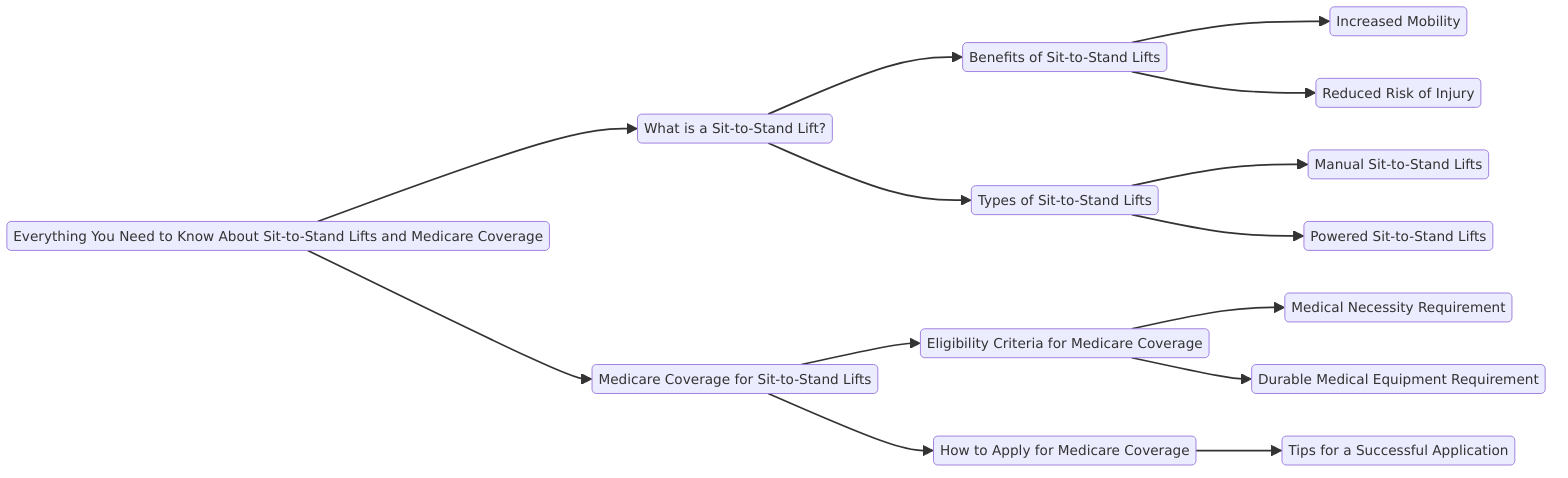

Everything You Need to Know About Sit-to-Stand Lifts and Medicare Coverage

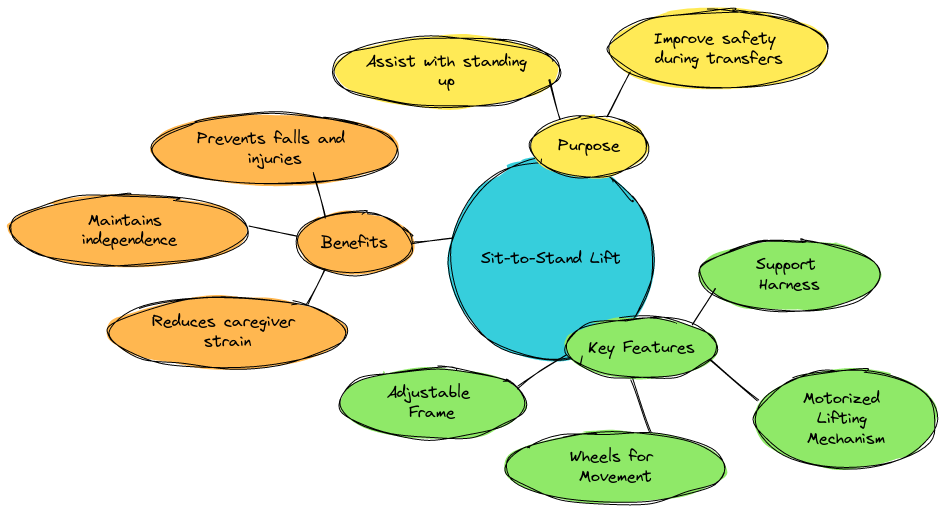

Sit-to-stand lifts are invaluable devices that help patients with mobility challenges move from a seated to a standing position without straining themselves or their caregivers. If you’ve ever tried helping a loved one or patient stand up after sitting for a while you know it’s not easy—trust me it’s almost like trying to move a mountain on a bad day. Luckily sit-to-stand lifts make the process easier safer and more comfortable.

