“Open Enrollment for Medicare Supplement Policies: A 6-Month Window of Opportunity.”

Understanding the Duration of Open Enrollment for Medicare Supplement Policies

Open enrollment for Medicare Supplement policies, also known as Medigap, is a period of golden opportunity, a time when the doors of choice swing wide open, inviting you to step through and select the coverage that best suits your needs. It’s a season of decision, a time to take control of your health and your future. But just how long does this period last? Let’s embark on a journey to understand the duration of open enrollment for Medicare Supplement policies.

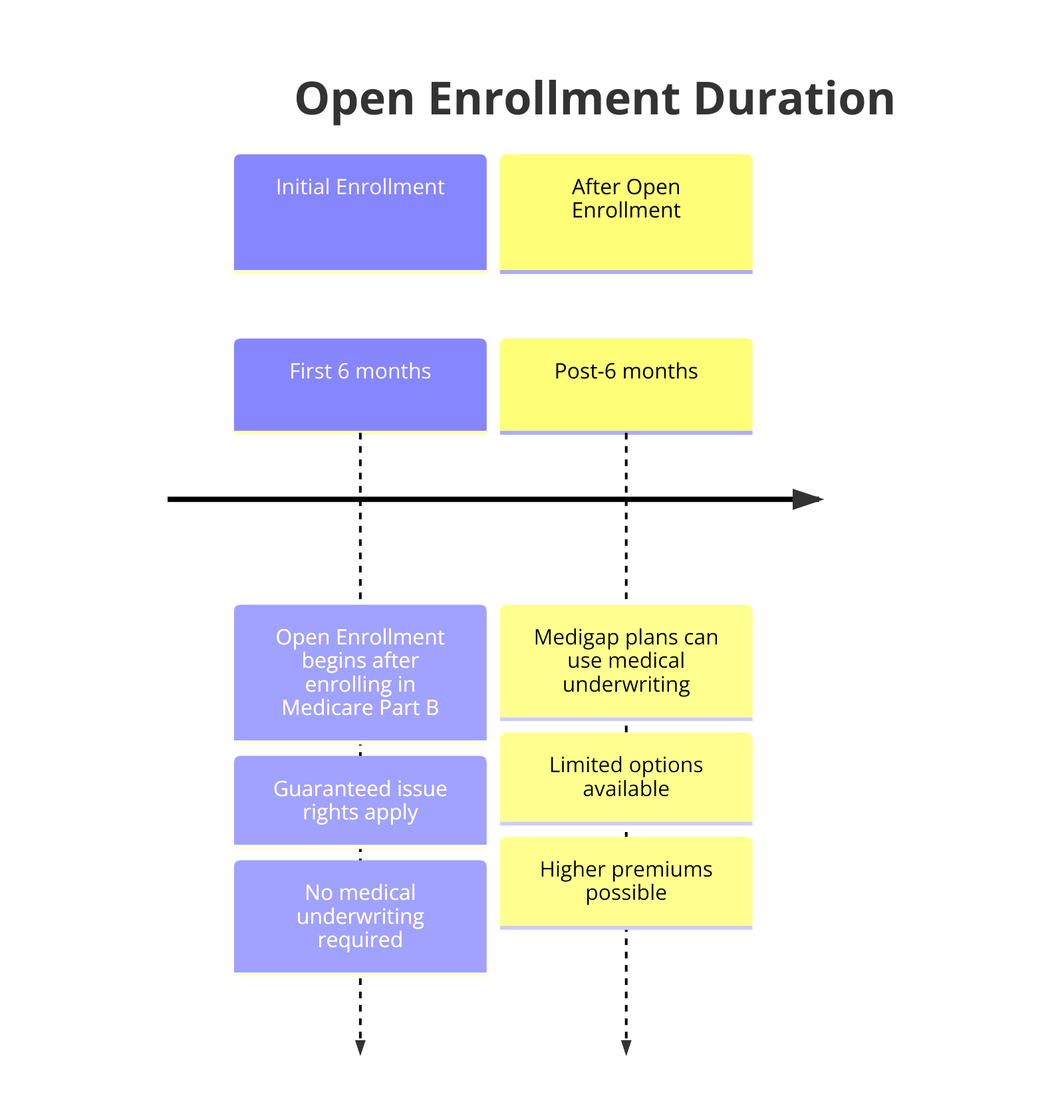

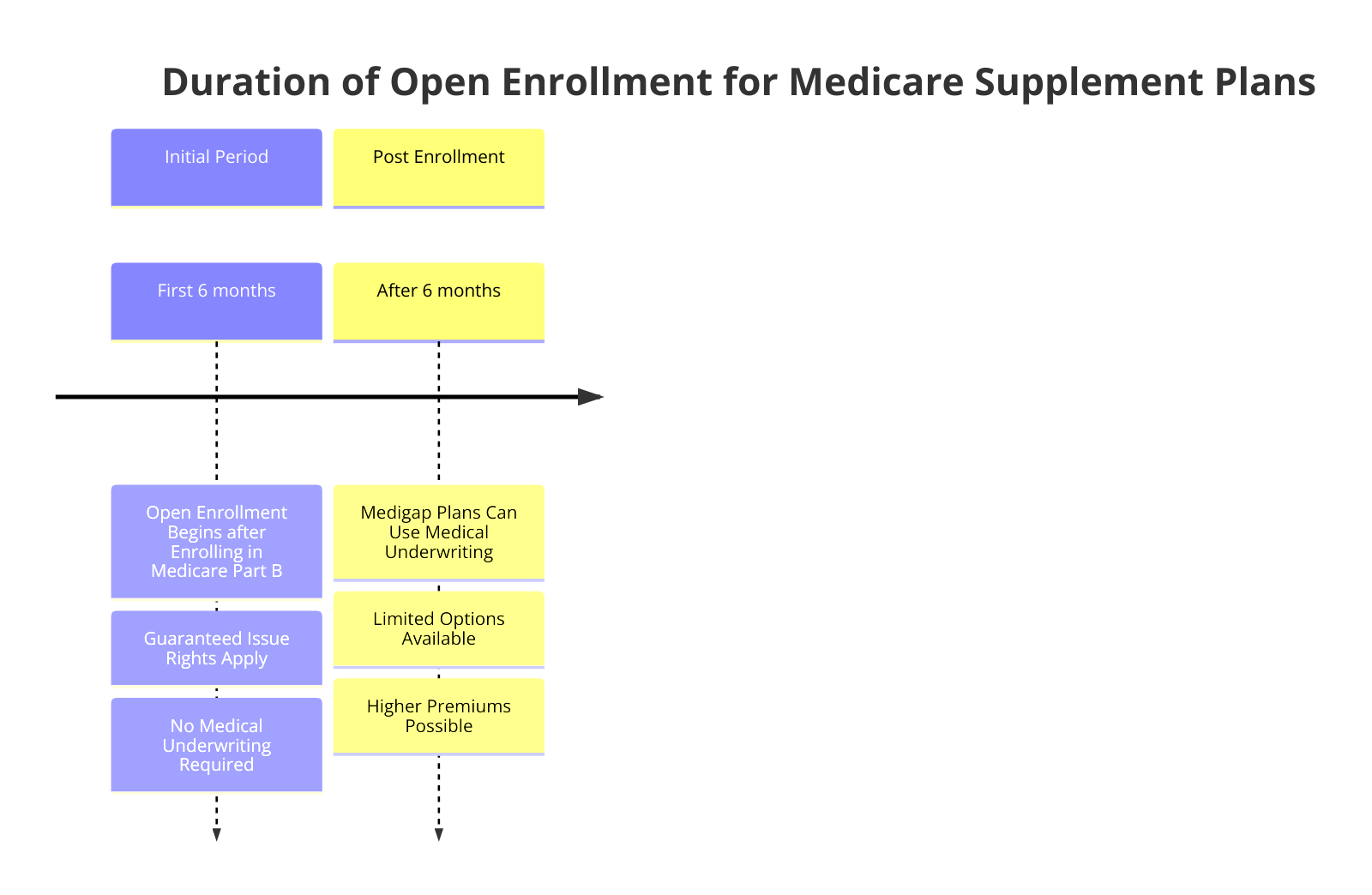

Imagine the open enrollment period as a train station, bustling with activity. The train, representing the Medicare Supplement policy, is scheduled to arrive at a specific time. The station is open for six months, starting from the first day of the month when you turn 65 and are enrolled in Medicare Part B. This is your ticket to board the train, to seize the opportunity to choose a Medicare Supplement policy that will journey with you through the ups and downs of your health journey.

During this six-month window, the world is your oyster. You have the freedom to choose any Medigap policy offered in your state, regardless of any health problems you may have. It’s a time when insurance companies are required to sell you a policy at the best available rate, regardless of your health status. It’s a time when you hold the reins, a time when you can make decisions that will shape your future health care.

