Thinking about Gundersen Quartz Medicare Advantage for your Medicare coverage? You’ve come to the right place! I’m here from Medicare Advisors Insurance Group LLC to walk you through what these plans offer—what’s great about them—and what you might want to watch out for. We’ll keep it easygoing—and throw in a little humor—because who said health insurance can’t be fun?

So What Exactly is Gundersen Quartz Medicare Advantage?

Gundersen Quartz Medicare Advantage plans are Medicare Part C plans—they bundle up Medicare Parts A (hospital insurance) and Part B (medical insurance) into one neat package. They also usually include Part D for prescription drugs—plus some other extras like vision and dental care.

These plans come from a partnership between Quartz Health Solutions and Gundersen Health System—mostly offered in Wisconsin and Illinois.

What’s in the Box?

Here’s a quick rundown of what you can get with a Gundersen Quartz Medicare Advantage plan:

- Hospital coverage (Part A)

- Medical coverage (Part B)

- Prescription drugs (Part D) because nobody wants to pay full price for meds

- Extras like dental and vision—because your eyes and teeth need some love too

Many of these plans have lower premiums than Original Medicare and come with a maximum out-of-pocket limit—so you won’t get hit with those surprise bills no one likes.

Prescription Drug Coverage – Saving You at the Pharmacy

Most Gundersen Quartz Medicare Advantage plans come with prescription drug coverage—meaning you don’t have to worry about emptying your savings every time you head to the pharmacy. They cover a wide range of medications—but double-check their formulary (the list of covered drugs) to make sure yours is included—no one wants to pay full price for their anti-snore spray.

Vision and Dental Benefits – Keep That Smile Bright

The fact that you get vision and dental coverage with Gundersen Quartz is a pretty sweet deal. Most plans will cover stuff like annual eye exams and routine dental care. Let’s face it—no one enjoys surprise dental bills—so it’s nice to have those covered.

Henry Beltran—our very own owner of Medicare Advisors Insurance Group LLC—puts it best: “The extras you get with Gundersen Quartz Medicare Advantage really make a difference—it’s like getting a plan with all the benefits you actually care about.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Not-So-Great Stuff

As much as we’d love to say these plans are flawless—they’re not. Here are a few things to keep in mind—with a bit of humor thrown in for good measure:

Limited Provider Networks – Is My Doctor on the List?

One potential downside with Gundersen Quartz Medicare Advantage plans is they might have limited networks. This means you could only be able to see doctors and specialists within their network. If your favorite doc isn’t on the list—well—you might be driving an hour to see someone new!

Pro Tip: Always check the provider network before you sign up. No one wants to find out their doctor isn’t covered after the fact!

Referrals – A Little Extra Work

For some of these Medicare Advantage plans—you might need a referral from your primary doctor to see a specialist. If you’re the kind of person who likes to cut straight to the chase—this might slow you down a bit. But hey—it could be worse—you could be explaining your symptoms to an AI robot. Oh wait—we’re getting there!

Is Gundersen Quartz Medicare Advantage Right for You?

Before you jump in with both feet—here are a few things you’ll want to think about:

- Do you want more than Original Medicare?

- Are you in the coverage area? Gundersen Quartz only covers certain regions—mostly in Wisconsin and Illinois.

- Are your doctors in-network? If not—you could be paying more.

- How’s your prescription situation? Make sure your meds are covered.

