Humana Medicare Advantage International Coverage: Your Cheat Sheet

Choosing a Medicare plan is a lot to take in. Whether you’re crossing state lines or thinking of taking a vacation out of the country, the fine print of your coverage feels like a spaceship manual. Don’t worry, you’re not alone in this rocket ship! I’ll break down the weirdness and wackiness of Humana Medicare Advantage and if it really covers you when you’re sipping espresso in Italy or stuck with a hospital bill in Paris.

Does Humana Medicare Advantage Cover International Travel?

Short answer? Maybe.

Here’s the thing: Medicare Advantage plans, including Humana Medicare Advantage, are private health plans that have to follow Medicare rules but have their own set of services and benefits. Most of these plans are designed for people living in the U.S. So if you’re traveling abroad, you might have some problems.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

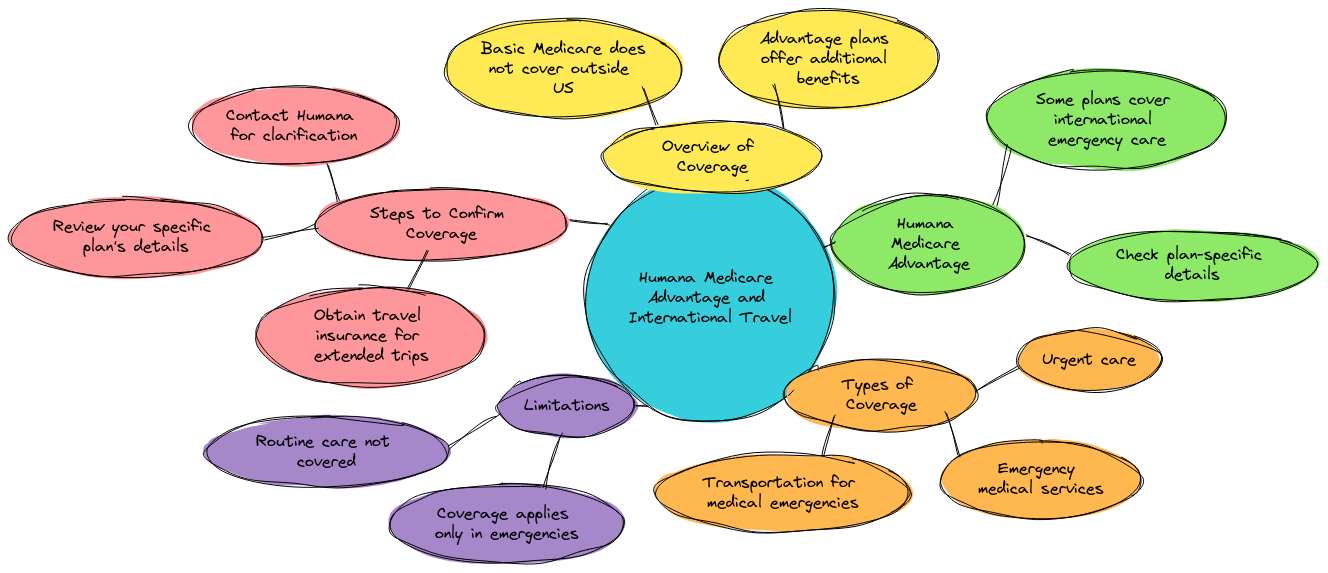

Humana Medicare Advantage International Coverage: What’s up?

Humana Medicare Advantage doesn’t cover international coverage except in emergency situations. In other words, if you get sick while hiking in the Swiss Alps, your plan will pay the hospital bills, but don’t expect it to cover routine care abroad.

As Henry Beltran, owner of Medicare Advisors Insurance Group LLC says, “Humana Medicare Advantage is great for domestic coverage, but when it comes to international travel, you need a backup plan.”

In those rare cases where coverage applies, you might still have to pay some of the costs upfront before filing for reimbursement. Talk about a buzzkill on your European adventure!