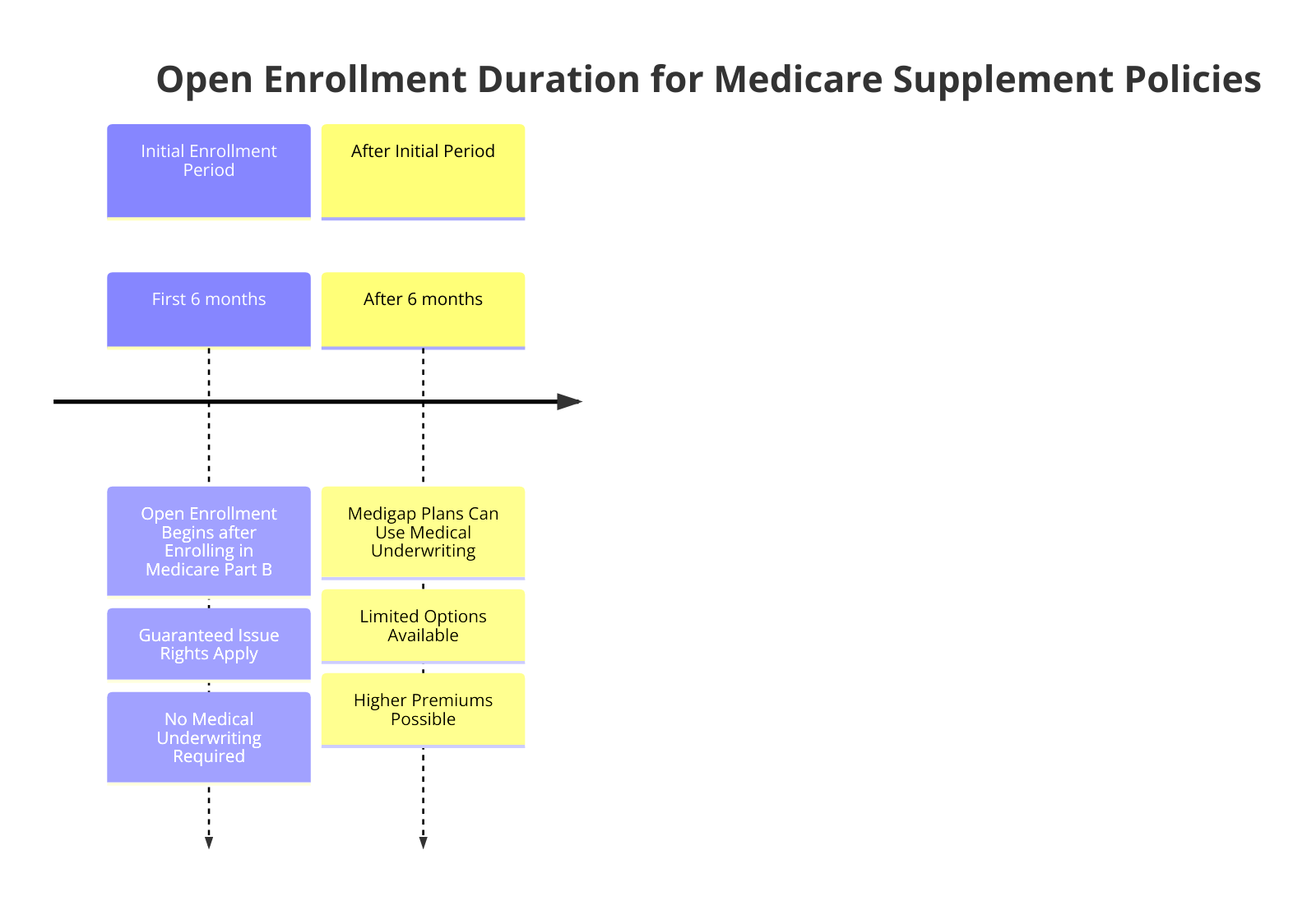

But what happens when the six-month period ends? The train station doesn’t close immediately. You can still purchase a Medigap policy after the open enrollment period, but the landscape changes. The insurance companies now have the power to use medical underwriting to decide whether to accept your application and how much to charge you for the policy. The golden opportunity of guaranteed coverage at the best rate has passed, but the possibility of securing a policy still exists.

The open enrollment period for Medicare Supplement policies is like a sunrise, a beautiful spectacle that lasts for a limited time. It’s a period of six months that offers you the chance to take control of your health care, to choose a policy that will stand by you, come what may. It’s a time when you can step into the spotlight and make decisions that will shape your future.

But remember, the sun doesn’t set immediately after the sunrise. Even after the open enrollment period, you can still purchase a Medigap policy. The conditions may be different, but the opportunity still exists. It’s a reminder that while the golden opportunity of open enrollment is precious, it’s not the only chance you have to secure your health care future.

In conclusion, the open enrollment period for Medicare Supplement policies is a six-month window of opportunity that starts when you turn 65 and are enrolled in Medicare Part B. It’s a time when you can choose a policy that suits your needs, regardless of your health status. But even after this period, you can still purchase a policy, albeit under different conditions. It’s a journey of choice, a journey of decision, a journey that can shape your health care future. So, seize the day, seize the opportunity, and take control of your health care with a Medicare Supplement policy.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Key Dates for Medicare Supplement Policies Open Enrollment

Open enrollment for Medicare Supplement policies, also known as Medigap, is a golden opportunity that shines once in the lifetime of every Medicare beneficiary. It’s a period of time when the doors of choice swing wide open, allowing you to select a Medigap policy that best suits your health needs and financial circumstances. But just like the fleeting beauty of a sunset, this period doesn’t last forever. So, how long is open enrollment for Medicare Supplement policies?

Imagine a six-month window of time, beginning on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B. This is the duration of the open enrollment period for Medicare Supplement policies. It’s a half-year horizon, a generous span of time designed to give you ample opportunity to make an informed and unhurried decision about your healthcare coverage.

During this six-month period, the world of Medigap is your oyster. You have the freedom to choose any Medigap policy offered in your state, regardless of any health problems you may have. It’s a time when insurance companies are required to sell you a policy at the best available rate, regardless of your health status. They cannot deny you coverage or charge you more because of any health conditions. It’s a time of empowerment, a time when you hold the reins of your healthcare decisions firmly in your hands.

But as with all good things, this period of open enrollment must come to an end. Once your six-month window closes, the landscape changes. Insurance companies are no longer required to sell you a Medigap policy, and if they do, they can charge you more if you have health problems. The sunset of your open enrollment period can bring a chill of uncertainty, a sense of lost control over your healthcare decisions.

However, there’s a silver lining to this cloud. Even after your open enrollment period ends, there may be certain situations, known as guaranteed issue rights or Medigap protections, when insurance companies are still required to sell you a Medigap policy. These situations include losing your health care coverage, moving out of your plan’s service area, or your insurance company going bankrupt. In these situations, the sun of opportunity rises again, casting a warm glow of hope and possibility.

