“Medicare Pre Existing Conditions: Your Health History, Our Coverage Commitment.”

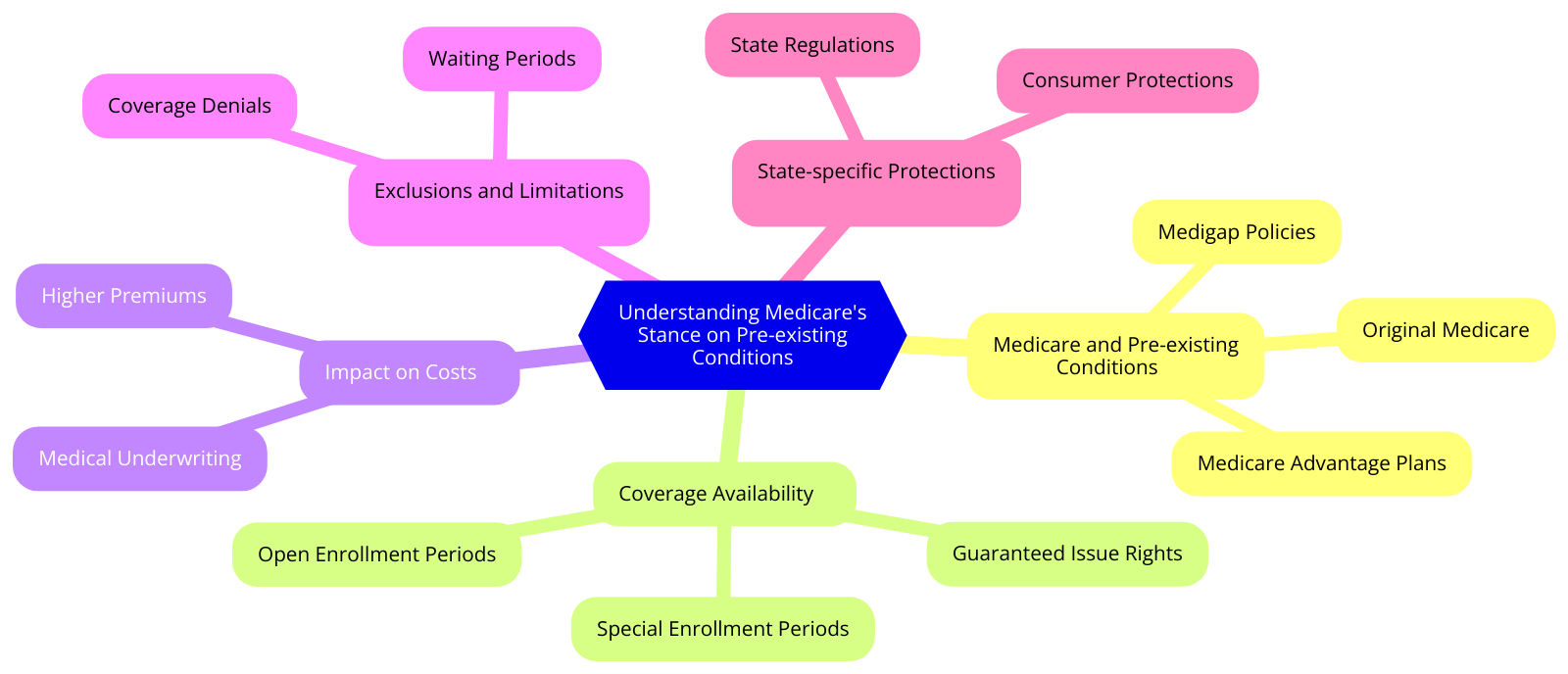

Understanding Medicare’s Stance on Pre-existing Conditions

Medicare, the beacon of hope for many Americans, is a federal health insurance program that primarily serves individuals aged 65 and older. It also extends its benevolent hand to younger individuals with certain disabilities and people with End-Stage Renal Disease. However, a question that often arises in the minds of many is, “What is Medicare’s stance on pre-existing conditions?”

In the world of health insurance, a pre-existing condition is a health problem that existed before you apply for a health insurance policy. It could be anything from a chronic illness like diabetes or heart disease to a life-threatening condition like cancer. In the past, health insurance companies could deny coverage or charge higher premiums based on these pre-existing conditions. But, like a lighthouse guiding ships through a stormy night, Medicare shines its light of assurance, offering coverage to individuals regardless of their pre-existing conditions.

