Preparing for your 2025 Molina Medicare exam? You’re in the right place! Whether you’re a new agent or an experienced one looking to brush up on your Medicare knowledge understanding what to expect can give you the edge you need. But before diving into the content, let’s break things down in an easy-to-digest way—mistakes and all—because hey, we’re only human!

Henry Beltran, owner of Medicare Advisors Insurance Group LLC, puts it like this: “Studying for the Medicare exam isn’t rocket science, but it sure does feel like it sometimes. You’ve got to be ready for curveballs.”

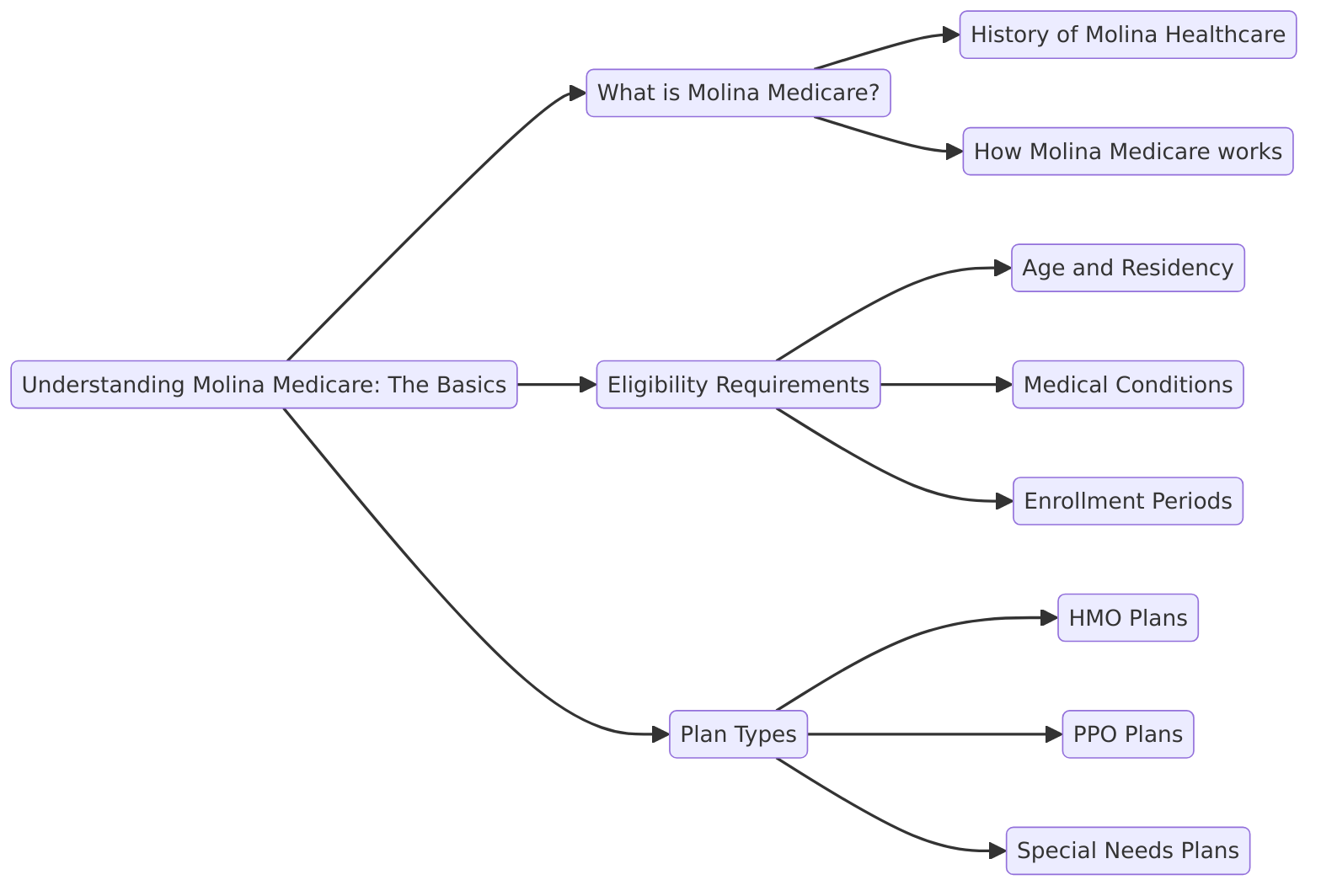

Understanding Molina Medicare: The Basics

Molina Healthcare is one of the leading providers of Medicare plans in the U.S. offering a variety of Medicare Advantage Plans for beneficiaries. Before taking the 2025 exam, you’ll need to know the ins and outs of how Molina structures its offerings.

- Medicare Advantage Plans (Part C): These include medical and prescription drug coverage all in one plan, kind of like bundling your TV internet and phone services, except you know—way more important.