But here’s the big question: Does Medicare cover sit-to-stand lifts? Well you’re in the right place to find out.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What is a Sit-to-Stand Lift Anyway?

A sit-to-stand lift is a type of patient lift that assists individuals in transitioning from sitting to standing. The device supports the patient by lifting them gently from a seated position typically from a bed wheelchair or chair and then helping them achieve a stable standing position. Sit-to-stand lifts come in different forms including mechanical lifts or electric lifts and they often include a harness or sling to support the patient’s weight.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Henry Beltran the owner of Medicare Advisors Insurance Group LLC often tells his clients: “Think of a sit-to-stand lift like your very own weightlifting coach except you don’t have to pay for gym membership and it won’t yell at you for missing leg day.”

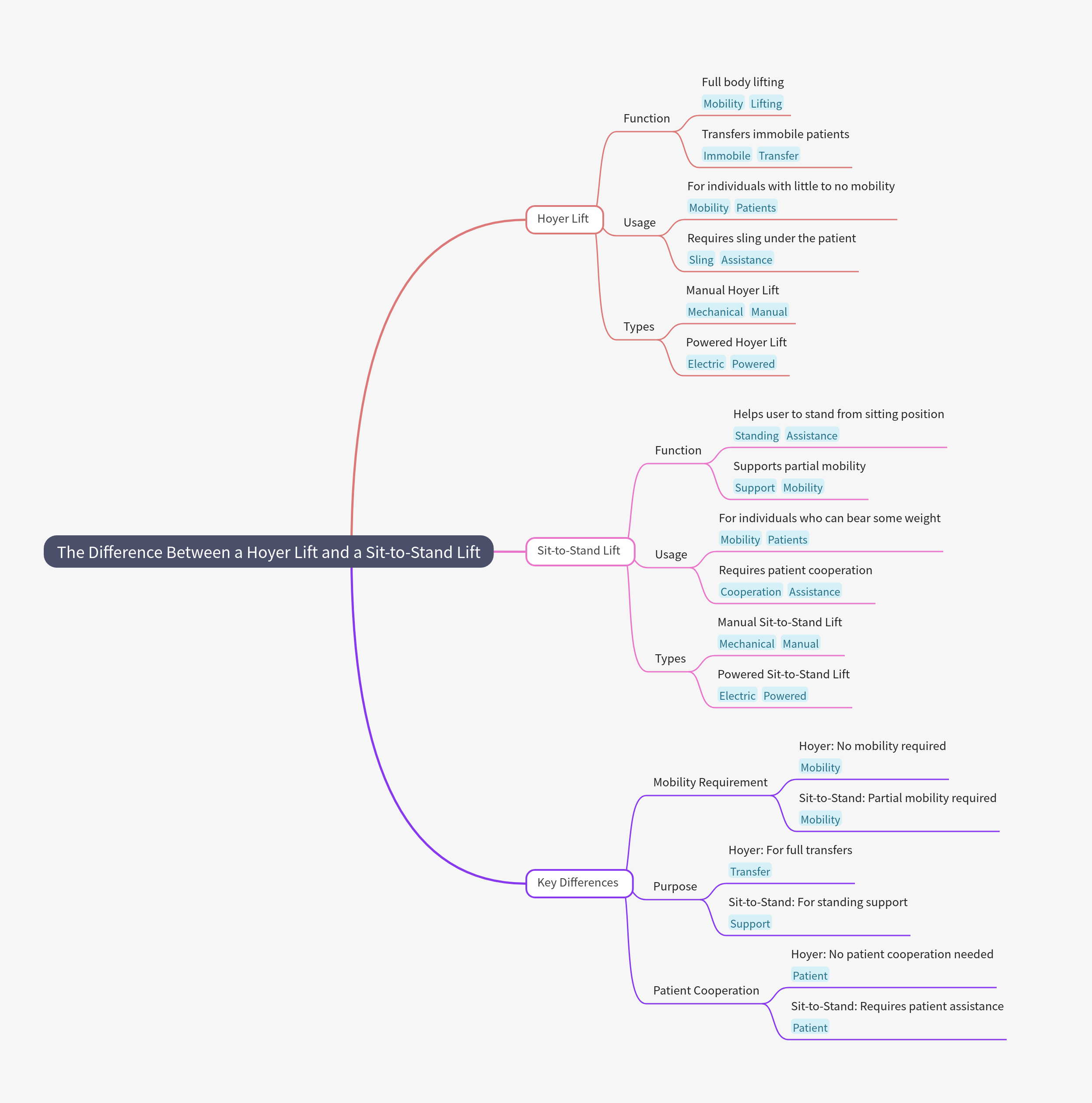

The Difference Between a Hoyer Lift and a Sit-to-Stand Lift

Now here’s where things can get a little confusing. Hoyer lifts are another common type of patient lift but they function differently. While sit-to-stand lifts are designed to assist patients who can bear some of their weight Hoyer lifts are intended for those who can’t. In essence the sit-to-stand lift helps with partial mobility while the Hoyer lift is more like a full-body crane ready to hoist the patient up like a delicate feather.

So if you’re trying to figure out which one is best for you it comes down to patient mobility. Are they able to assist a little with their standing or do they need a full lift?

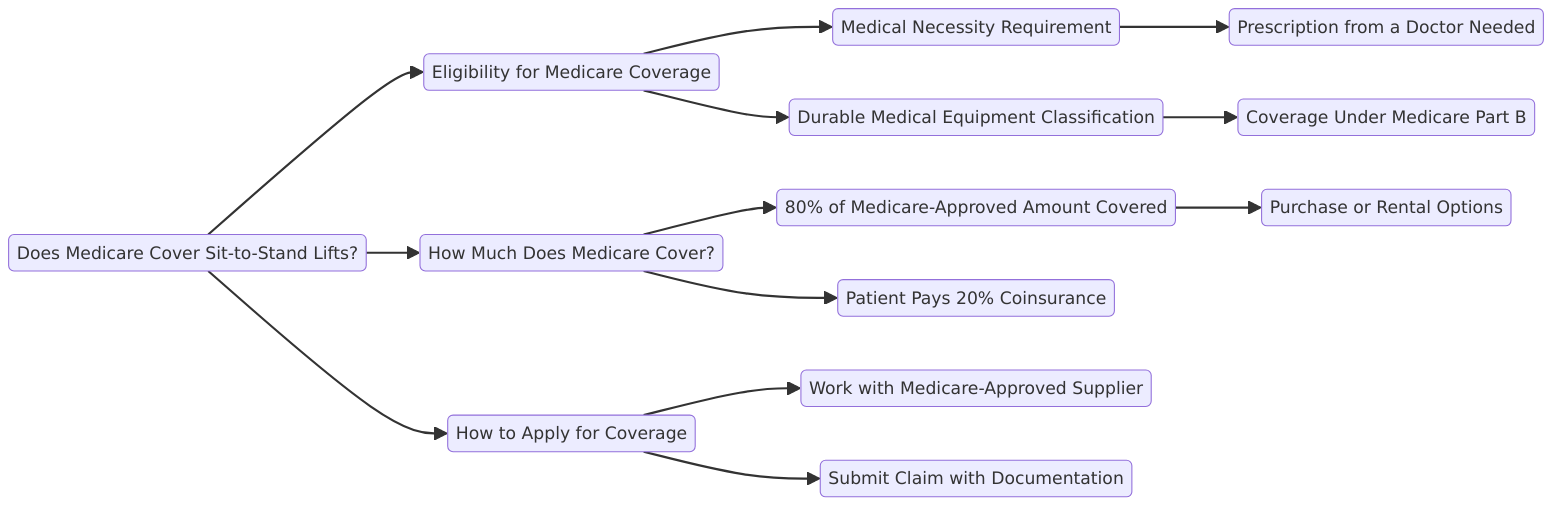

Does Medicare Cover Sit-to-Stand Lifts?

Ah the million-dollar question—or more accurately the several-hundred-dollar question. Does Medicare pay for sit-to-stand lifts?

Yes and no.