Medicare’s stance on pre-existing conditions is a testament to its commitment to providing quality healthcare for all. It is a beacon of hope for those who have been turned away by other insurance providers due to their health status. This is a significant relief for many, as it means that they can receive the necessary medical care without the fear of financial ruin.

When you first become eligible for Medicare, you are granted a seven-month Initial Enrollment Period. During this time, you can join any Medicare plan available in your area, regardless of your health status or pre-existing conditions. This period usually begins three months before the month you turn 65, includes the month you turn 65, and ends three months after the month you turn 65.

Medicare Part A, which covers hospital insurance, and Medicare Part B, which covers medical insurance, do not deny coverage or charge higher premiums based on pre-existing conditions. Similarly, Medicare Advantage Plans, also known as Part C, can’t refuse coverage or charge more based on current or past health conditions. However, there is one exception to this rule. Medicare Advantage Plans are not required to cover end-stage renal disease. In such cases, individuals can opt for Original Medicare.

Medicare Part D, which covers prescription drugs, also accepts individuals with pre-existing conditions. It is worth noting that while these plans cannot refuse coverage or charge more because of pre-existing conditions, the cost and coverage of medications can vary from plan to plan.

Medicare Supplement Insurance, also known as Medigap, has a slightly different approach. If you apply for a Medigap policy after your Medigap Open Enrollment Period, the insurance company can use medical underwriting. This means they can refuse to sell you a policy, or they can charge you more based on your health status. However, during your Medigap Open Enrollment Period, you can buy any policy sold in your state, even if you have health problems.

In the grand tapestry of healthcare, Medicare’s stance on pre-existing conditions is a vibrant thread of inclusivity and compassion. It is a testament to the belief that everyone deserves access to quality healthcare, regardless of their health history. It is a beacon of hope, guiding individuals towards a future where their health conditions do not define their access to healthcare. It is a reminder that in the face of adversity, there is always a helping hand, a ray of hope, and a path forward.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How Medicare Covers Pre-existing Conditions

Medicare, the beacon of hope for many Americans, is a testament to the nation’s commitment to the health and well-being of its citizens. It is a symbol of compassion, a lifeline for those in the twilight of their lives, and those grappling with disabilities. But what about those with pre-existing conditions? Does Medicare extend its benevolent hand to them as well? The answer, dear reader, is a resounding yes.

Imagine a world where your past health history is not a barrier to your future health care. A world where you are not penalized for conditions that are beyond your control. This is not a utopian dream, but a reality made possible by Medicare. It is a testament to the belief that everyone deserves access to quality healthcare, regardless of their past or present health conditions.

Medicare, in its infinite wisdom, does not discriminate based on pre-existing conditions. It does not matter if you have been diagnosed with diabetes, heart disease, or any other chronic condition. Medicare embraces you with open arms, offering coverage that is as comprehensive as it is compassionate.

The journey begins with Medicare Part A and Part B, which cover hospital stays and medical services respectively. These parts of Medicare do not consider pre-existing conditions during enrollment. This means that you can sign up for these services without fear of being denied or charged more due to your health history.

But the story does not end there. Medicare Advantage Plans, also known as Part C, also welcome those with pre-existing conditions, with one notable exception – end-stage renal disease. However, even in this case, there are certain circumstances under which individuals may still be eligible for coverage.

Medicare’s prescription drug coverage, Part D, also follows suit. It does not deny coverage or charge more based on pre-existing conditions. This ensures that you have access to the medications you need to manage your condition and lead a healthy life.

The tale of Medicare and pre-existing conditions is one of inclusivity and compassion. It is a story that inspires hope and fosters a sense of security. It is a narrative that underscores the fundamental belief that healthcare is a right, not a privilege.

However, it is important to remember that while Medicare does not discriminate based on pre-existing conditions, the timing of enrollment is crucial. Delaying enrollment can lead to penalties, which can increase your premiums. Therefore, it is advisable to enroll as soon as you are eligible to avoid any potential penalties.

Medicare’s approach to pre-existing conditions is a shining example of its commitment to the health and well-being of all Americans. It is a testament to the belief that everyone deserves access to quality healthcare, regardless of their past or present health conditions.

In the grand tapestry of healthcare, Medicare stands out as a beacon of hope. It is a symbol of a nation’s commitment to its citizens, a testament to the power of compassion and inclusivity. It is a lifeline for those in need, a safety net for those who have nowhere else to turn. And for those with pre-existing conditions, it is a promise of coverage, care, and compassion.