- Medicare-Medicaid Plans (MMPs): For individuals eligible for both programs.

Why Is the Exam So Important?

The 2025 Molina Medicare exam ensures agents stay compliant with all federal and Molina-specific guidelines. Passing this test allows you to sell Molina Medicare products confidently and legally. It also means you’re up to date on the latest regulations, so you’re not leading clients astray (nobody wants to mess up grandma’s healthcare!).

Key Sections to Study for the Molina Medicare Exam

To pass the 2025 Molina Medicare exam, here’s what you should really focus on. But remember nobody’s perfect—and there’s no penalty for taking a coffee break or three while studying.

Medicare Advantage Plan Basics

Understanding the fundamentals is crucial. The exam will cover:

- Eligibility requirements: Who can sign up for Molina’s Medicare plans?

- Enrollment periods: When can beneficiaries join or change plans? This stuff is always tricky. Make sure you know your dates or you’ll end up giving your client the wrong info and…oops.

- Benefits and coverage: What does Molina’s Medicare Advantage cover? Medical vision dental—oh, and hearing. Basically all the things we wish our car insurance covered too.

Pitfall to Avoid: Forgetting Enrollment Deadlines

You’ve gotta know your dates—especially Annual Enrollment Period (AEP) and Initial Enrollment Period (IEP). Mixing them up might make you look like you slept through the calendar lesson in school. “Agents who can’t keep up with these dates are just asking for trouble,” says Henry Beltran. And trust me missing those dates is like showing up to the DMV with no appointment.

Compliance Guidelines

The Molina Medicare exam will drill you on federal and state regulations that impact Medicare. You might feel like a lawyer studying for this one but hey no lawsuit’s involved here!

- HIPAA: Understanding privacy rules. You don’t want to be the agent who accidentally emails client info to the wrong Henry in your contacts.

- Marketing Guidelines: Knowing how to present plans legally is key. The last thing you want is to promise the moon and stars—only to get clients stuck with a bunch of hospital bills instead. That’s not a way to keep a good review!

Pitfall to Avoid: Misunderstanding Compliance Rules

Compliance rules can feel like trying to dance a waltz in clown shoes—awkward at best. But these are vital. If you mess up here you’ll not just lose a sale but maybe your license.

Special Needs Plans (SNPs)

Special Needs Plans are tailored for individuals with specific diseases or characteristics. There’s quite a bit to memorize here and it’s easy to feel overwhelmed.

- Dual-Eligible SNPs (D-SNPs): For those eligible for both Medicare and Medicaid.

- Chronic Condition SNPs (C-SNPs): Designed for folks with chronic conditions like diabetes or heart disease.

- Institutional SNPs (I-SNPs): For individuals in institutions such as nursing homes.

Pitfall to Avoid: Forgetting SNP Criteria

The exam might throw you a curveball and ask for exact qualifications for an SNP. Missing this one is like knowing how to drive but forgetting where the ignition key goes.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Sample Exam Questions for the Molina Medicare Exam

Getting a feel for the type of questions you’ll encounter can really help ease the anxiety. Here are a few example questions you might face:

- What are the differences between Medicare Advantage Plans and Medicare Supplements?

- How do Medicare Advantage Special Needs Plans differ from traditional Medicare Advantage Plans?

- When can a person enroll in a Medicare Advantage plan? (Pro tip: Have your AEP dates ready!)

Tips for Answering the Questions

- Read the question carefully: This seems obvious but trust me you’ll be kicking yourself if you miss an easy one because you skimmed.

- Eliminate the obviously wrong answers: Some options will be as out of place as a cactus in a rainforest.

- Practice makes perfect: Answering sample questions will help build confidence.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Potential Drawbacks of Molina Medicare Plans

While we’re here to help you ace your exam, it’s also important to remember that every Medicare plan, including Molina’s, has its cons—like a car that’s missing cup holders. These drawbacks might not come up on your exam but they could in your real-world conversations with clients.

High Out-of-Pocket Costs

Molina plans often come with low or zero premiums, which sounds fantastic. But beware—high out-of-pocket costs can sneak up like your electric bill after a long summer of blasting the AC.

Drawback: “It’s like buying a sports car with no trunk space,” says Henry Beltran. “Sure it’s fun to drive but good luck taking it on a road trip.”

Limited Network of Providers

Molina Medicare plans have a limited network of doctors and hospitals. If your client loves their current doctor but their doc isn’t in the network? Well, good luck.

Drawback: It’s like buying a Ferrari and then realizing there are no mechanics in your town who know how to fix it. Cool car though.