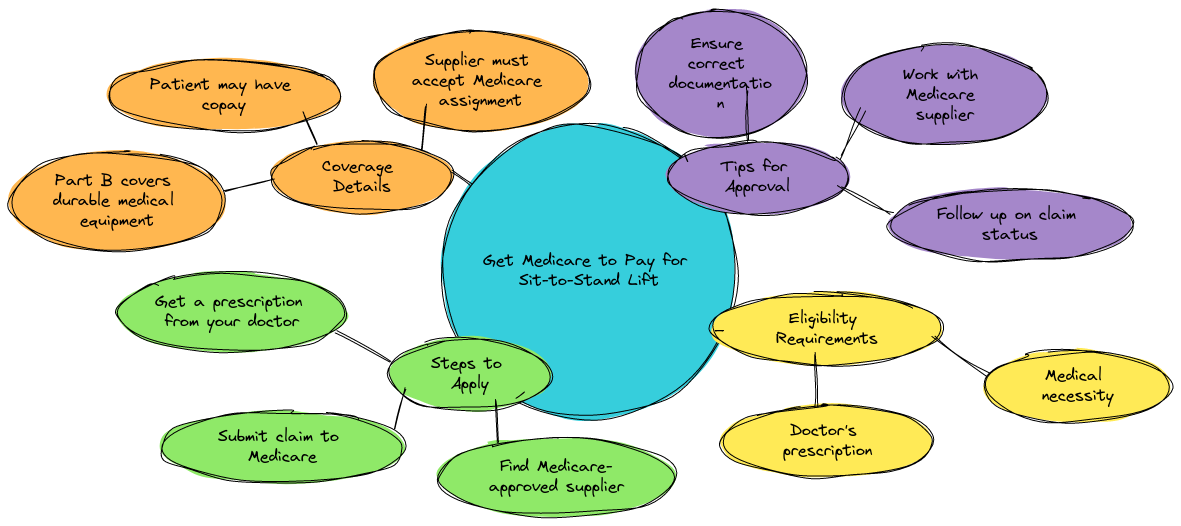

Medicare Part B covers durable medical equipment (DME) like sit-to-stand lifts under certain conditions. The patient lift must be medically necessary meaning your doctor must prescribe it as part of your treatment plan. Additionally the device must meet the criteria of being used in your home and ordered from a Medicare-approved supplier.

However don’t go rushing to your doctor just yet. Medicare may not cover 100% of the cost. There could be deductibles or payments involved depending on your specific plan. For those hoping Medicare will just hand out these lifts like candy… sorry that’s not how it works!

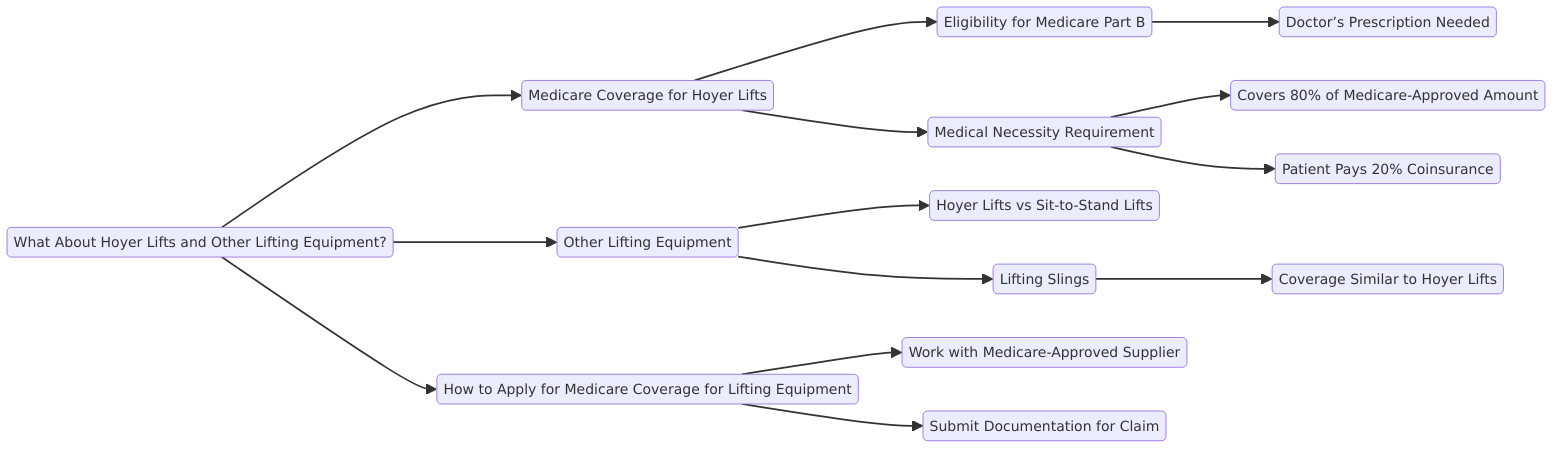

What About Hoyer Lifts and Other Lifting Equipment?

Similar to sit-to-stand lifts Medicare can cover Hoyer lifts too—but with the same requirements. The patient’s doctor needs to provide written consent stating that the equipment is medically necessary. If you think you can walk into a medical equipment store and leave with a shiny new Hoyer lift just by flashing your Medicare card think again. Documentation and proper process are key.