So, as you embark on your journey through the world of Medicare and Medigap, remember this: the open enrollment period for Medicare Supplement policies is a six-month window of opportunity. It’s a time to explore, to ask questions, to weigh your options. It’s a time to take control of your healthcare decisions, to choose a policy that will provide the coverage you need at a price you can afford. And even when this period ends, there may still be opportunities to secure a Medigap policy under certain circumstances.

In the end, the key to navigating the open enrollment period for Medicare Supplement policies is knowledge. Arm yourself with information, understand your rights, and make the most of the opportunities that come your way. After all, your health is your wealth, and you deserve the best coverage that you can get. So seize the day, embrace the possibilities, and step confidently into your future with the Medicare Supplement policy that’s right for you.

Navigating the Open Enrollment Period for Medicare Supplement Plans

The journey through the labyrinth of Medicare Supplement Plans can often feel like a daunting expedition. However, with the right compass in hand, the path becomes less intimidating and more of an enlightening adventure. The key to this journey is understanding the open enrollment period for Medicare Supplement Policies, a crucial time frame that can significantly impact your healthcare coverage.

Imagine the open enrollment period as a golden window of opportunity, a time when the sun shines brightly, illuminating the path to comprehensive healthcare coverage. This period begins on the first day of the month when you turn 65 and are enrolled in Medicare Part B. It lasts for six months, a generous half-year during which you can explore and choose the Medicare Supplement Plan that best suits your needs.

During this golden window, insurance companies are like welcoming hosts at a grand banquet. They cannot refuse you coverage, nor can they charge you more due to pre-existing health conditions. It’s a time when you, the guest, have the upper hand. You can peruse the buffet of options, selecting the plan that most appeals to your palate without fear of being turned away.

However, like all good things, this open enrollment period does not last forever. Once the six-month period has passed, the sun begins to set on this golden opportunity. Insurance companies regain their power to use medical underwriting. They can scrutinize your health status and pre-existing conditions, potentially denying coverage or charging higher premiums based on their findings. The banquet is over, and the hosts are no longer as accommodating.

