Knowing what is the best Medicare supplement insurance plan is critical when choosing your health insurance plan

Nowadays, most people choose to purchase Medicare Supplement Insurance plans from a private insurer to fill Medicare’s gaps. Of course, you’re skeptical about investing more money in any other plans. Is Medigap Policy worth it? Is Medigap Policy right for you? – To make the right decision, you must know all about this plan, understand the benefits, and determine your budget first. So, what is the best Medicare Supplement Insurance Plan?! Let’s get started!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Is Medicare Supplement the same as Medigap?

The terms Medicare Supplement and Medigap are used interchangeably because they are both used for the same health insurance plan. Any Medicare-certified company or center uses both terms to refer to this plan. The term “Medigap” is used more often because it is a bit shorter. So, what is the explanation of the names? – Medigap is the plan that fills the “gaps” that Original Medicare doesn’t cover. As for Medicare Supplement, it is the plan that “supplements” Original Medicare, covering Medicare’s out-of-pocket expenses. No need to be confused!

what are Medicare supplement benefits?

As we stated before, Medicare Supplement Plans pay for out-of-pocket costs that aren’t covered by Medicare A & B. Yes, Original Medicare has extensive coverage, but not all the health care services and supplies. Here comes the role of the Medicare Supplement Plan that covers the remaining costs, including copayments, deductibles, and coinsurance. The great thing about this plan is that it covers medical services when you travel outside of the U.S, unlike Original Medicare. However, it doesn’t cover prescriptions. You need to enroll in a stand-alone Medicare Part D drug plan for prescriptions.

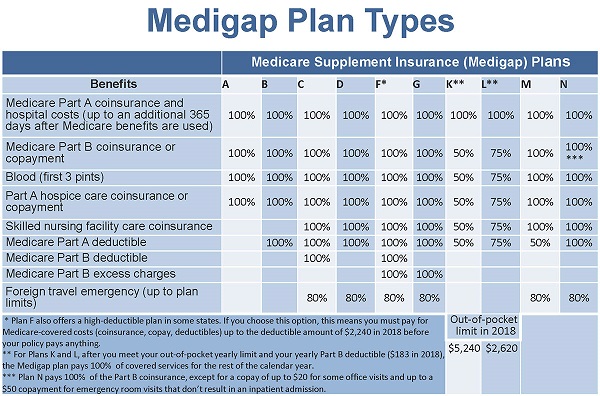

In most states, there are 10 Medigap basic plans, which are A, B, C, D, F, G, K, L, M, and N benefits. Make sure to differentiate between Medicare Part A and Medigap Plan A. The plans E, H, I, and J are no longer available to sign up for. You must choose a health insurer with a good reputation and ask for different prices before you make a purchase.

Things you should know about Medigap policies:

- You must have Original Medicare (Part A & B)

- Medigap only supplements what isn’t covered by Original Medicare benefits

- Medigap isn’t a plan to get Medicare benefits

- Medigap plan covers only one person. If you and your spouse need this coverage, you will have to purchase two separate policies

- You can get this plan at any licensed insurance company in your state or area

- As long as you pay the premium, the insurance company can’t cancel your plan

- The insurance company can’t sell you a Medigap plan if you have Medicare Advantage Plan. It is legal only if you’re getting back to Original Medicare

Read More: Medicare Supplemental Plan?

Benefits that some Medicare Supplement insurance plans may cover

All Medicare Supplement Plans offer basic health care benefits, including the following:

-

Part A & B deductibles

It covers a combination of Part A & B deductibles, including Part B excess charges, foreign travel emergencies, and Part A SNF coinsurance (Skilled Nursing Facility).

-

Part A hospital coinsurance

It covers 100% of Medicare Part A hospital coinsurance with the addition of extra 365 days after Medicare benefits run out.

-

Part A hospice coinsurance

It covers 100% of Medicare Part A hospice coinsurance. However, plan K covers only 50% and plan L covers only 75% of hospice coinsurance.

-

First 3 pints of blood

It covers 100% of the first three pints of blood each year. However, plan K covers only 50% and plan L covers only 75%.

-

Part B coinsurance

It covers 100% of Medicare Part B coinsurance or copayments. However, plan K covers only 50% and plan L covers only 75%.

Medigap policies don’t cover the following:

- Long-term care

- Vision care

- Dental care

- Hearing aids

- Long-term care (Outside of the U.S)

- Eyeglasses

- Private nursing

- Part A & B deductibles

- Medicare Part B copayments and coinsurance

- Prescription drugs

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Read More : Dental Insurance Plan?

What are the different Medicare supplement plans?