Who Qualifies for a Sit-to-Stand Lift?

Not everyone who gets a little wobbly while standing needs a sit-to-stand lift. Generally these lifts are intended for individuals with limited mobility who can still bear some weight on their legs. So if you or a loved one has knee support issues or bed transfers are becoming increasingly difficult a sit-to-stand lift could be the answer to your prayers.

Here’s a fun tip from Henry Beltran: “If you’re using more energy helping someone stand than you are actually doing your daily workout it’s probably time to look into a sit-to-stand lift.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

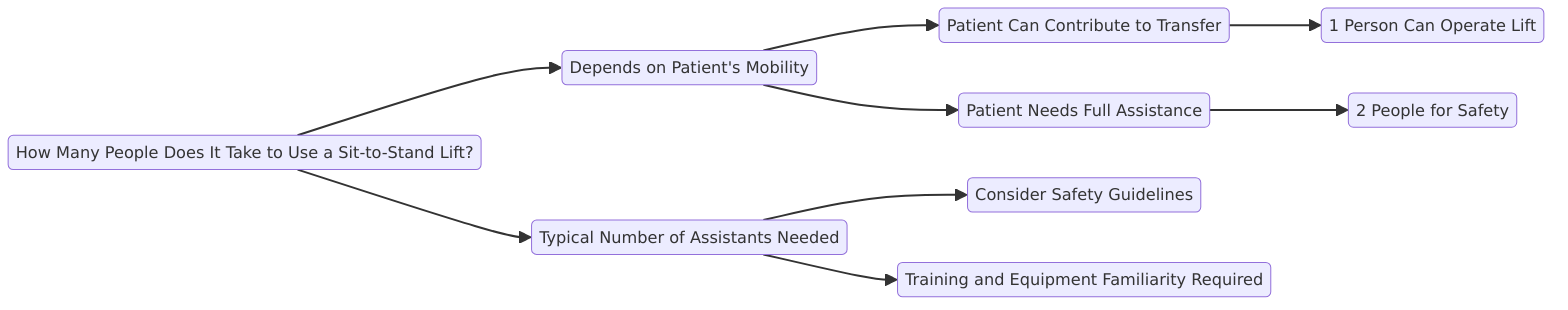

How Many People Does It Take to Use a Sit-to-Stand Lift?

Good news! In most cases a sit-to-stand lift only requires one caregiver to operate. However make sure to follow the manufacturer’s instructions as some devices may recommend having two people for safety—especially if the patient’s mobility is very limited.

Potential Drawbacks of Sit-to-Stand Lifts (With a Humorous Twist)

While sit-to-stand lifts are a game-changer for patient care they’re not without their quirks. Let’s take a look at some potential drawbacks—with a bit of humor because hey why not?

They’re Not Exactly Compact: These devices can be bulky so if you’re living in a cozy apartment that’s already packed with furniture adding a sit-to-stand lift might leave you feeling like you’re playing a game of real-life Tetris.

Assembly Required: Ever tried assembling IKEA furniture? Now imagine assembling a medical patient lift. It’s not the same thing but sometimes it feels just as complicated. Don’t worry though—many models come with easy-to-follow instructions. Just remember to read them (seriously).

Pricey But Worth It: Sure these lifts aren’t exactly cheap and even though Medicare coverage helps it won’t always cover the full cost. But hey you can’t really put a price on safety and avoiding back pain right?

Looks a Little “Medical”: Having a sit-to-stand lift in your living room might not exactly scream “modern décor.” But if you throw a blanket over it maybe no one will notice.

How to Get Medicare to Pay for Your Sit-to-Stand Lift

Let’s break it down step by step because navigating Medicare can feel like trying to solve a riddle inside a maze:

Visit Your Doctor: Make sure your doctor assesses your needs and provides a prescription for the sit-to-stand lift.

Choose an Approved Supplier: Make sure the supplier you choose is approved by Medicare or you’ll be stuck paying out of pocket.

Submit Your Claim: Once you’ve got the device work with your doctor and supplier to file the proper paperwork. Remember to cross your fingers and hope for speedy approval!