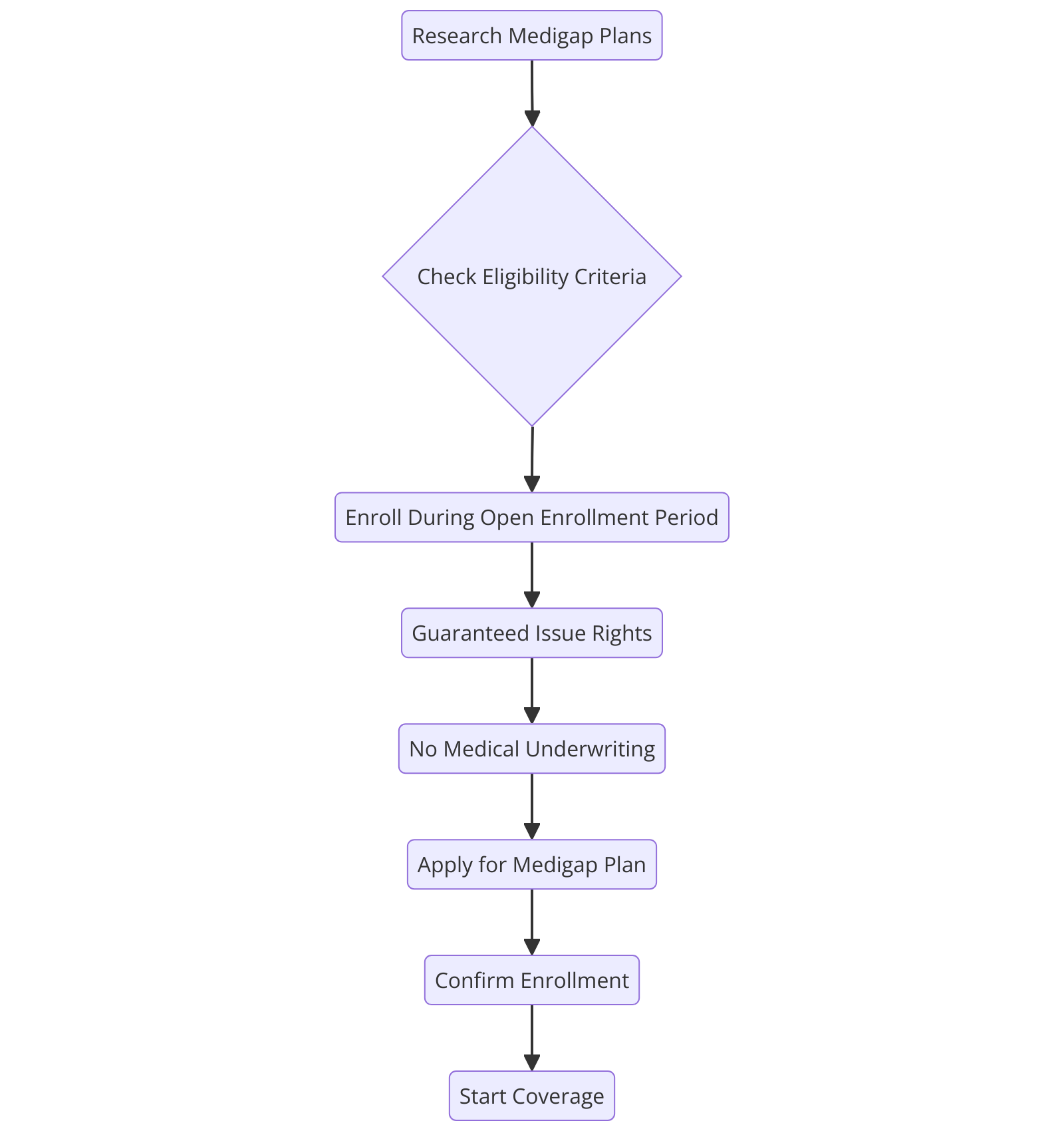

Therefore, it is essential to seize this golden opportunity while it lasts. Like a seasoned explorer, you must prepare for your journey well in advance. Research the different Medicare Supplement Plans, understand their benefits, and weigh them against your healthcare needs. Consult with professionals, seek advice from those who have already navigated this path, and make an informed decision.

Remember, this journey is not a race. It’s a six-month-long expedition, and it’s crucial to take your time. Rushing might lead to overlooking essential details or settling for a plan that doesn’t fully meet your needs. Instead, approach this journey with the spirit of an adventurer, eager to explore every nook and cranny, leaving no stone unturned.

As you embark on this journey, keep in mind that the open enrollment period for Medicare Supplement Policies is a gift. It’s a time when the healthcare system acknowledges your needs, offering you the freedom to choose without fear of rejection or discrimination. It’s a golden window of opportunity that opens once in a lifetime, a chance to secure your health and peace of mind for the years to come.

So, strap on your explorer’s boots, arm yourself with knowledge, and step into the open enrollment period with confidence. Remember, the journey of a thousand miles begins with a single step. And in this case, that step is understanding and navigating the open enrollment period for Medicare Supplement Plans. Embrace this journey, for it leads to a destination of comprehensive healthcare coverage, ensuring a healthier, happier future.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Timeline of Open Enrollment for Medicare Supplement Insurance

Open enrollment for Medicare Supplement Insurance, also known as Medigap, is a period of golden opportunity, a time when the doors of choice swing wide open, inviting you to step through and select the coverage that best suits your needs. It’s a season of decision, a moment in time when you can take control of your healthcare future. But how long does this period last? Let’s embark on a journey through the timeline of open enrollment for Medicare Supplement Insurance.

Imagine the day you turn 65. It’s a milestone, a marker of time that signifies wisdom, experience, and a life well-lived. But it also signifies something else: the beginning of your six-month Medigap open enrollment period. This period starts on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B. It’s a half-year window of opportunity, a generous span of time designed to give you the freedom to make informed, unhurried decisions about your healthcare coverage.

During this six-month period, the world of Medigap is your oyster. You can choose from up to 10 different standardized plans, each offering a unique blend of benefits to supplement your Original Medicare coverage. And the best part? During open enrollment, you can’t be turned down or charged more due to any health problems. It’s a level playing field, a time when everyone, regardless of their health status, has an equal opportunity to secure the coverage they need.

But what happens when the six-month period ends? The doors of open enrollment close, and the landscape of Medigap changes. Outside of this period, insurance companies are no longer required to sell you a Medigap policy, and if they do, they can charge you more if you have health problems. It’s a shift in the tide, a change that underscores the importance of making the most of your open enrollment period.

However, there’s a silver lining. In some cases, you may have guaranteed issue rights, also known as Medigap protections. This means that even outside of open enrollment, insurance companies must sell you a Medigap policy, can’t charge you more due to health problems, and can’t delay the start of your coverage. These rights are typically triggered by specific situations, such as losing other health insurance coverage. It’s a safety net, a beacon of hope in the sometimes confusing world of healthcare coverage.

So, how long is open enrollment for Medicare Supplement Insurance? It’s a six-month journey, a 180-day adventure through the world of Medigap. But it’s more than just a period of time. It’s an opportunity, a chance to take control of your healthcare future. It’s a call to action, a reminder to make the most of the choices available to you. And above all, it’s a testament to the power of informed decision-making, a tribute to the wisdom and experience that come with age.

So, as you navigate the timeline of open enrollment for Medicare Supplement Insurance, remember this: it’s your time. Use it wisely, make informed decisions, and seize the opportunities that come your way. After all, your healthcare future is in your hands.

How Long Does Open Enrollment Last for Medicare Supplement Policies?

Open enrollment for Medicare Supplement policies, also known as Medigap, is a golden opportunity that shines brightly for a limited time, offering a beacon of hope for those seeking additional health coverage. This period, like the fleeting beauty of a sunset, doesn’t last forever. It’s a six-month window that opens the moment you turn 65 and are enrolled in Medicare Part B. This is your chance to secure a Medicare Supplement policy, a lifeline that can help cover the costs that traditional Medicare does not.

Imagine standing at the edge of a vast ocean, the waves lapping at your feet. The horizon stretches out before you, full of possibilities. This is what the open enrollment period for Medicare Supplement policies feels like. It’s a time of opportunity, a time to take control of your health coverage and secure your future. But just as the tide eventually recedes, so too does this window of opportunity. It lasts for six months, a seemingly generous amount of time, but it passes quicker than you might think.