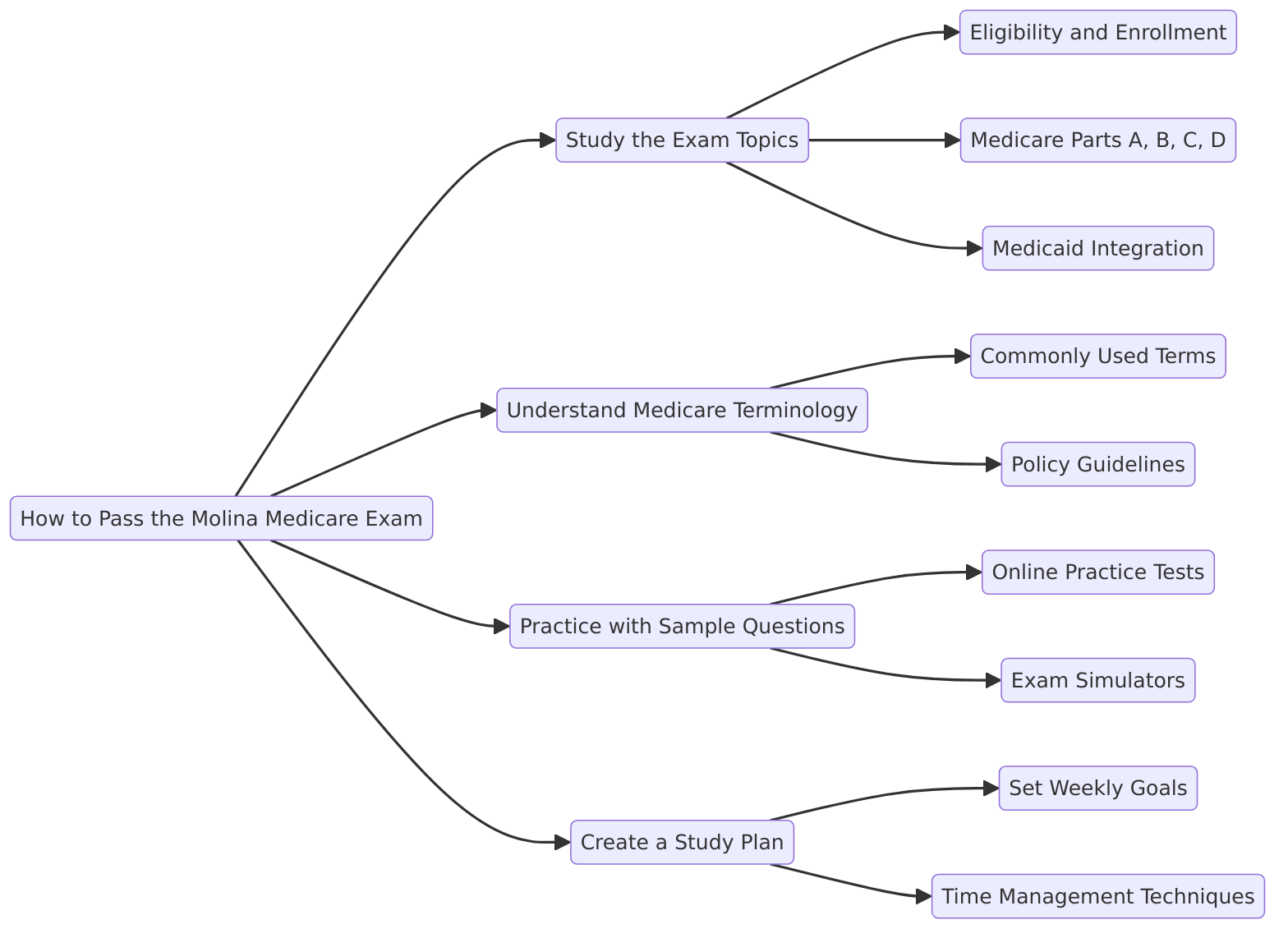

How to Pass the Molina Medicare Exam

To pass this exam you’ll need preparation patience and a whole lot of coffee. Follow these tips:

- Study daily: Cramming the night before never worked for anyone. Take it one bite-sized chapter at a time.

- Take practice exams: There are plenty of free resources out there.

- Ask questions: If you’re stuck reach out to other agents or find a study group.

Henry Beltran has this to say about exam prep: “The key is to pace yourself. No one expects you to be a Medicare encyclopedia overnight.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Final Thoughts

Passing the 2025 Molina Medicare exam is totally achievable if you study and prepare correctly. You don’t need to be a genius—you just need to be persistent and organized. And if you make a few mistakes along the way? Don’t sweat it. As long as you learn from them you’re on the right track.

Remember: “Nobody’s perfect. But with the right prep you’ll be as close as humanly possible,” says Henry Beltran.

Now get out there study hard and make sure to nail that exam just like you’d want to avoid potholes in your dream car!