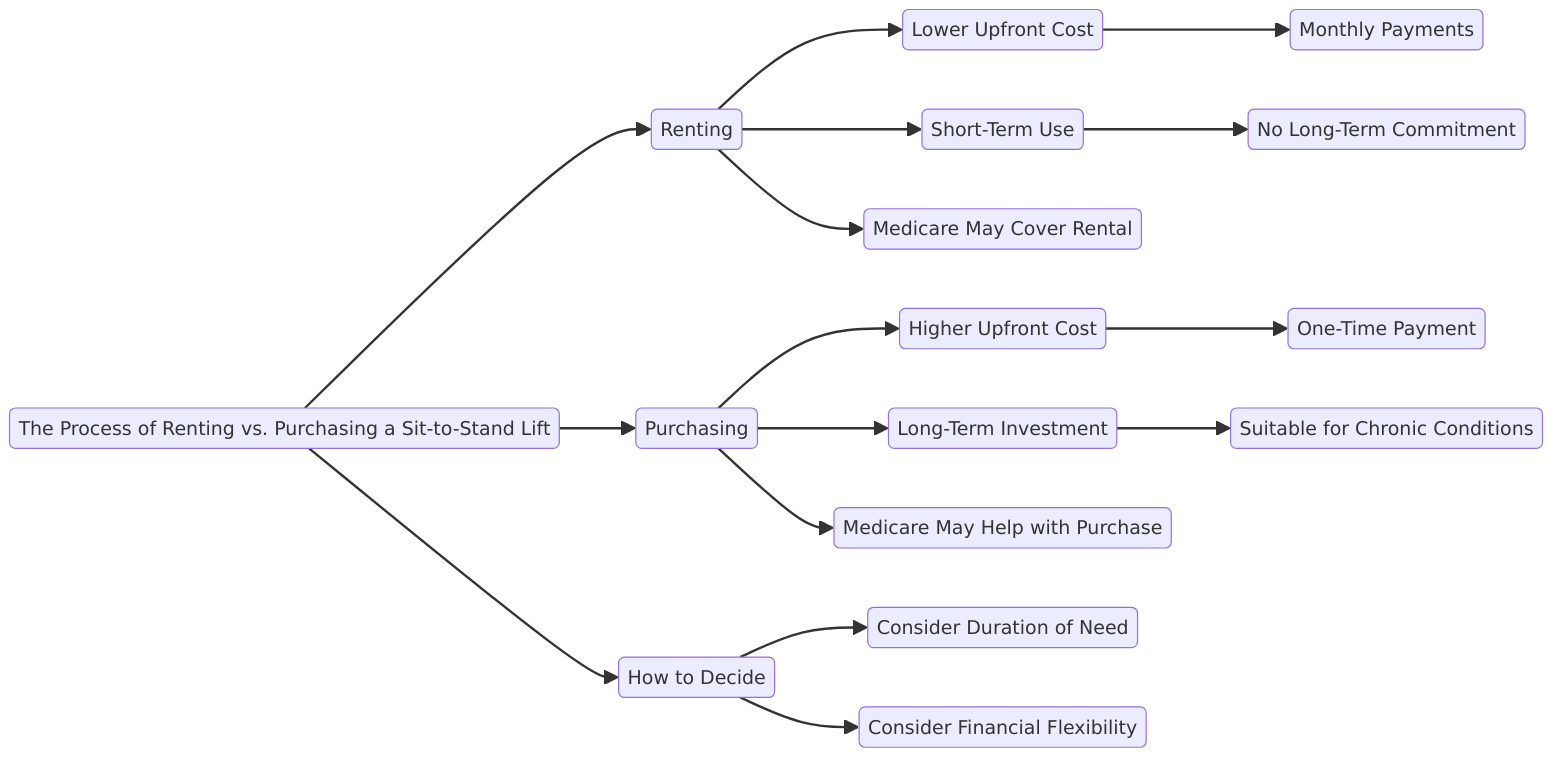

The Process of Renting vs. Purchasing a Sit-to-Stand Lift

You can either rent or purchase a sit-to-stand lift. If you plan to use it for a shorter time period renting might be the smarter move. But if you or a loved one will need the lift for the long haul purchasing is usually more cost-effective.

Rental Costs: Expect to pay a monthly fee.

Purchase Costs: A one-time payment with potential for partial Medicare benefits.