During this period, insurance companies are like welcoming lighthouses guiding you to safe harbor. They cannot use medical underwriting to decide whether to accept your application or determine the cost of your policy. This means that even if you have health problems, you can purchase any policy at the same price as someone with perfect health. It’s a level playing field, a time when the scales of health insurance tilt in your favor.

But as the sun dips below the horizon, casting long shadows and bathing the world in twilight, the open enrollment period for Medicare Supplement policies also draws to a close. Once the six-month period ends, the landscape changes. Insurance companies can then use medical underwriting. They can consider your health status, and your premiums may be higher. The lighthouse dims, the path becomes less clear, and the journey to secure additional health coverage becomes more challenging.

Therefore, it’s crucial to seize this opportunity while it lasts. Like a bird taking flight at the break of dawn, you should embark on your journey to secure a Medicare Supplement policy as soon as the open enrollment period begins. Don’t wait for the twilight, for the closing of the day. The early bird, after all, catches the worm.

The open enrollment period for Medicare Supplement policies is a gift, a precious gem that sparkles with opportunity. It’s a time when you can take control of your health coverage, secure your future, and navigate the often turbulent waters of health insurance with ease. But like all good things, it doesn’t last forever. It’s a six-month window that opens wide the moment you turn 65 and are enrolled in Medicare Part B.

So, as you stand on the shore, gazing out at the vast ocean of possibilities, remember this: the open enrollment period for Medicare Supplement policies is a fleeting moment, a sunset that lasts for six months. Embrace it, seize it, and let it guide you to the safe harbor of comprehensive health coverage. After all, your health is your wealth, and securing a Medicare Supplement policy during open enrollment is an investment in your most valuable asset.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Important Facts about the Open Enrollment Period for Medicare Supplement Policies

Open enrollment for Medicare Supplement policies, also known as Medigap, is a golden opportunity that shines brightly once in a lifetime. It’s a period of six months that begins on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B. This period is your chance to secure a Medigap policy that can help fill the gaps in your Original Medicare coverage, providing you with a safety net for unexpected medical costs.

Imagine standing on the edge of a vast ocean, the waves lapping at your feet. The open enrollment period is like a sturdy ship, ready to carry you across the unpredictable seas of healthcare expenses. It’s a vessel that can help you navigate the choppy waters of unexpected medical bills, ensuring you reach the shores of financial security.

During this six-month window, insurance companies are required to sell you any Medigap policy they offer, regardless of any health problems you may have. They cannot charge you more because of your health status or refuse to sell you a policy. It’s as if the doors to a grand marketplace have been flung wide open, inviting you to stroll through and select the best policy for your needs without fear of rejection or inflated prices.

However, like the setting sun, this period of open enrollment will not last forever. Once your six-month window closes, it may never open again. Insurance companies may then use medical underwriting to decide whether to accept your application and how much to charge you for a Medigap policy. It’s akin to the ship setting sail without you, leaving you to navigate the unpredictable seas of healthcare expenses on your own.

Therefore, it’s crucial to seize this opportunity when it arises. Like a rare celestial event, the open enrollment period for Medicare Supplement policies is a unique occurrence that demands your attention. It’s a chance to secure your future, to ensure that you’re prepared for whatever health challenges may come your way.

But remember, the journey doesn’t end once you’ve secured a Medigap policy. It’s important to review your coverage annually, as your health needs and the available policies may change over time. It’s like charting a course for your ship, adjusting your path as necessary to ensure you continue to sail towards the shores of financial security.

In conclusion, the open enrollment period for Medicare Supplement policies is a beacon of hope in the often confusing world of healthcare. It’s a six-month window of opportunity that can help you secure the coverage you need to navigate the unpredictable seas of medical expenses. So, when your time comes, seize this opportunity with both hands. Step aboard the ship and set sail towards a future of financial security and peace of mind. After all, the journey of a thousand miles begins with a single step, and the journey towards securing your health begins with the open enrollment period for Medicare Supplement policies.

The Duration of Open Enrollment for Medicare Supplement Plans: A Comprehensive Guide

Open enrollment for Medicare Supplement policies, a time of year that is as important as it is fleeting, is a period that demands our attention and careful planning. It’s a golden opportunity, a window of time when you can make crucial decisions about your healthcare coverage without the usual restrictions. But how long does this period last? Let’s embark on a journey to understand the duration of open enrollment for Medicare Supplement plans.

Imagine the open enrollment period as a train station. The train, representing the opportunity to enroll in a Medicare Supplement plan, arrives once a year. The station is bustling with activity, with people eager to board the train and secure their healthcare future. The train stays at the station for a specific period, allowing everyone ample time to make their decisions and get on board. This period, my friends, is a six-month timeframe that begins on the first day of the month when you’re both 65 or older and enrolled in Medicare Part B.

Now, you might be wondering, why is this six-month period so special? Well, during this time, insurance companies are required to sell you any Medicare Supplement policy they offer, regardless of any health problems you may have. They cannot charge you more because of your health status, nor can they delay the start of your coverage. This period is your golden ticket, your chance to secure the best possible healthcare coverage for your future.