So, let us celebrate Medicare, for it is more than just a healthcare program. It is a symbol of hope, a beacon of compassion, and a testament to the power of inclusivity. It is a reminder that in the realm of healthcare, no one should be left behind.

The Impact of Pre-existing Conditions on Medicare Coverage

Medicare, the golden beacon of hope for many Americans, is often seen as a lifeline, a safety net that catches us when we stumble into the twilight years of our lives. It’s a promise of care, a pledge of support, a commitment to our health and well-being. But what happens when we approach this beacon with a pre-existing condition? Does Medicare still extend its warm, comforting embrace? Let’s delve into the impact of pre-existing conditions on Medicare coverage.

Imagine, if you will, a journey. A journey that begins with the first breath we take and ends with the last. Along this journey, we encounter various challenges, some of which leave indelible marks on our health. These marks, these health conditions that we carry with us, are what we call pre-existing conditions. They are the silent passengers on our journey, often influencing the course we take.

Now, let’s shift our gaze to Medicare, the stalwart companion on our journey. Medicare, in its essence, is designed to ensure that no one is left behind, that everyone has access to the care they need. But does this include those with pre-existing conditions? The answer, in its simplest form, is yes. Medicare does not discriminate based on pre-existing conditions. It does not turn a blind eye to those who need it most. It stands by us, steadfast and unwavering, ready to lend a helping hand.

However, like any journey, the path to Medicare coverage is not always smooth. There are twists and turns, bumps and hurdles. One such hurdle is the Medicare Supplement Insurance, also known as Medigap. Medigap policies are designed to fill in the gaps in Medicare coverage, to provide that extra layer of protection. But here’s the catch – Medigap can deny coverage or charge higher premiums based on pre-existing conditions, especially if you apply outside your Medigap Open Enrollment Period.

But don’t let this deter you. Don’t let this be a stumbling block on your journey. Instead, let it be a stepping stone, a challenge to overcome. Because, remember, Medicare itself does not discriminate. It does not turn its back on those with pre-existing conditions. And there are protections in place, safeguards to ensure that you are not left in the lurch. For instance, if you apply for Medigap during your Open Enrollment Period, the insurance company cannot use medical underwriting. They cannot deny you coverage or charge you more based on your health.

So, as we continue on our journey, let’s remember this. Pre-existing conditions may be silent passengers, but they do not define us. They do not dictate the path we take. And with Medicare by our side, we can face these challenges head-on. We can navigate the twists and turns, the bumps and hurdles. We can ensure that we are not left behind, that we have access to the care we need.

In the end, the impact of pre-existing conditions on Medicare coverage is not a barrier, but a bridge. A bridge that connects us to a better understanding of our health, a deeper appreciation of our journey, and a stronger commitment to our well-being. So, let’s cross this bridge together, with hope in our hearts and Medicare by our side. Because, after all, we are not defined by our pre-existing conditions, but by our ability to overcome them.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Navigating Medicare with Pre-existing Conditions

Navigating the labyrinth of healthcare can be a daunting task, especially when you’re dealing with pre-existing conditions. But fear not, for the beacon of hope known as Medicare is here to guide you through the darkness. It’s a journey that may seem overwhelming at first, but with a little knowledge and understanding, you can conquer the complexities of Medicare and pre-existing conditions with confidence and grace.

Medicare, the federal health insurance program for people aged 65 and older, as well as certain younger individuals with disabilities, is a lifeline for millions of Americans. It’s a safety net, a shield against the financial burdens of healthcare. But what happens when you have a pre-existing condition? Does Medicare still extend its protective arm to cover you? The answer, in short, is yes.

In the past, insurance companies could deny coverage or charge higher premiums to individuals with pre-existing conditions. However, the landscape of healthcare has changed dramatically. Today, Medicare cannot refuse to cover your treatment for a pre-existing condition nor can it charge you a higher premium based on your health status. This is a significant victory for those who have been battling health issues, a testament to the progress we’ve made in ensuring that everyone has access to the care they need.

But while Medicare does cover pre-existing conditions, it’s important to understand that there may be waiting periods for certain benefits. For instance, if you have End-Stage Renal Disease (ESRD) and need a kidney transplant, there’s a three-month waiting period before Medicare will cover your transplant. However, there are exceptions to this rule, and in some cases, the waiting period can be waived. It’s a subtle dance between policy and patient care, a delicate balance that Medicare strives to maintain.