Maintenance: Don’t forget about upkeep! Just like any other piece of equipment your lift will need regular care.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

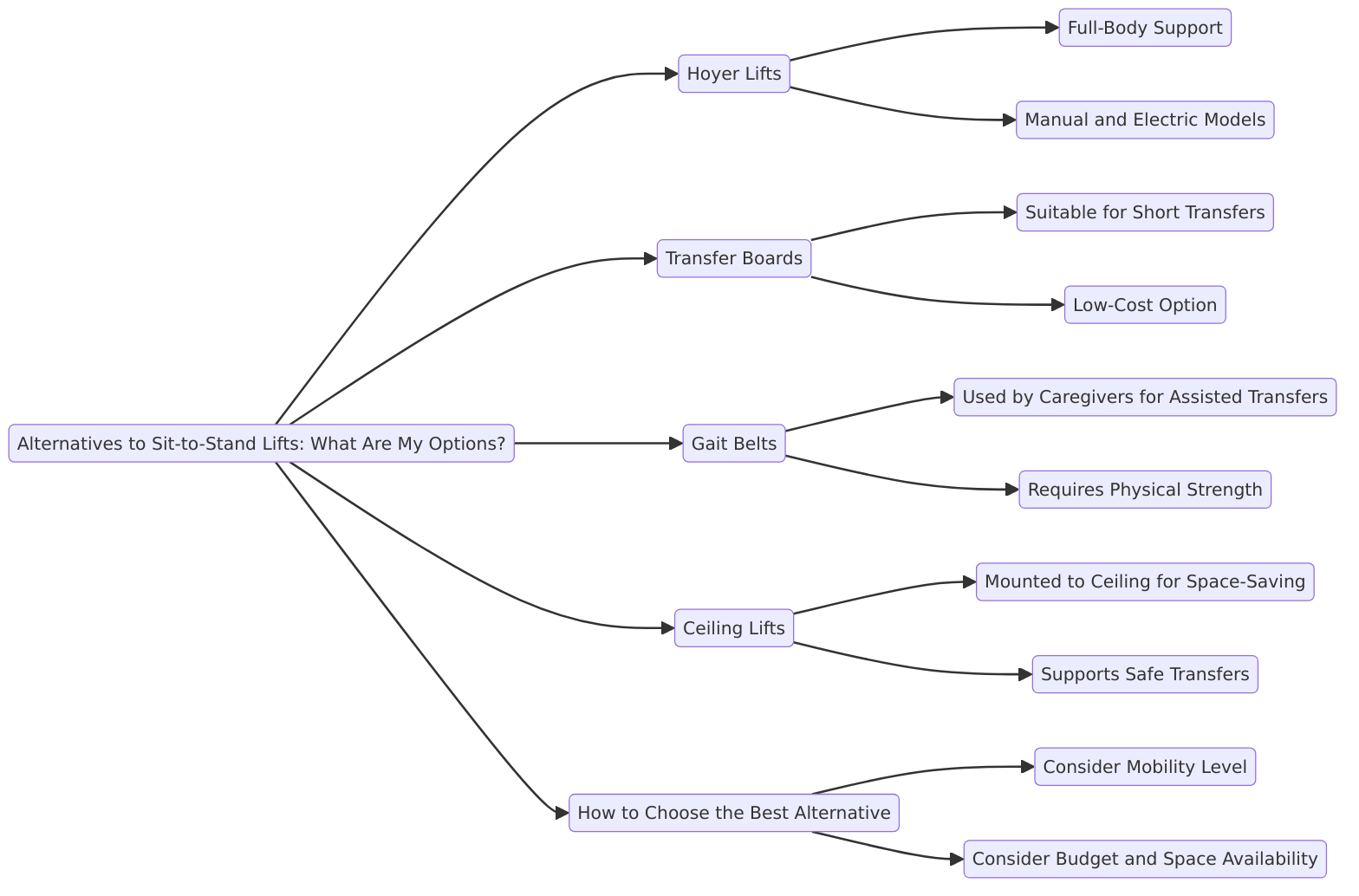

Alternatives to Sit-to-Stand Lifts: What Are My Options?

If a sit-to-stand lift doesn’t quite fit your needs (or your living room) you might want to consider other patient lifts. One popular option is the Sara Stedy which is like a more compact sit-to-stand lift. Some folks even say it’s easier to use—though sadly it’s not always Medicare covered.

You could also look into Hoyer lifts or even wheelchair lifts depending on your specific needs. Keep in mind that different patients require different types of assistance so always consult your healthcare provider for the best device for your situation.

