Dale, 45, was aware that there was a three-month waiting period before he was qualified to join his new employer’s health plan when he left his job to accept a new one. Debra, a 62-year-old acquaintance of his, lost her work around the same time and would soon no longer have insurance for herself and her spouse.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Fortunately, COBRA, officially known as the Consolidated Omnibus Reconciliation Act, allows Dale and Debra to both continue on their employer-sponsored health insurance. A federal legislation known as COBRA was enacted thirty years ago to provide families with insurance protection in between jobs. It is eligible if your company employs 20 or more people and you are currently a member of an employer-sponsored medical, dental, or vision plan. Your COBRA coverage may also extend to your spouse, civil union partner, and dependents.

Before registering for COBRA benefits, consider the following 5 questions:

1. What is my deadline to enroll in COBRA?

Your employer must provide COBRA information to you within 44 days after the later of your last day of employment or your last day of insurance coverage. However, it’s a wise move to speak with your benefits manager a few weeks after you depart.

Once your benefits expire, you’ll have 60 days to sign up for COBRA or another health plan. However, bear in mind that delaying enrollment won’t result in cost savings. You must pay your rates for the entire COBRA time because it always goes back to the day your prior coverage ended. One benefit of signing up right away is that your coverage won’t lapse as you continue to visit doctors and fill prescriptions.

You are able to preserve all of your prior benefits through COBRA. Your plan cannot be altered at this time. However, if you’re still enrolled in COBRA at the time of the subsequent open enrollment, you can select another plan from those that your previous employer provides to its employees. The new strategy shall go into action on January 1st.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

2. How much does COBRA cost?

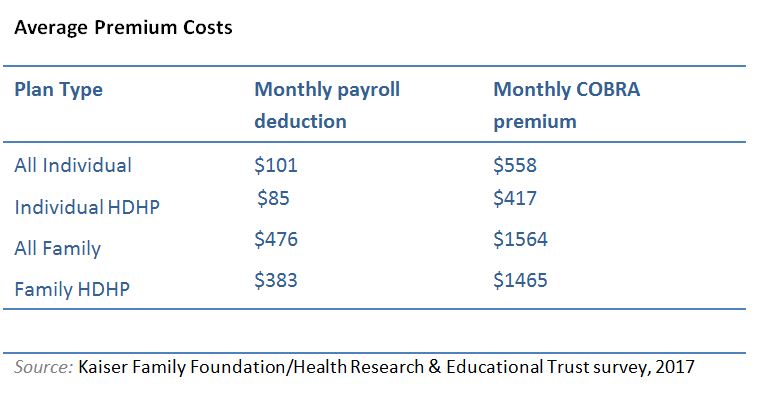

The majority of employers cover the costs of their employees’ health plans, with the remainder being deducted from your wages. Workers typically pay 30% of the family premium and 20% of the individual premium. Your monthly COBRA payment may be five times more than your payroll deduction because you will be responsible for paying the entire premium amount under COBRA.

Despite the fact that it may seem expensive, COBRA rates are typically less than what you’d pay on the open market because you still get the group discount from your employer.

You may use the money in your health savings account (HSA) to cover your COBRA premiums. (Typically, insurance premiums are not a qualified medical expense under the HSA.)

You have the option to change to a less expensive plan during the subsequent open enrollment period. For single and family coverage, high-deductible health plans (HDHP) have significantly cheaper premiums than other types of plans.

3. How long will my COBRA coverage last?

Despite the short duration of COBRA, you will have time to select a different plan. Federal coverage lasts for 18 months, beginning with the termination of your prior benefits. Some states offer 36 months of medical coverage, but not always dental or vision. To find out if your state offers COBRA benefits, speak with your benefits manager.

While COBRA does not have a lifetime cap, some benefits do. You are qualified for the same benefits for the same duration each time you enroll.

4. What are the alternatives to COBRA when I leave my job?

If you lose your employer-sponsored insurance plan, COBRA isn’t your only choice. Depending on your circumstances, you can be eligible for additional health benefits:

- Join the employer-sponsored plan of your spouse or partner. You can enrol in your spouse’s or partner’s plan during an unique enrollment period that is triggered by leaving your work. Your job loss enables you both to enrol outside of the typical open enrollment period within 30 days, even if your spouse isn’t currently enrolled in their employer’s plan. Learn how qualifying life events, such as getting married or having a child, affect your access to health care.

- Select a plan using healthcare.gov‘s health insurance marketplace. If you have a qualifying life event, such as quitting your work, you don’t have to wait until Open Enrollment in the autumn. Your benefits will begin on the first day of the month following the loss of your insurance, and you have 60 days to select a plan.

- Join a trade or professional group insurance plan. National associations that provide benefits for independent workers, such as the National Association for the Self-Employed ($120/year membership fee; NASE.org), or the Freelancers Union, may be able to help you find plans with reduced premiums (free membership; freelancersunion.org). A self-employed status declaration is not necessary.

- The Children’s Health Insurance Program may be available to families with low and moderate incomes (CHIP). If your income is too high to be covered by Medicaid, CHIP, which is jointly supported by the federal and state governments, may be able to help you provide your children with affordable coverage. More details are available at healthcare.gov.

- Find out about additional health insurance options if you’re 65 or older.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

5. What happens when my COBRA coverage runs out?

Choose one of the options above if, after your COBRA ends, you haven’t secured a new job with coverage. You prevent any coverage gaps, make sure to comparison-shop in advance.

Dale and Debra may now choose the best health care options for them by properly analysing COBRA benefits. They’ll have one less item to worry about, allowing them to concentrate on the upcoming changes in their lives.

About the author

New Jersey native Christina Joseph Robinson, a seasoned editor and writer, nevertheless enjoys reading traditional newspapers. To counteract all the delicacies Grandma provides, she is raising two girls who enjoy eating fruits and vegetables. Christina wants to get back into shape after being hampered by injuries.