Navigating Medicare with pre-existing conditions also requires an understanding of the different parts of Medicare. Part A covers hospital insurance, Part B covers medical insurance, and Part D covers prescription drugs. Each part plays a crucial role in your healthcare journey, and understanding how they work together can help you make the most of your Medicare benefits.

Moreover, there’s also Medicare Advantage, also known as Part C. These are plans offered by private companies that contract with Medicare to provide all your Part A and Part B benefits. Many Medicare Advantage Plans also offer prescription drug coverage. These plans often come with additional benefits and may be a good option for individuals with pre-existing conditions.

The journey through Medicare with pre-existing conditions may seem like a winding path, filled with twists and turns. But remember, every journey begins with a single step. And with each step you take, you’re moving closer to understanding and maximizing your Medicare benefits.

So, take heart. You’re not alone on this journey. There are resources available to help you navigate the complexities of Medicare. Reach out to healthcare professionals, join support groups, and educate yourself. Remember, knowledge is power. And with this power, you can conquer the challenges of Medicare and pre-existing conditions.

In the end, the journey through Medicare with pre-existing conditions is not just about understanding policies and navigating paperwork. It’s about securing your health, your happiness, and your peace of mind. It’s about standing tall in the face of adversity and saying, “I am more than my condition. I am strong. I am resilient. And with Medicare by my side, I can face any challenge that comes my way.”

Medicare Pre-existing Conditions: What You Need to Know

Medicare, the beacon of hope for many Americans, is a health insurance program that primarily serves people over 65, whatever their income, and younger disabled people and dialysis patients. It’s a lifeline, a safety net, a promise of care and support when it’s needed most. But what happens when you have a pre-existing condition? Does Medicare still extend its warm, protective embrace? The answer, in short, is yes. But there’s more to the story, and it’s a tale worth telling.

Imagine, if you will, a journey. You’re setting off into the unknown, a landscape filled with medical jargon, insurance policies, and healthcare providers. It’s daunting, to say the least. But you’re not alone. Medicare is there, a guiding star in the night, ready to light your way. And it doesn’t matter if you’re carrying extra baggage in the form of a pre-existing condition. Medicare doesn’t turn you away. It doesn’t judge or discriminate. It simply helps.

Medicare Part A and Part B, often referred to as Original Medicare, cover hospital stays, doctor visits, and other medical services. They don’t exclude coverage based on pre-existing conditions. That’s right, whether you have high blood pressure, diabetes, or a heart condition, Medicare is there for you. It’s a comforting thought, isn’t it? Knowing that you’re not alone, that you have a safety net, that you’re covered.

But what about Medicare Advantage Plans, also known as Part C? These are offered by private companies approved by Medicare, and they provide all your Part A and Part B benefits. They often include additional benefits like vision, hearing, and dental coverage. And the good news? They also can’t refuse to cover you or charge you more because of a pre-existing condition, except for end-stage renal disease. But even then, there are exceptions and special circumstances where you may still be able to enroll in a Medicare Advantage Plan.

And then there’s Medicare Supplement Insurance, also known as Medigap. These policies help pay some of the healthcare costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles. Now, this is where the journey gets a little tricky. If you apply for a Medigap policy after your initial enrollment period and you have a pre-existing condition, the insurance company can refuse to cover your out-of-pocket costs for these pre-existing conditions for up to six months. This is known as a “pre-existing condition waiting period”. But don’t despair. After this waiting period, the Medigap policy will cover the pre-existing condition.

So, as you can see, Medicare is a journey, but it’s one you don’t have to take alone. It’s a journey filled with support, care, and coverage, regardless of your pre-existing conditions. It’s a journey that may have its challenges, but it’s also one filled with hope. Because Medicare, in all its forms, is there for you. It’s a beacon of light in the often confusing world of healthcare, a guiding star that doesn’t dim or fade, no matter what health conditions you may have. And that, dear reader, is a tale worth telling.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Role of Medicare in Covering Pre-existing Conditions

Medicare, the beacon of hope for millions of Americans, is more than just a government-funded health insurance program. It is a lifeline, a safety net, and a testament to the belief that everyone deserves access to quality healthcare, regardless of their age or health status. One of the most significant aspects of Medicare is its role in covering pre-existing conditions, a topic that has been at the forefront of healthcare discussions in recent years.

Imagine, if you will, a world where your health history becomes a barrier to receiving the care you need. A world where a diagnosis of diabetes, heart disease, or cancer could mean financial ruin. This was the reality for many Americans before the advent of Medicare and the protections it offers for those with pre-existing conditions.