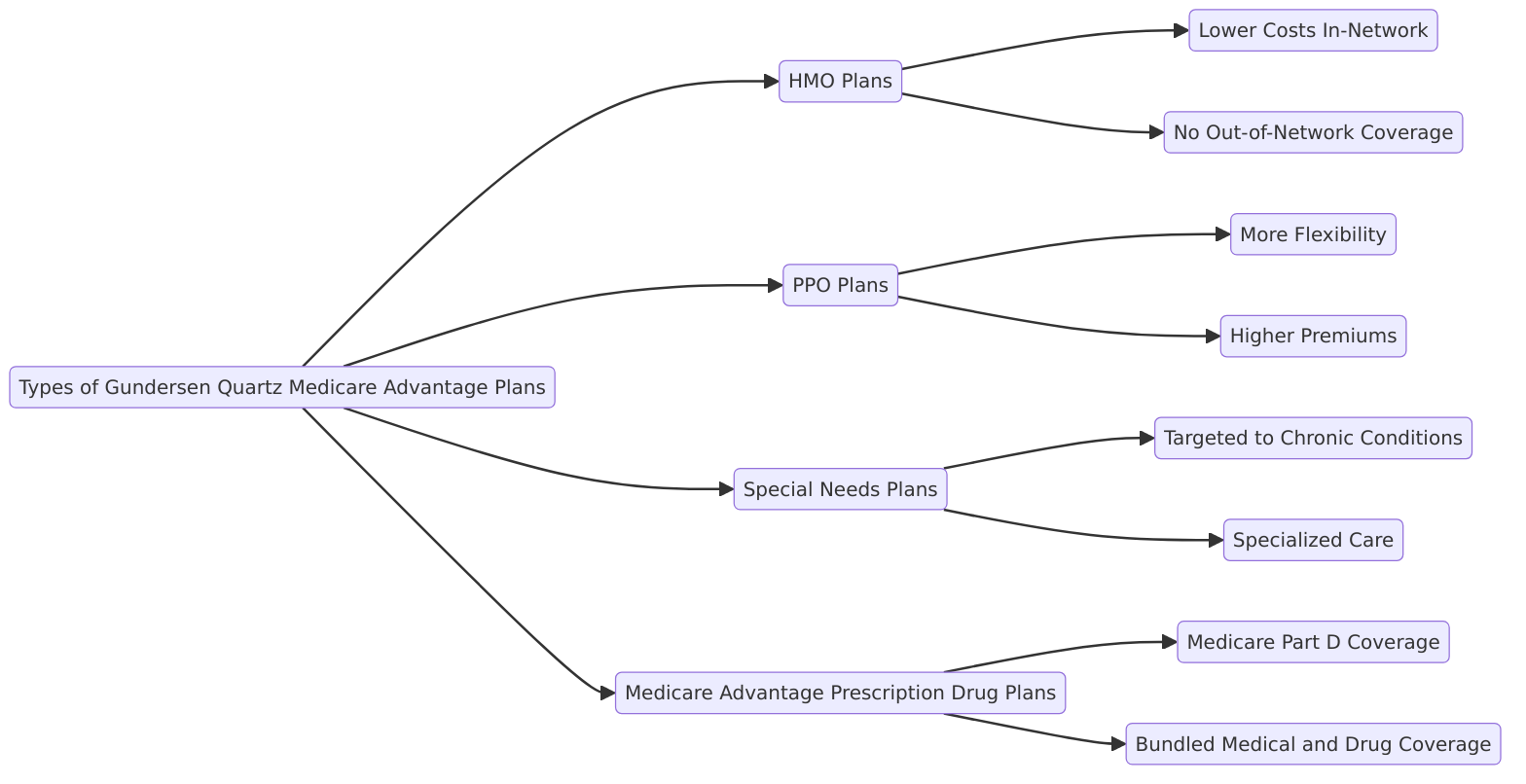

Types of Gundersen Quartz Medicare Advantage Plans

Gundersen Quartz offers a few different plans depending on what you’re looking for. Here’s a quick breakdown:

- HMO Plans – Usually cheaper—but you have to stick to their network.

- PPO Plans – More freedom to see out-of-network docs—but it’ll cost you more.

- HMO-POS Plans – Some flexibility to go outside the network—but still mainly an HMO.

- Special Needs Plans – For those with specific chronic conditions.

HMO Plans: Stay in Your Lane

HMO plans are usually the low-cost option but they keep you pretty locked into the provider network. If you’re OK sticking with the Gundersen Quartz doctors—you’re golden—but if you like seeing specialists outside the network—it might feel a bit limiting.

PPO Plans: Go Where You Want—For a Price

PPO plans give you more freedom to see doctors outside the network—though you’ll pay more for the privilege. It’s kind of like flying economy plus—more legroom but also more dollars out of your pocket.

Special Needs Plans: Made for You

If you have a specific chronic condition—Special Needs Plans (SNPs) could be your best bet. They offer tailored coverage for those with health conditions like diabetes or heart disease—giving you the care you need when you need it.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Gundersen Quartz vs Original Medicare

Why would you go for Gundersen Quartz Medicare Advantage over Original Medicare? Here’s how they stack up:

- Medicare Advantage offers extras like dental—vision—and hearing that Original Medicare doesn’t.

- You’ll get lower out-of-pocket costs with Medicare Advantage—but you’re often stuck in a network.

- With Original Medicare you can see any doctor that accepts Medicare—but you’ll need to add a Part D for drug coverage and maybe a Medigap policy.

Ready to Enroll in Gundersen Quartz Medicare Advantage?

If you’re ready to hop on board—you can enroll in Gundersen Quartz Medicare Advantage during your Initial Enrollment Period when you first qualify for Medicare or during the Annual Enrollment Period from October 15 to December 7.

Missed those? No worries—there’s also Special Enrollment Periods if you’ve moved or lost other coverage.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Wrapping it All Up

Medicare Advantage plans—like Gundersen Quartz—can be a fantastic option if you’re looking for more benefits and lower out-of-pocket costs. Just be sure to check the network and make sure the plan covers your medications and doctors.

As Henry Beltran always says: “Gundersen Quartz is a solid choice for folks in Wisconsin and Illinois who want comprehensive coverage—but make sure it fits your doctors and meds first.”

For more details and to explore your Medicare coverage options—check out this page on Medicare Advisors Insurance Group’s site.

In the end—finding the right Medicare Advantage plan is about choosing what fits your lifestyle and health needs. Let’s make sure you get the best care possible!

Need Help? Contact Us Anytime

If you’re still a little confused or want a one-on-one chat—reach out to us at Medicare Advisors Insurance Group LLC for friendly advice and help.

Your health matters—let’s get it right!