But what happens if you miss the train? If the six-month open enrollment period passes and you haven’t enrolled in a Medicare Supplement plan, you might find yourself standing alone at the station. Outside of this period, insurance companies are not required to sell you a policy. If they do agree to sell you one, they might charge you more because of your health status or past medical conditions. They might even make you wait for coverage to start. It’s like trying to catch a train after it has already left the station – it’s possible, but it’s certainly more challenging.

So, how can you ensure you don’t miss the train? The key is preparation. Mark your calendar, set reminders, and start researching your options well before the open enrollment period begins. Understand what different Medicare Supplement policies offer and consider what kind of coverage you might need. Talk to healthcare professionals, discuss with your family, and seek advice from those who have already boarded the train.

Remember, the journey to securing your healthcare future is not a race, but a journey that requires careful planning and timely decisions. The open enrollment period for Medicare Supplement policies is your chance to take control of your healthcare coverage, to make decisions that will impact your future. It’s a six-month window of opportunity that opens once in a lifetime, a golden ticket to a secure healthcare future.

In the grand scheme of life, six months might seem like a fleeting moment. But when it comes to the open enrollment period for Medicare Supplement policies, these six months hold the power to shape your healthcare journey. So, seize the moment, board the train, and embark on a journey towards a secure and healthy future. After all, the best time to plan for tomorrow is today.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Decoding the Open Enrollment Period for Medicare Supplement Insurance

The open enrollment period for Medicare Supplement Insurance, often referred to as Medigap, is a time of great significance, a window of opportunity that opens once in a lifetime. It’s a period that invites you to take control of your health and wellness, to ensure that you’re covered for the unexpected, and to secure peace of mind for your golden years.

The open enrollment period for Medicare Supplement Insurance is a six-month timeframe. It begins on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B. This period is not just a date on a calendar, but a beacon of hope, a chance to take a proactive step towards safeguarding your health.

During this six-month period, insurance companies are required by law to sell you any Medigap policy they offer, regardless of your health status. They cannot charge you more based on pre-existing conditions or turn you down outright. This period is a golden ticket, a rare opportunity where the power is in your hands, not in the hands of insurance companies.

However, like all good things, this period of open enrollment does not last forever. Once your six-month window closes, it’s closed for good. If you miss this period, you may not be able to buy a Medigap policy, or it may cost you more. This is why it’s crucial to seize this opportunity when it presents itself. It’s a call to action, a reminder that in the face of uncertainty, we have the power to take control and make decisions that serve our best interests.

But what if you’re past 65 and didn’t enroll during your open enrollment period? Fear not, for there are certain situations, known as guaranteed issue rights or Medigap protections, where insurance companies must offer you Medigap policies. These situations include losing health coverage or your Medigap insurance company going bankrupt. While these situations are less than ideal, they serve as a safety net, a reminder that even when things don’t go as planned, there are still options available to you.

The open enrollment period for Medicare Supplement Insurance is more than just a time to buy insurance. It’s a testament to the value of preparation, a celebration of the power of choice, and a reminder of the importance of taking control of our health. It’s a period that encourages us to look ahead, to plan for the future, and to make decisions today that will benefit us tomorrow.

In the grand scheme of life, six months may seem like a fleeting moment. But when it comes to the open enrollment period for Medicare Supplement Insurance, these six months hold the potential to significantly impact your health and wellness in your golden years. So, when your window of opportunity opens, seize it. Embrace the chance to take control, to make choices that serve your best interests, and to secure peace of mind for your future. After all, your health is your wealth, and there’s no better investment than in yourself.

A Closer Look at the Open Enrollment Duration for Medicare Supplement Policies

As the golden hues of autumn begin to paint the landscape, a season of change is ushered in, not just in nature, but also in the realm of healthcare. This is the time when the open enrollment period for Medicare Supplement Policies, also known as Medigap, commences. It’s a time of opportunity, a window of choice, a moment to secure a future of health and wellness. But how long does this season of choice last? Let’s delve into the heart of the matter.

The open enrollment period for Medicare Supplement Policies is a six-month timeframe that begins on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B. This period is like a golden ticket, a key that unlocks a door to a world of healthcare possibilities. It’s a time when insurance companies are required by law to sell you any Medigap policy they offer, regardless of any health problems you may have. It’s a time when the scales of healthcare are tipped in your favor, a time when you hold the reins of your health destiny.

But like the fleeting colors of autumn, this period of open enrollment is transient. It lasts for six months, a seemingly generous span of time. Yet, it’s crucial to remember that this period doesn’t roll around every year like the seasons. It’s a one-time opportunity, a single shot at securing a Medigap policy under the best possible conditions. Once this six-month period ends, the golden ticket expires, the door closes, and the scales tip back to their usual balance.

During this period, you have the freedom to choose from a variety of Medigap policies, each offering different benefits and coverage levels. It’s like standing in an orchard of options, each tree bearing different fruits of healthcare coverage. You have the power to choose the policy that best suits your health needs and financial capabilities. It’s a time to reflect, to assess, and to make informed decisions about your health future.

However, the clock is always ticking. Six months may seem like a long time, but it can pass in the blink of an eye. It’s essential to seize this opportunity, to act while the window is open. It’s a time to be proactive, to take control of your health destiny. It’s a time to step into the driver’s seat and steer your health journey in the direction you want it to go.