Medicare, in its infinite wisdom, has taken a stand against this form of discrimination. It has declared, in no uncertain terms, that your health history should not determine your access to healthcare. Instead, it has championed the cause of those with pre-existing conditions, ensuring that they receive the same coverage as those without.

The beauty of Medicare lies in its simplicity. Once you turn 65 or qualify due to disability, you are eligible for Medicare, regardless of your health status. There are no medical underwriting or health questions to answer. Your pre-existing conditions, no matter how severe, do not affect your eligibility or your premiums. This is a breath of fresh air in a world where insurance companies often penalize those with health issues.

But Medicare’s role in covering pre-existing conditions goes beyond just offering coverage. It also provides a sense of security and peace of mind. Knowing that your health insurance won’t be ripped away because of a new diagnosis or a worsening condition is a comfort that cannot be overstated. It allows individuals to focus on what truly matters – managing their health and living their lives to the fullest.

Moreover, Medicare’s coverage of pre-existing conditions is comprehensive. It covers hospital stays, doctor visits, prescription medications, and even preventive services to help manage chronic conditions. It also offers special programs for those with certain conditions, such as diabetes or end-stage renal disease, providing them with the specialized care they need.

Yet, despite its many benefits, Medicare is not perfect. There are gaps in coverage and out-of-pocket costs that can be burdensome for those with chronic conditions. But even in its imperfection, Medicare serves as a beacon of hope. It is a testament to the belief that healthcare is a right, not a privilege, and that pre-existing conditions should not be a barrier to receiving care.

In the grand tapestry of healthcare, Medicare is a shining thread. It weaves together the principles of equality, compassion, and justice, creating a safety net for those who need it most. Its role in covering pre-existing conditions is a testament to its commitment to these principles, a commitment that has made a difference in the lives of millions of Americans.

So, let us celebrate Medicare, not just for what it is, but for what it represents – a promise of care, a commitment to equality, and a beacon of hope in a world that often seems uncertain. Let us remember that, in the face of pre-existing conditions, Medicare stands tall, offering coverage, peace of mind, and the promise of a healthier future.