Does United Healthcare Medicare Advantage Cover Out of Country?

United Healthcare Medicare Advantage is similar. Like Humana, it may offer limited emergency coverage outside the U.S., but it’s not full coverage. Medicare Advantage plans are designed to keep you safe and sound in the U.S. So, if you’re thinking of cruising around the world, get an international health insurance policy to fill in the gaps.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Humana Medicare and Travel Within the U.S.

If you’re staying within the United States, including the District of Columbia, you’re in good shape. Humana Medicare Advantage covers the entire country, but the network may vary by state. One state may have better options than others when it comes to doctors and hospitals. So, yes, you can road trip across state lines with confidence, but just check your doctors are in-network.

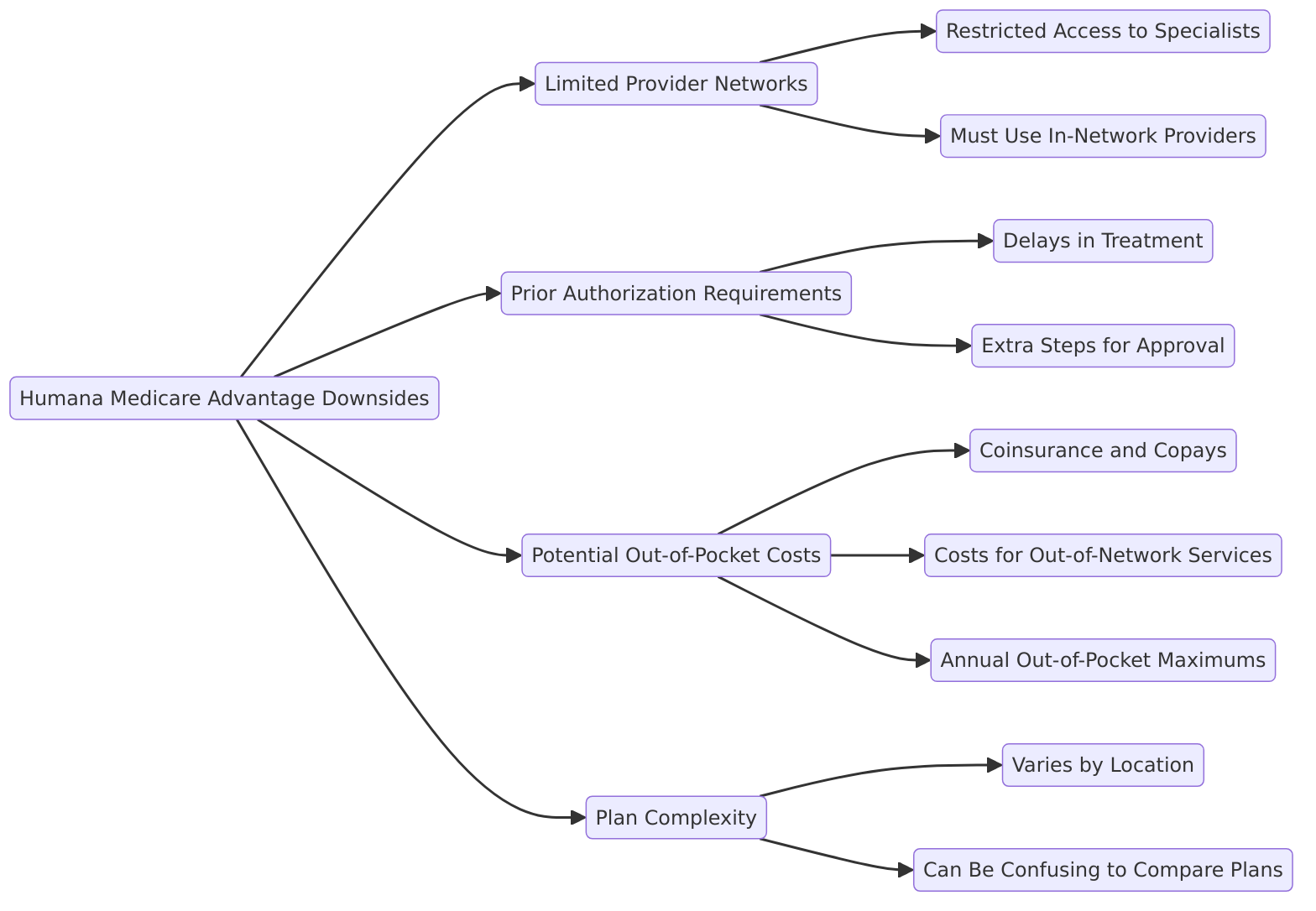

Humana Medicare Advantage Downsides

Okay, now let’s add some humor to this. Choosing a Medicare Advantage plan is like buying a car. Sure, it’s shiny and looks great in the showroom, but when you’re halfway through your trip, you realize the car has no cupholders, and the radio only picks up one station.

Limited International Coverage

Want to know the first drawback? It’s the same one I’ve been talking about. If you’re a world traveler, this plan feels like a car that only drives on one continent. Humana Medicare Advantage’s limited international coverage means you’ll likely need additional insurance when you’re traveling overseas.

Network Restrictions

This plan is like having a GPS that only works in certain states. While Humana Medicare Advantage covers you all over the country, your doctor network may change from state to state. If you’re not in-network during your travels, you’ll pay out of pocket for some of your healthcare needs.

Out-of-Pocket Costs

This is like buying a car that looks affordable, but you realize later you have to pay extra for the steering wheel and gas pedal! While the Medicare Advantage plan may have lower premiums, it can come with sneaky out-of-pocket costs, like deductibles, copays, or coinsurance. So, before you hit the road or the sky, make sure to read the fine print.

Do You Need a Separate International Health Insurance Plan?