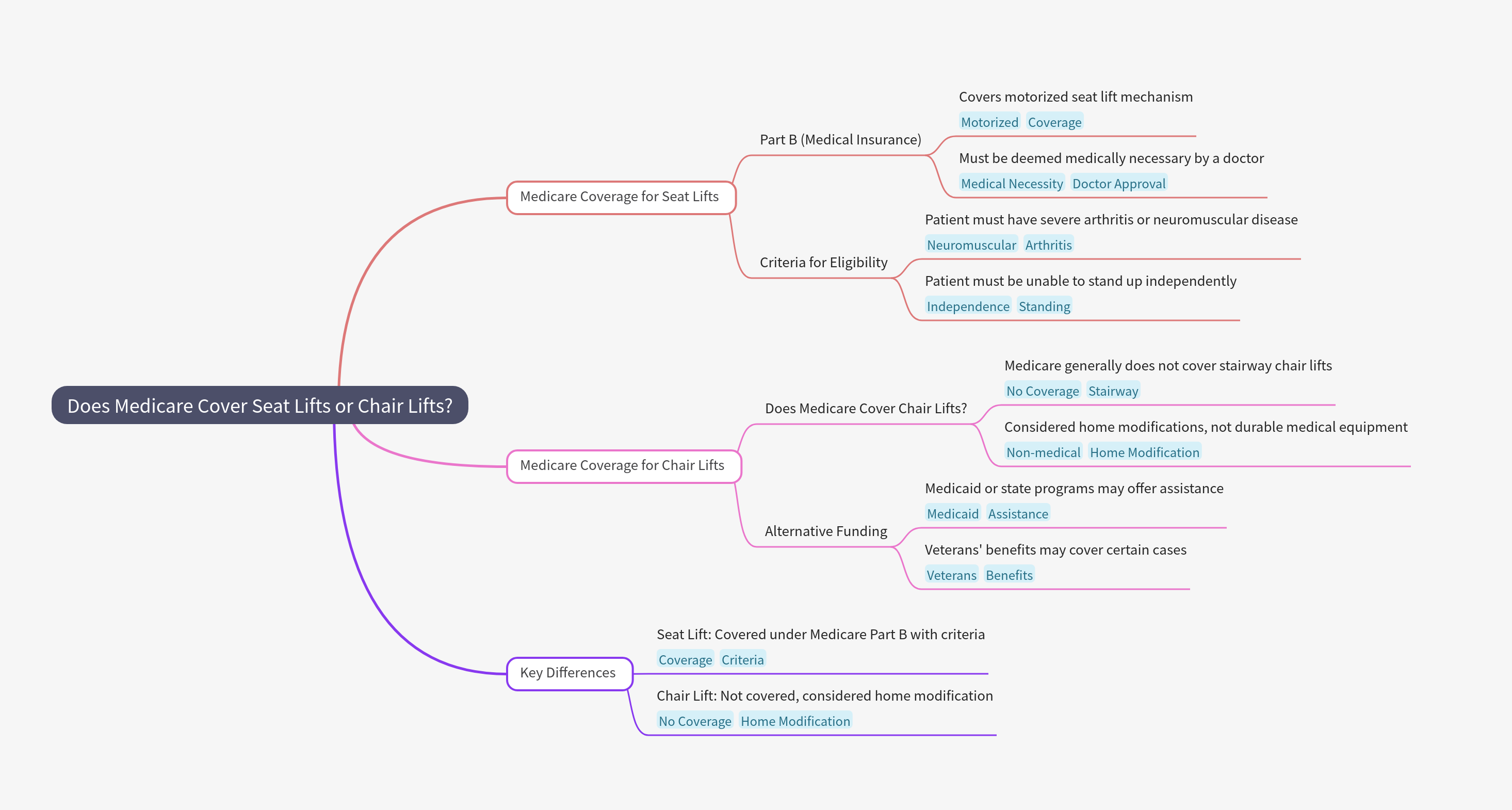

Does Medicare Cover Seat Lifts or Chair Lifts?

Medicare may also cover seat lifts or chair lifts but only if they are considered medically necessary. If you or a loved one is having difficulty transitioning from a seated to a standing position on a regular chair a chair lift may help—though it’s more commonly covered under Part B of Medicare.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Conclusion: Can You Stand It?

Sit-to-stand lifts are a fantastic solution for those who need a little extra help getting back on their feet—literally. While they come with a price tag Medicare benefits can significantly reduce your out-of-pocket costs. Just remember to talk to your doctor and choose an approved Medicare supplier to make the most of your coverage.

In the wise words of Henry Beltran: “When it comes to patient care it’s not about lifting the most weight but about making life easier and safer for everyone involved.”

So whether you’re considering a sit-to-stand lift for yourself or someone else the Medicare process doesn’t have to be as daunting as it seems. Now go stand tall (with a little help)!