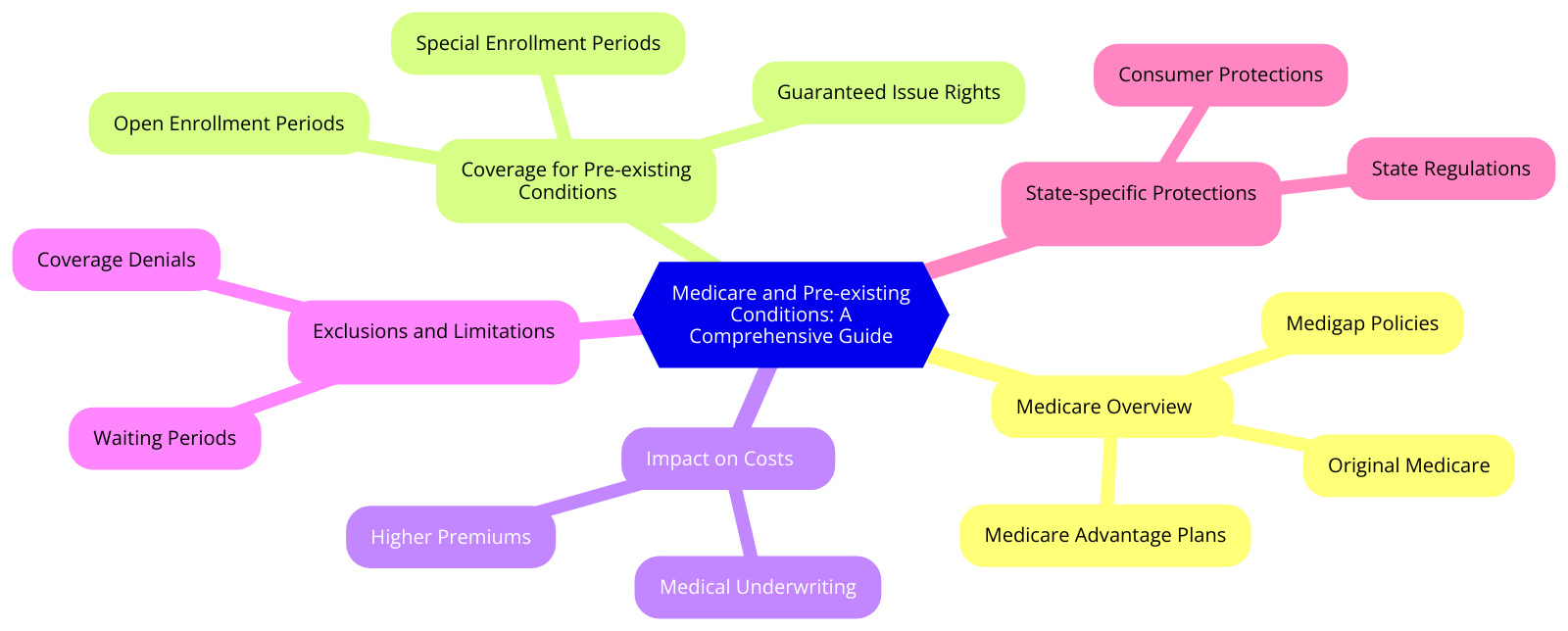

Medicare and Pre-existing Conditions: A Comprehensive Guide

Medicare, the federal health insurance program, is a beacon of hope for many Americans aged 65 and older, as well as for younger individuals with certain disabilities. It’s a lifeline, a safety net, a promise of care when it’s needed most. But what about those with pre-existing conditions? Does Medicare extend its warm, protective embrace to them as well? The answer, in short, is a resounding yes.

Imagine a world where your health history doesn’t dictate your future, where your past ailments don’t cast a shadow over your present. That’s the world Medicare strives to create. It’s a world where pre-existing conditions aren’t barriers to coverage but are simply part of your unique health journey.

Medicare doesn’t discriminate based on health history. It doesn’t shy away from those with pre-existing conditions. Instead, it steps up, offering coverage and care to those who need it most. Whether you’re living with heart disease, diabetes, or any other chronic condition, Medicare is there for you. It’s a testament to the program’s commitment to inclusivity and its dedication to the health and wellbeing of all Americans.

But how does this work in practice? Well, when you first become eligible for Medicare, you’re granted a golden opportunity: the Initial Enrollment Period. This is a seven-month window that begins three months before your 65th birthday, includes the month you turn 65, and extends for three months after. During this time, you can enroll in Medicare Part A and Part B without worrying about your health history. Your pre-existing conditions won’t affect your premiums, and you won’t be denied coverage. It’s a fresh start, a clean slate, a chance to secure the care you need without fear of rejection or inflated costs.

But what if you miss this initial window? Fear not, for Medicare has another provision in place: the Guaranteed Issue Rights, also known as Medigap protections. These rights ensure that even if you miss your Initial Enrollment Period, you can still enroll in a Medigap policy without being penalized for your pre-existing conditions. It’s a safety net within a safety net, a testament to Medicare’s commitment to leaving no one behind.

And what about prescription drugs, often a lifeline for those with chronic conditions? Here too, Medicare extends its helping hand. With Medicare Part D, you can secure coverage for your prescription drugs, regardless of your health history. It’s yet another way Medicare ensures that pre-existing conditions don’t stand in the way of the care you need.

In the end, Medicare’s approach to pre-existing conditions is more than just a policy. It’s a statement, a declaration of intent. It says that your health history won’t define your future, that your past ailments won’t dictate your present. It’s a promise of care, of coverage, of compassion. It’s a testament to the power of inclusivity, to the strength of a system that refuses to leave anyone behind.

So, if you’re living with a pre-existing condition and wondering if Medicare is right for you, let this be your answer. Yes, Medicare is here for you. Yes, it will cover you. And yes, it will do so without discrimination, without hesitation, and without inflated costs. Because at its core, Medicare is about more than just health insurance. It’s about hope, it’s about care, and it’s about ensuring that everyone, regardless of their health history, has access to the care they need.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Exploring the Limits of Medicare for Pre-existing Conditions

Medicare, the beacon of hope for many Americans, is often seen as a lifeline, a safety net that catches us when we fall into the abyss of health issues. It is a testament to our society’s commitment to care for its elderly and disabled citizens. However, like any beacon, it has its limits, and one of those limits is its coverage for pre-existing conditions.

Imagine, if you will, a ship sailing through a storm. The crew is confident, knowing they have a sturdy vessel and a reliable lighthouse guiding them to safety. But what if there are hidden rocks beneath the surface, unseen dangers that the lighthouse can’t warn them about? These are the pre-existing conditions, the health issues that existed before the safety net of Medicare was in place.

Medicare, in its essence, is designed to provide health coverage for individuals aged 65 and above, as well as certain younger individuals with disabilities. It’s a beautiful concept, a testament to our society’s commitment to care for its most vulnerable members. However, it’s not without its limitations.