If you’re a frequent flyer abroad, it’s worth getting an international health insurance plan. Think of it as an extra set of keys, just in case your regular coverage leaves you stranded. These plans cover both emergency medical expenses and routine healthcare services when you’re out of the country.

Here’s a Quick Checklist:

Humana Medicare Advantage may cover emergencies outside the U.S.

Routine care, like checkups or planned surgeries abroad, are not covered.

You’ll pay upfront and get reimbursed later.

International health insurance plans fill in the gaps for your globe-trotting lifestyle.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Choosing Wisely for Your Health and Pocketbook

As Henry Beltran says, “Medicare is meant to give you peace of mind, but sometimes you need to layer in a little extra coverage for best results.”

Whether you stay at home or travel the world, you need to understand how your coverage works and where it falls short. Make sure to gather all the information about your specific plan so you can make the best decision. Here are the main points:

Domestic Coverage

Humana Medicare Advantage covers you across the U.S., including the District of Columbia, but check for in-network providers before you travel.

International Travel

You’ll want to get a separate international health insurance plan. Humana Medicare Advantage may help in some emergency cases, but that’s not guaranteed.

Out-of-Pocket Costs

Keep an eye on those deductibles and copays—they can sneak up on you like hidden tolls on a road trip.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Q&A

Can I Use Humana Medicare Advantage Internationally?

Only in emergencies, and even then it’s limited.

Does Medicare Pay for Travel Expenses?

No. Medicare doesn’t cover travel expenses for treatment unless you’re in extreme situations.

Should I Bring My Medicare Card When I Travel?

Yes, but it’s also smart to carry an international health insurance card.

Does Humana Medicare Advantage Cover Endoscopies?

Yes, if you’re in-network and in the state of coverage.

So, Humana Medicare Advantage is like a reliable car for your daily commute within the country, but for international trips, you want a car with more horsepower. Get all the details of what your plan covers and doesn’t cover, and always have a backup plan before you hit the road or the skies!

In addition, make sure to check how your plan will treat various services, especially if you’re traveling within different regions, including states and the District of Columbia.