Many private health care insurers offer 10 different Supplement Plans which are A, B, C, D, F, G, K, L, M, and N. Here is a comparison between the plans, presenting basic benefits of each policy:Medigap Plan A Coverage

- Covers Part A coinsurance and hospital expenses with additional 365 days after Medicare benefits run out

- Covers Part B coinsurance or copayment

- Covers Blood (first 3 pints)

- Covers Part A hospice care coinsurance or copayment

- Doesn’t cover Part A deductible

- Doesn’t cover Part B deductible

- Doesn’t cover Part B excess charge

- Doesn’t cover foreign travel exchange

- No out-of-pocket limit

| Medigap Benefits | Medigap Plans | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| A | B | C | D | F* | G* | K | L | M | N | |

| Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Part B coinsurance or copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes*** |

| Blood (first 3 pints) | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Part A hospice care coinsurance or copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Skilled nursing facility care coinsurance | No | No | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Part A deductible | No | Yes | Yes | Yes | Yes | Yes | 50% | 75% | 50% | Yes |

| Part B deductible | No | No | Yes | No | Yes | No | No | No | No | No |

|

Part B ** |

N/A | N/A | N/A | N/A | N/A | N/A | $5,880 in 2020 ($6,220 in 2021) | $2,940 in 2020 ($3,110 in 2021) | N/A | N/A |

Medigap Plan B Coverage

- Covers Part A coinsurance and hospital expenses with additional 365 days after Medicare benefits run out

- Covers Part B coinsurance or copayment

- Covers Blood (first 3 pints)

- Covers Part A hospice care coinsurance or copayment

- Covers Part A deductible

- Doesn’t cover Part B deductible

- Doesn’t cover Part B excess charge

- Doesn’t cover foreign travel exchange

- No out-of-pocket limit

Read More: Medicare Advantage Plan (Part C)

Medigap Plan C Coverage

- Covers Part A coinsurance and hospital expenses with additional 365 days after Medicare benefits run out

- Covers Part B coinsurance or copayment

- Covers Blood (first 3 pints)

- Covers Part A hospice care coinsurance or copayment

- Covers skilled nursing facility care coinsurance

- Covers Part A deductible

- Covers Part B deductible

- Doesn’t cover Part B excess charge

- Covers 80% of foreign travel exchange

- No out-of-pocket limit

Medigap Plan D Coverage

- Covers Part A coinsurance and hospital expenses with additional 365 days after Medicare benefits run out

- Covers Part B coinsurance or copayment

- Covers Blood (first 3 pints)

- Covers Part A hospice care coinsurance or copayment

- Covers skilled nursing facility care coinsurance

- Covers Part A deductible

- Doesn’t cover Part B deductible

- Doesn’t cover Part B excess charge

- Covers 80% of foreign travel exchange

- No out-of-pocket limit

Medigap Plan F Coverage

- Covers Part A coinsurance and hospital expenses with additional 365 days after Medicare benefits run out

- Covers Part B coinsurance or copayment

- Covers Blood (first 3 pints)

- Covers Part A hospice care coinsurance or copayment

- Covers skilled nursing facility care coinsurance

- Covers Part A deductible

- Cover Part B deductible

- Covers Part B excess charge

- Covers 80% of foreign travel exchange

- No out-of-pocket limit

Medigap Plan G Coverage

- Covers Part A coinsurance and hospital expenses with additional 365 days after Medicare benefits run out

- Covers Part B coinsurance or copayment

- Covers Blood (first 3 pints)

- Covers Part A hospice care coinsurance or copayment

- Covers skilled nursing facility care coinsurance

- Covers Part A deductible

- Doesn’t cover Part B deductible

- Covers Part B excess charge

- Covers 80% of foreign travel exchange

- No out-of-pocket limit

Medigap Plan K Coverage

- Covers Part A coinsurance and hospital expenses with additional 365 days after Medicare benefits run out

- Covers 50% of Part B coinsurance or copayment

- Covers 50% of Blood (first 3 pints)

- Covers 50% of Part A hospice care coinsurance or copayment

- Covers 50% of skilled nursing facility care coinsurance

- Covers 50% of Part A deductible

- Doesn’t cover Part B deductible

- Doesn’t cover Part B excess charge

- Doesn’t cover foreign travel exchange

- $6, 220 out-of-pocket limit in 2021

Medigap Plan L Coverage

- Covers Part A coinsurance and hospital expenses with additional 365 days after Medicare benefits run out

- Covers 75% of Part B coinsurance or copayment

- Covers 75% of Blood (first 3 pints)