One of the most significant limitations is the coverage for pre-existing conditions. While Medicare Part A and Part B cover hospital and medical insurance, they do not cover all the costs associated with pre-existing conditions. This can leave beneficiaries with significant out-of-pocket expenses, creating a financial burden that can be as debilitating as the health condition itself.

However, there is a silver lining. Medicare Advantage Plans, also known as Part C, often provide more comprehensive coverage for pre-existing conditions. These plans are offered by private companies approved by Medicare and combine Part A and Part B benefits, often including prescription drug coverage.

But even with this additional coverage, there can be limitations. Some Medicare Advantage Plans require health screenings or have waiting periods for coverage of pre-existing conditions. This can create a gap in coverage, leaving beneficiaries vulnerable to high medical costs.

Yet, despite these challenges, there is a sense of resilience and determination that permeates the Medicare community. Beneficiaries navigate the complex world of health insurance with tenacity, advocating for themselves and others to ensure they receive the care they need.

And there is hope on the horizon. Legislation is continually being proposed to improve Medicare’s coverage for pre-existing conditions. Advocacy groups are tirelessly working to raise awareness and push for change. And every day, beneficiaries are sharing their stories, shedding light on the realities of living with pre-existing conditions and the need for better coverage.

In the end, Medicare, like the lighthouse, is a guide, a source of support in the stormy seas of health issues. And while it may not always illuminate the hidden dangers beneath the surface, it provides a path forward, a beacon of hope in the darkness.

The journey may be challenging, the waters may be rough, but with determination, advocacy, and a commitment to change, we can navigate the limitations of Medicare for pre-existing conditions. We can ensure that all beneficiaries have the coverage they need, the care they deserve, and the peace of mind that comes with knowing they are not alone in their journey.

So, let us continue to sail forward, guided by the beacon of Medicare, inspired by the resilience of its beneficiaries, and driven by the hope of a brighter, more inclusive future.

The Truth about Medicare and Pre-existing Conditions

Medicare, the federal health insurance program for people aged 65 and older, is a beacon of hope for many. It’s a promise of care and support in the golden years of life, a promise that health concerns won’t be a barrier to living life to the fullest. But what about those who carry the burden of pre-existing conditions? Is Medicare still a beacon of hope for them? The answer is a resounding yes.

The term “pre-existing conditions” can be a source of anxiety for many. It’s a phrase that often brings with it a sense of uncertainty, a fear of being denied coverage or facing exorbitant costs. But when it comes to Medicare, the truth is far more reassuring.

Medicare, in its essence, is a program designed to ensure that no one is left behind. It’s a program that believes in the inherent dignity of every individual, regardless of their health status. And so, it does not penalize or exclude those with pre-existing conditions.

When you enroll in Medicare Part A and Part B, which cover hospital stays and medical services respectively, your pre-existing conditions do not affect your eligibility or the cost of your premium. This is a testament to the inclusive nature of Medicare, a testament to its commitment to providing care for all.

But what about Medicare Advantage plans, also known as Part C? These plans are offered by private insurance companies and often provide additional benefits. Here too, the news is positive. Medicare Advantage plans are required by law to accept all applicants, including those with pre-existing conditions, with the exception of End-Stage Renal Disease.

Even in the case of Medicare Supplement Insurance, also known as Medigap, which helps cover out-of-pocket costs not covered by Original Medicare, there is a window of opportunity. If you enroll during the Medigap Open Enrollment Period, which begins on the first day of the month you’re both 65 or older and enrolled in Medicare Part B, you cannot be denied coverage or charged more due to pre-existing conditions.

The truth about Medicare and pre-existing conditions is a story of hope and inclusivity. It’s a story that reaffirms the commitment of Medicare to ensure that everyone, regardless of their health status, has access to the care they need.

But it’s also a story that underscores the importance of being informed. Understanding the nuances of Medicare, knowing the right time to enroll, can make all the difference. It can ensure that you’re not just covered, but that you’re getting the most out of your coverage.

So, if you’re approaching 65 and carrying the weight of a pre-existing condition, let this be a source of comfort. Medicare is not a door that’s closed to you. It’s a door that’s wide open, inviting you in with the promise of care and support.