In the grand scheme of life, six months is but a fleeting moment. Yet, in the realm of healthcare, it’s a golden opportunity, a chance to secure a future of health and wellness. The open enrollment period for Medicare Supplement Policies is a testament to the power of choice, the importance of proactive health management, and the value of seizing opportunities when they arise.

So, as the leaves begin to fall and the air turns crisp, remember that a season of change is upon us. It’s a time to embrace the opportunity, to make choices, and to secure a future of health and wellness. The open enrollment period for Medicare Supplement Policies is here. It’s your time to shine, your moment to seize, your opportunity to secure a future of health and wellness. So, step into the orchard of options, pick the fruit that suits you best, and savor the sweet taste of proactive health management.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Ins and Outs of Open Enrollment for Medicare Supplement Plans

Open enrollment for Medicare Supplement policies, also known as Medigap, is a golden opportunity that shines brightly once in a lifetime for most beneficiaries. It’s a period of time when the doors swing wide open, inviting you to step into a world of healthcare coverage that can provide a safety net for your future. This period, often referred to as the Medigap Open Enrollment Period (OEP), is a six-month window that begins the month you turn 65 and are enrolled in Medicare Part B.

Imagine standing on the precipice of a new adventure, the wind of opportunity blowing gently at your back, urging you forward. That’s what the open enrollment period feels like. It’s a chance to take control of your healthcare journey, to navigate the often turbulent seas of medical expenses with a sturdy ship and a reliable compass.

During this six-month period, insurance companies are required to sell you any Medigap policy they offer, regardless of any health problems you may have. They cannot charge you more based on pre-existing conditions, nor can they deny you coverage. It’s as if you’re standing at the helm of your own ship, the horizon stretching out before you, full of possibilities.

But like any journey, the open enrollment period for Medicare Supplement policies is not without its challenges. It’s a one-time-only opportunity, and once it’s gone, it’s gone. If you miss this window, you may find yourself facing higher premiums or even denial of coverage due to health conditions. It’s like missing the tide – once it’s out, you can’t bring it back in.

That’s why it’s so important to seize this opportunity when it comes. It’s a chance to secure your future, to ensure that you’re covered no matter what health challenges you may face down the line. It’s a chance to stand tall, to face the future with confidence and courage, knowing that you’ve done everything you can to protect yourself and your health.

But what if you’re not ready to enroll during your open enrollment period? What if you’re still working and have employer coverage, or you’re simply not ready to make a decision? The good news is, there are certain situations where you may be granted a delay or an extension. It’s like being given a second chance, a lifeline thrown to you just when you need it most.

However, these situations are exceptions rather than the rule. It’s always best to plan ahead, to chart your course carefully and make sure you’re ready to set sail when the time comes. After all, the open enrollment period for Medicare Supplement policies is a journey, and like any journey, it requires preparation, foresight, and a spirit of adventure.

So, as you stand on the brink of this new adventure, remember this: the open enrollment period for Medicare Supplement policies is a golden opportunity, a chance to take control of your healthcare journey. It’s a six-month window of opportunity that opens once in a lifetime. Don’t let it pass you by. Embrace it, seize it, and step boldly into your future. After all, the horizon is full of possibilities, and the wind of opportunity is blowing in your favor.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Q&A

1. Question: When does the open enrollment for Medicare Supplement Policies usually start?

Answer: The open enrollment for Medicare Supplement Policies starts on the first day of the month when you’re both 65 or older and enrolled in Medicare Part B.

2. Question: How long does the open enrollment period for Medicare Supplement Policies last?

Answer: The open enrollment period for Medicare Supplement Policies lasts for six months.

3. Question: Can I enroll in a Medicare Supplement Policy after the open enrollment period?

Answer: Yes, you can enroll in a Medicare Supplement Policy after the open enrollment period, but you may have to go through medical underwriting and the insurer can charge you more or deny coverage based on health conditions.

4. Question: Is there a specific time of the year for the open enrollment period?

Answer: No, the open enrollment period for Medicare Supplement Policies is based on your personal situation, starting when you’re both 65 or older and enrolled in Medicare Part B.

5. Question: What happens if I miss the open enrollment period?

Answer: If you miss the open enrollment period, you may not have guaranteed issue rights, and insurers can use medical underwriting to decide whether to accept your application and how much to charge you.

6. Question: Can I change my Medicare Supplement Policy during the open enrollment period?

Answer: Yes, during the open enrollment period, you can change your Medicare Supplement Policy without any restrictions.

7. Question: Is the open enrollment period the same every year?

Answer: No, the open enrollment period for Medicare Supplement Policies is not based on the calendar year. It begins when you’re both 65 or older and enrolled in Medicare Part B.

8. Question: Can I enroll in any Medicare Supplement Policy during the open enrollment period?

Answer: Yes, during the open enrollment period, you can enroll in any Medicare Supplement Policy available in your state.

9. Question: What if I want to switch my Medicare Supplement Policy after the open enrollment period?

Answer: If you want to switch your Medicare Supplement Policy after the open enrollment period, you may have to go through medical underwriting and the insurer can charge you more or deny coverage based on health conditions.

10. Question: Can I cancel my Medicare Supplement Policy during the open enrollment period?

Answer: Yes, you can cancel your Medicare Supplement Policy during the open enrollment period without any penalties.