- Covers 75% of Part A hospice care coinsurance or copayment

- Covers 75% of skilled nursing facility care coinsurance

- Covers 75% of Part A deductible

- Doesn’t cover Part B deductible

- Doesn’t cover Part B excess charge

- Doesn’t cover foreign travel exchange

- $3, 110 out-of-pocket limit in 2021

Medigap Plan M Coverage

- Covers Part A coinsurance and hospital expenses with additional 365 days after Medicare benefits run out

- Covers Part B coinsurance or copayment

- Covers Blood (first 3 pints)

- Covers Part A hospice care coinsurance or copayment

- Covers skilled nursing facility care coinsurance

- Covers 50% of Part A deductible

- Doesn’t cover Part B deductible

- Doesn’t cover Part B excess charge

- Covers 80% of foreign travel exchange

- No out-of-pocket limit

Medigap Plan N Coverage

- Covers Part A coinsurance and hospital expenses with additional 365 days after Medicare benefits run out

- Covers Part B coinsurance or copayment

- Covers Blood (first 3 pints)

- Covers Part A hospice care coinsurance or copayment

- Covers skilled nursing facility care coinsurance

- Covers 50% of Part A deductible

- Doesn’t cover Part B deductible

- Doesn’t cover Part B excess charge

- Covers 80% of foreign travel exchange

- No out-of-pocket limit

You are probably asking

are Medicare supplement plans worth it?

Around 14.1 million people decide to purchase Medicare Supplement Plans. But, are they worth it? – If you can’t afford the large out-of-pocket expenses, then, yes it is totally worth it. A Medigap policy is a wise investment that protects you and your family from the high medical expenses.

Besides, it will be highly effective if you suffer from a chronic disease or a health emergency, saving a large amount of money. In this case, A Medigap Plan will be the savior from a huge financial risk that you can’t afford. Just remember that Medigap Plans don’t cover prescription drugs. You will have to purchase a stand-alone Medicare Plan D with monthly premiums.

How to buy a Medigap policy or Medicare Supplement plan?

- Compare between the benefits of the different Medigap plans, considering your health condition.

- Select the policy that meets your future health care needs (You may not be able to switch to a different policy later)

- Search online for the private health insurance companies

- You can call State Health Insurance Assistance Program and they will help you choose the most suitable plan for free

- Call the State Insurance Department to know if there are any complaints against the chosen company

- Choose the insurance company and fill out the application

- Answer the Medical questions, which identify your eligibility for Open Enrollment or Guaranteed Issue Rights

- If you purchase the Medigap Policy during Medigap Open Enrollment Period, the insurance company can’t cancel the plan or change the price

- If you provide evidence that you’re qualified for Guaranteed Issue Rights, the insurance company can’t cancel the plan or change the price

- Pay for the chosen policy by check, bank draft, or money order.

- The Medigap policy starts automatically on the first of the month after your application

If 60 days have passed after your application and you haven’t received your benefits yet, call your State Insurance Department

Choose and decide Medicare Supplement plan that fits you:

Choose the most suitable plan according to your health needs and of course, your budget

Enroll during the Medigap Open Enrollment Period

Search if any insurance company offers discounts

You will have guaranteed-issue rights one time only during the Medigap Open Enrollment period

How much do Medigap policies cost?

In 2021, the Medigap premium may vary from $51 to $650 per month and this price depends on age, gender, location, deductible amounts, and more. Each insurance company has its own prices, but generally according to main three ways:

Community-rated: The Same rate for everyone, whatever the age

Issue-age rated: The monthly premium depends on your age at the issuance time of the policy. The prices are cheaper when purchasing at a young age and don’t increase over the time

Attained-age rated: The monthly premiums depends on your current age and increases over the time.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

FAQs

What is the average cost of supplemental insurance for Medicare?

In 2021, the Medigap premium may vary from $51 to $650 per month and this price depends on age, gender, location, deductible amounts, and more.

What are the top 5 Medicare supplement plans?

According to different studies, the top 5 Medicare Supplement Plans will be F, G, N, C, and high deductible Plan F.

What is the best supplemental insurance for seniors?

Plan G is the best supplemental insurance. On the other hand, Plan K is the cheapest provided supplemental plan. Plan F was the best overall plan before 2020.

Is AARP supplemental insurance any good?

Yes, AARP Supplemental Insurance Plans are great with a high rating for services, financial strength, and customer experience.

How much is AARP Medicare supplemental insurance?

To be eligible for AARP Supplemental Insurance Policy, you must pay $16 per year for the membership.

Contact us now!

Over the years, medical care expenses can be a burden that you can’t afford. Using Medicare Plans can give you some peace of mind, especially with the addition of Medigap benefits. Not sure which Medigap policy is suitable for you? Whether you’re choosing a Medicare plan for the first time or thinking about adding a Medigap policy, we’ve got your back. Don’t hesitate, call us now, and let us help you choose the most suitable plan.