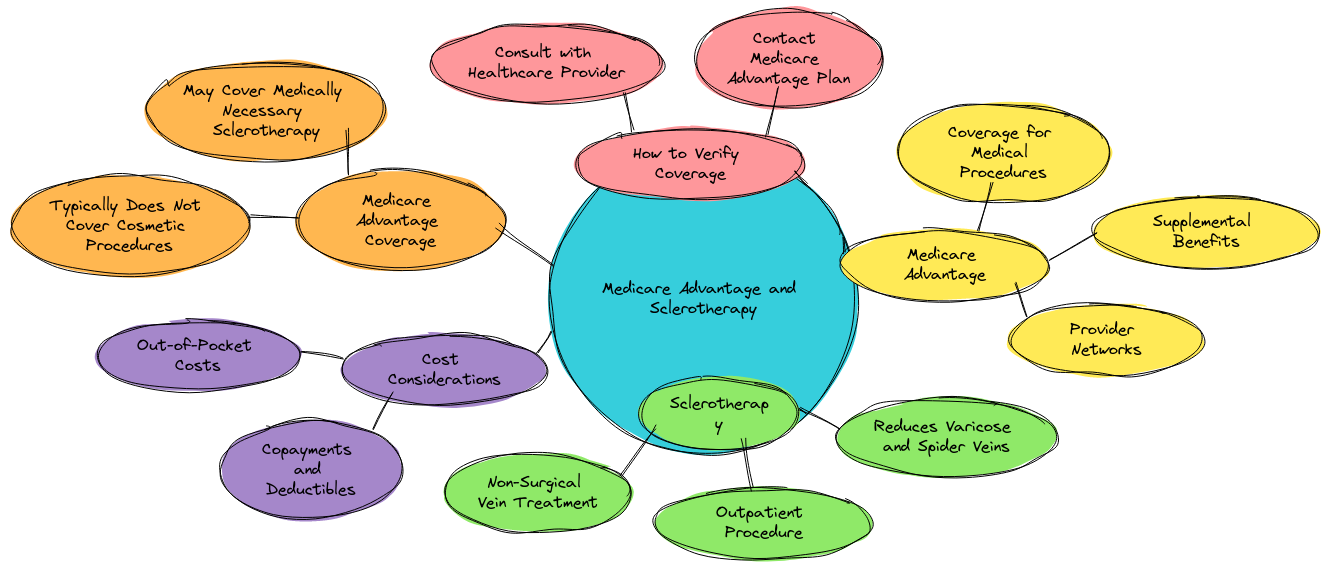

Medicare Advantage and Sclerotherapy

If you have a Medicare Advantage Plan it’s a bit of a different story. Some Medicare Advantage plans may cover sclerotherapy for cosmetic reasons but these plans vary widely in their coverage. You’ll want to check with your specific provider to see what’s included. As Henry Beltran the owner of Medicare Advisors Insurance Group LLC says “It’s always a good idea to check in with your provider. Sometimes the fine print can surprise you.”

What to Do If Medicare Doesn’t Cover Your Sclerotherapy?

So you’ve got a pesky spider vein that you want gone but Medicare won’t cover it? Here are a few options to consider:

Out-of-pocket payment

You can always pay for the procedure yourself. Prices for sclerotherapy vary but it typically costs between $300 and $500 per session. That’s not exactly cheap but hey beauty has its price right?

Consider Financing Options

Many clinics offer financing options for treatments like sclerotherapy. You can spread the cost over a few months or even longer so it’s not as heavy a hit on your wallet.

Explore Supplemental Insurance

Some people choose to get Medigap or other supplemental insurance to help cover costs that Medicare doesn’t. Again it’s always a good idea to consult with someone who knows the ins and outs of these policies (like us at Medicare Advisors Insurance Group LLC).

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How to File a Claim for Sclerotherapy

Filing a claim for sclerotherapy under Medicare can be like filing your taxes – not exactly the most fun. But here’s a simplified process to help guide you through:

Steps:

- Get a referral from your primary care doctor if needed.

- Make sure your doctor is Medicare-approved. If they’re not Medicare won’t cover a cent.

- Check that the procedure is considered medically necessary by getting documentation from your doctor.

- Submit your claim to Medicare or have your healthcare provider do it for you.

“Medicare can be tricky but that’s why we’re here to help our clients get through the process and make sure they understand what’s covered and what’s not” says Henry Beltran.

Final Thoughts on Medicare and Sclerotherapy

In summary whether or not Medicare covers sclerotherapy really boils down to whether it’s considered medically necessary. If you’re getting the procedure for cosmetic reasons don’t hold your breath on Medicare covering it. But if you’re dealing with pain or discomfort from varicose veins Medicare Part B may step in to help.

For those exploring options beyond Medicare it’s always worth having a chat with your Medicare Advantage plan provider or reaching out to our team at Medicare Advisors Insurance Group LLC for personalized advice.

As Henry Beltran puts it “Don’t be afraid to ask questions. The more informed you are the better choices you can make about your health and healthcare costs.”

Key Takeaways

- Medicare Part B may cover sclerotherapy if it’s considered medically necessary.

- Cosmetic sclerotherapy is typically not covered by Medicare.

- Explore Medicare Advantage Plans and other options for potential coverage.

- You can always pay out of pocket or explore financing for cosmetic treatments.