In the end, the truth about Medicare and pre-existing conditions is not just about insurance policies and healthcare costs. It’s about a commitment to dignity and care for all. It’s about a promise that health concerns, no matter how big or small, won’t stand in the way of living life to the fullest. And that, truly, is a beacon of hope.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Decoding Medicare Coverage for Pre-existing Conditions

Medicare, the golden beacon of health insurance for those aged 65 and above, is often seen as a labyrinth of rules and regulations. One of the most misunderstood aspects of this program is its stance on pre-existing conditions. The term “pre-existing conditions” refers to health issues that were diagnosed or treated before your health coverage began. It’s a term that can send shivers down the spine of anyone seeking insurance coverage, conjuring images of denied claims and sky-high premiums. But fear not, for Medicare’s approach to pre-existing conditions is not as daunting as it may seem.

Imagine you’re embarking on a journey, a journey towards understanding Medicare’s coverage for pre-existing conditions. As you step onto this path, you’ll find that Original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance), does not deny coverage or increase premiums based on pre-existing conditions. This is a breath of fresh air, a ray of hope for those who have been battling health issues. It’s like finding an oasis in the middle of a desert, a sanctuary where your health history does not dictate your access to care.

As you continue on this journey, you’ll come across Medicare Advantage Plans, also known as Part C. These plans are offered by private companies approved by Medicare, and they cover all the services offered by Original Medicare, often including prescription drugs. Now, you might be thinking, “This sounds too good to be true. Surely, they must deny coverage for pre-existing conditions.” But hold onto your hats, because Medicare Advantage Plans are required by law to cover all applicants, regardless of their health history. The only exception is End-Stage Renal Disease (ESRD), but there are still ways to get coverage even with this condition.

Now, let’s venture into the realm of Medigap, also known as Medicare Supplement Insurance. These policies help pay some of the health care costs that Original Medicare doesn’t cover. Here, the waters get a bit murkier. If you apply for a Medigap policy after your initial enrollment period and you have a pre-existing condition, the insurance company can refuse to cover your out-of-pocket costs for these conditions for up to six months. This is known as a “pre-existing condition waiting period”. However, if you’ve had at least six months of prior “creditable” health insurance coverage, the waiting period is waived. It’s like having a golden ticket, a pass that allows you to bypass the waiting period and receive full coverage.

As we reach the end of our journey, let’s take a moment to reflect. Medicare’s approach to pre-existing conditions is not a maze of denial and high premiums. Instead, it’s a testament to the program’s commitment to ensuring that all beneficiaries have access to the care they need, regardless of their health history. It’s a beacon of hope, a promise that your health will not be a barrier to receiving quality care.

So, let’s step out of the shadows of misunderstanding and into the light of knowledge. Let’s embrace the fact that Medicare’s coverage for pre-existing conditions is not a hurdle, but a stepping stone towards better health. And let’s remember that no matter what health challenges we may face, Medicare is there to support us, to guide us, and to ensure that we can continue to live our lives to the fullest.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Q&A

1. Q: What is a pre-existing condition in the context of Medicare?

A: A pre-existing condition is a health issue that existed before the start of a person’s health insurance coverage.

2. Q: Does Medicare cover pre-existing conditions?

A: Yes, Medicare Part A and Part B cover pre-existing conditions.

3. Q: Are there any waiting periods for coverage of pre-existing conditions under Medicare?

A: No, there are no waiting periods for coverage of pre-existing conditions under Original Medicare.

4. Q: Does Medicare Advantage cover pre-existing conditions?

A: Yes, Medicare Advantage plans are required by law to cover all pre-existing conditions except for end-stage renal disease.

5. Q: Can I be denied Medicare coverage due to a pre-existing condition?

A: No, you cannot be denied coverage or charged more due to a pre-existing condition under Original Medicare.

6. Q: Are there any exceptions to Medicare’s coverage of pre-existing conditions?

A: Yes, the main exception is for end-stage renal disease, which may affect your eligibility for certain Medicare Advantage plans.

7. Q: Does Medicare Supplement Insurance (Medigap) cover pre-existing conditions?

A: Yes, but there may be a waiting period of up to six months for coverage of pre-existing conditions under Medigap.

8. Q: Can I be charged more for Medicare coverage due to a pre-existing condition?

A: No, Original Medicare does not charge more based on health status or pre-existing conditions.

9. Q: What is the waiting period for pre-existing conditions under Medigap?

A: The waiting period can be up to six months, during which the Medigap policy may not cover out-of-pocket costs for pre-existing conditions.

10. Q: Can I avoid the Medigap waiting period for pre-existing conditions?

A: Yes, if you buy the Medigap policy during your Medigap open enrollment period or if you have had at least six months of prior “creditable” health insurance coverage.